The Long and Short on Long-Short Equity Funds

These all-weather funds can provide diversification benefits in a market downturn.

Those who feel that the current market rally will soon run out of steam can consider long-short equity funds. Long-short equity funds may provide some diversification benefits because of their less volatile exposure to equity markets.

Managers here typically seek to generate returns from two sources: first by some exposure to equity beta (or the performance of equity markets) and second from stock selection--holding stocks they like in a long portfolio and shorting stocks they don’t like in a short portfolio.

With these short positions, long-short funds have some downside protection during market declines, but when these short positions rise (which typically occurs in a rising market), they will detract from returns. For example, in 2008, funds in this category declined an average of 15.4%, versus a 37.0% decline in the S&P 500.

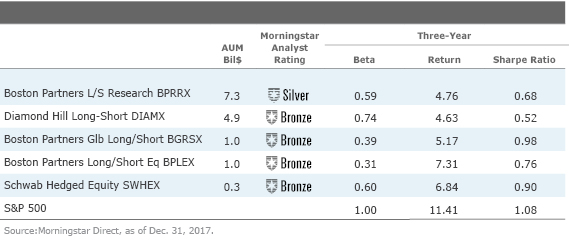

But on the flip side, in a multiyear rally, long-short funds, which have a lower beta, can significantly lag long-only funds. In the trailing three years through December 2017, while the S&P 500 returned 11.4%, annualized, funds in the long-short equity category, on average, returned only 3.4%.

Over the long run, however, these long-short funds can provide diversification benefits if they are able to capture certain factor exposures that do not necessarily overlap with the factors driving the performance of the S&P 500. And unlike balanced funds, which hold a mix of equities and bonds, these funds are not exposed to interest-rate risks.

The funds in the long-short equity Morningstar Category are heterogeneous. Over the past three years, the category’s average net exposure (long exposure minus short exposure) has been around 50%, resulting in a similar 0.5 beta. But individual funds can be significantly higher or lower than these averages. Long-short equity managers have many tools at their disposal, including stock selection, beta exposure, leverage, investment universe (geography, style, size) and factor exposure (value, momentum), so performance can be quite dispersed within the category. With such a heterogeneous group, relative performance within the category does not provide much insight into a manager’s skill. Therefore, selecting a long-short equity strategy should involve a good understanding of both the long and short process, the manager’s approach to beta management, historical portfolio trends, and the fund’s performance in up and down markets.

A quick way to check a fund’s overall performance is to compare the fund’s returns with the returns of a beta-adjusted benchmark. For example, if a long-short fund has a long term average beta to the S&P 500 of 0.5, then a good long-short fund would be expected to outperformed 50% the performance of the S&P 500. Investors can also check the fund’s downside capture in a down market. It is a manager’s ability to side-step market declines that can allow him to effectively compete with a long-only fund.

To dig deeper, an investor can also try to assess a manager’s stock-picking ability. To do this, investors can request the performance details of both the long and short portfolios. Like a long-only fund, the long book’s performance (rescaled to 100%) can be compared with that of its benchmark. On the short side, the short book (rescaled to 100%) should underperform the benchmark. The difference between the performances of the long and short book is the spread, a metric that can be used to gauge a manager’s stock-selection ability--a wide spread indicates the manager is good at picking winners and shorting losers.

But it is important to note that with long-short equity funds, the short book carries additional risks that generally do not pertain to long-only portfolios. A shorted stock with poor fundamentals can rally, especially in a strong market. Or a shorted stock could become an acquisition target. As short positions rise, they grow to become larger allocations (and therefore a larger drag) within the portfolio. This issue can quickly escalate if there is crowding or a short squeeze in a shorted name, which would make it difficult to cover the short. In addition, losses on a short position are theoretically unlimited if the stock continues to rise. So funds with significant sector overweightings or large single-stock bets in its short portfolio could exhibit large declines should those sectors or stocks rally sharply.

Another key challenge to managing a short portfolio is the fact that markets tend to go up over time, so it is unlikely that a short portfolio will consistently decline and provide positive contributions to returns. Over the past few years, markets have been strong, so, for many long-short funds, short positions have been rising and therefore detracting from returns. Without a market downturn, these short positions have not had an opportunity to demonstrate their hedging capabilities.

Long-short funds that focus on small caps, less-liquid holdings, and concentrated portfolios also have limited capacity. If managers with strong track records allow their funds to get too large, they may have to broaden their investment universe, which could dilute performance in the future. So, total assets under management is also worth monitoring.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)