New Alimony Tax Rules Cut Both Ways

The new tax laws no longer allow a deduction for the payer, and the recipient won't pay taxes on the income.

Q: I have heard about changes to tax laws for alimony payments. I can't figure out if the changes are good or bad!

A: You are right that the Tax Cuts and Jobs Act contains some changes to the way alimony is taxed. As for whether the changes are good or bad, that depends.

Alimony, or spousal support, is intended to mitigate the effects of divorce on the lower-earning spouse. Essentially, alimony payments help the lower-earning party maintain the same standard of living he or she was accustomed to when in the marriage. Also, alimony payments are part of a divorce settlement and do not include voluntary payments or payments to keep up property, according to IRS publication 504. The payments can be temporary or transitional or more permanent in nature, depending on the agreement.

To be absolutely clear, alimony is not the same as child support. Child support is a completely separate issue and the tax laws relating to child support payments are not changing: Payments are nondeductible to the payer and not taxable to the recipient.

The other vital thing to understand about the alimony tax law changes is that they do not go into effect until 2019. These changes will not affect any alimony paid in accordance with divorce settlements that occurred before Dec. 31, 2018.

"Existing divorce agreements can be modified after 2018 to take this into account, but only divorces finalized after 2018 are required to follow these rules," said Tim Steffen, director of advanced planning for Baird Private Wealth Management.

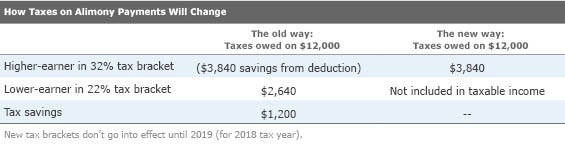

What's Changing? Currently, alimony is taxable for the recipient but not the payer. The spouse paying the alimony can deduct it from income before the adjusted gross income is figured. (This is known as an "above the line" deduction.) The recipient then pays taxes on the alimony received. Going forward, however, this would be reversed: Alimony will be paid with aftertax dollars, and the recipient will not have to pay taxes on it.

In general, shifting the tax burden to the payer will lead to more money being paid in taxes overall. (The government estimates the change will raise $8.3 billion over 10 years.) The reason is that, presumably, the higher-income spouse is the one paying the alimony, and the higher-income spouse is likely in a higher tax bracket. (If you and you former spouse are in the same tax bracket, your alimony payment is probably not as significant.)

Here's an example. Let's say $1,000 a month is paid to a former spouse by a higher earning ex.

If it's unclear where that $1,200 comes from, I was considering the two former spouses as one economic entity, payer and recipient. If the payer gets a tax break of $3,840 and the lower-earner then pays $2,640, they saved $1,200 in taxes as a unit.

Some divorce experts theorize that because the payer's tax deduction is taken into account when determining how much the payer can afford to pay in spousal support each month, eliminating the deduction could result in a lower alimony payment to the recipient in many cases, because more of the available money will be going to taxes.

How Will The New Law Affect the Payer? This change will increase the alimony payer's taxable income, which could push him or her into a higher tax bracket.

"For retired individuals, that higher income could mean that a larger amount of their Social Security benefits are taxable. More likely, it could also mean they’re subject to a higher Medicare premium under the IRMAA rules," Steffen said. "(But) some of the other AGI-based rules are gone now, like the phaseout of itemized deductions for high-income taxpayers, so the net impact might not be as significant as they might think."

If the person paying the alimony is the custodial parent, the new law could also result in less financial aid being available to prospective students applying for financial aid using the Free Application for Financial Aid. (Note that the form uses prior-prior-year tax returns, so this would only apply to students whose parents were divorced in 2019 or later, seeking aid for the 2021-22 school year.)

How Will It Affect the Recipient? The bigger impact will likely be on the person receiving the alimony, Steffen said. Because the alimony will no longer be considered taxable income, it will be easier for the alimony recipient to qualify for the newly expanded $2,000 child credit. (Eligibility for that is based on AGI.) Another potential benefit is that if the recipient is the custodial parent, the prospective student might also be able to qualify for more financial aid.

On the other hand, though, Steffen points out that taxable alimony was considered qualifying income for making an IRA contribution.

"If the receiving spouse doesn't otherwise work, they might not be able to make an IRA contribution (after the new law goes into effect). I haven't seen anything that says the IRA rules might be changing to accommodate this," Steffen said.

The recipient should also consider the state tax implications, as not all states automatically conform to federal rules on taxability and deductibility, Steffen said.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)