25 Funds Investors Dumped in 2017

Though investors continue their shift toward passive products and target-date funds, outflows from active funds were calmer than they've been in recent years.

Investors continue to dump higher-priced funds in favor of lower-priced fare--not only in U.S. stock categories, but in foreign-stock and bond categories, too.

That's one takeaway from the results of our survey of individual funds that investors sold in 2017. (Last week we covered the top 25 funds they've been buying.) The good news for active funds was that the 2017 outflow was minimal compared with previous years, though, said Alina Lamy, a senior analyst in Morningstar's Quantitative Research Group.

"It was an outflow ... . But it was really close to zero as opposed to 2015 and 2016 when the outflows were really heavy. It's almost a victory" for active funds, Lamy said.

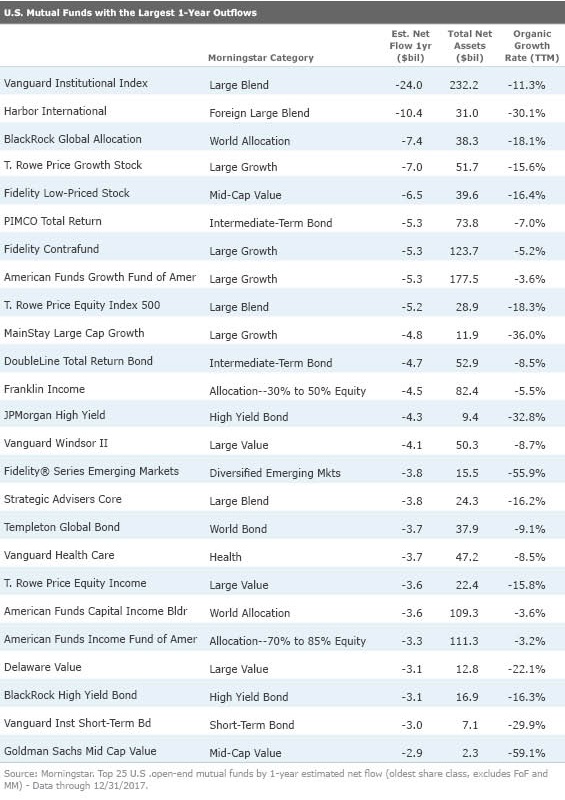

Using Morningstar Direct software, we took a look at the 25 funds that saw the biggest redemptions in absolute dollar terms during 2017. Although we screened for the largest redemptions in dollar terms, we also added a trailing 12-month organic growth data point, which helps put the flows in better perspective. Inflows and outflows to giant funds tend to tip the scales on a dollar-weighted basis even when the flows are a relatively small percentage of the fund's assets. For instance, two share classes of the mammoth Vanguard 500 Index fund--VINIX and VFINX--are on the list of top inflows and outflows over the one-year period; the story here is not really one of investor conviction, it's more about fund distribution and sales channels.

Eight out of 10 funds with the highest estimated net redemptions were actively managed funds, in a wide array of categories. By contrast, six of the top 10 most heavily purchased funds were index funds.

And finally, investors continue to chase performance. In many cases, the funds that are seeing redemptions have had disappointing returns over the short term, the long term, or both.

Redemptions Hit Large-Cap Equity Funds Outflows were not concentrated in any particular category last year, but there was a trend toward U.S. large-cap funds.

Silver-rated

Neutral-rated

"The year 2016 was the strategy's worst relative to peers and the benchmark as the fund's tilt toward more-expensive names proved highly detrimental," said Thomas Lancereau, director of global multi-asset and alternative strategies.

Sometimes though outflow data doesn't tell the whole story, and a closer look is warranted. For instance,

Although the fund's no-load investor share class PRGFX and its advisor share class TRSAX had outflows during 2017, the more recently launched I share class PRUFX had inflows. This is likely due to the fact that the no-load share class of T. Rowe Price Growth Stock is used in the firm's no-load share class of its Retirement target-date series, while the I share class of the fund is used in the I share class of the series.

"While the no-load Retirement funds saw net outflows in 2017, the Retirement I funds and the collective trusts had net inflows that more than offset those losses," explains senior analyst Leo Acheson.

The same logic likely applies to the no-load share class of Bronze-rated

Investors Chase Performance in Fixed Income

Number six on the list, and the most heavily redeemed bond fund for the third year running, was Silver-rated

Disappointing relative short-term performance is probably the major story at Neutral-rated

By contrast, the list of 25 open-end funds with the biggest inflows reveals investors flooded into passive bond funds Silver-rated

There are probably several trends at work here. One is performance-chasing: Prudential Total Return Bond landed in the category's top quintile in 2016 and finished 2017 as one of the category's best performers. PIMCO Income has had stellar returns on an absolute and relative basis compared with its multisector-bond category, and its risk-adjusted returns over both short and long periods outleg the average fund in the intermediate bond-category by a considerable margin.

Two other themes are likely at play: the migration to passive funds, and the rising popularity of target-date funds. Although taxable bond funds have been one of the few asset classes in which inflows to active funds have continued to outpace those into passive funds, fixed-income index funds have seen strong inflows, stemming in part from target-date funds' increasing popularity. (Some bond index funds, such as Vanguard Total Bond Index fund, are used as underlying holdings in target-date funds.)

Investors Turn to Indexing in International Categories

Though Gold-rated

"While the manager has been successful over the long term, it's important to note that the fund's key themes have worked against it at times and can weigh on results in the medium term," explains associate director of fixed-income manager research Karin Anderson. "Its short duration (close to zero for the past few years) has weighed on the fund in periods of stable rates, and its significant shorts on the yen and euro have hurt when those currencies strengthen relative to the U.S. dollar."

As Templeton Global Bond shed $3.7 billion in assets, new money poured into an index fund in the world-bond category--

Investors also continue to flee Silver-rated

One reason for Harbor International's underperformance has been its opportunistic misfires. These poor stock picks, plus its rising expenses resulting from outflows, led senior analyst Kevin McDevitt to downgrade the fund's Morningstar Analyst Rating to Silver from Gold.

As Harbor International shed billions in assets, foreign large-blend category peer

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)