9 Stocks Added to the Dividend Yield Focus Index

We take a look at the newest high-quality dividend payers in the index, and we take a closer look at an undervalued name.

In December, we made some changes to the Morningstar Dividend Yield Focus Index.

Our Dividend Yield Focus strategy looks at both backward-looking and qualitative forward-looking measures to find high-yielding stocks that are financially healthy enough to sustain their dividend.

We first screen the Morningstar US Market Index for dividend-payers. (The dividend must come from qualified income, so real estate investment trusts are not included.)

We then apply the quality screens: We search the high-yielders for companies that have Morningstar Economic Moat Ratings of wide or narrow, meaning that we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively.

We also consider a company's Morningstar distance to default ratio, a metric that uses market information and accounting data to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). Click here to see the current holdings.

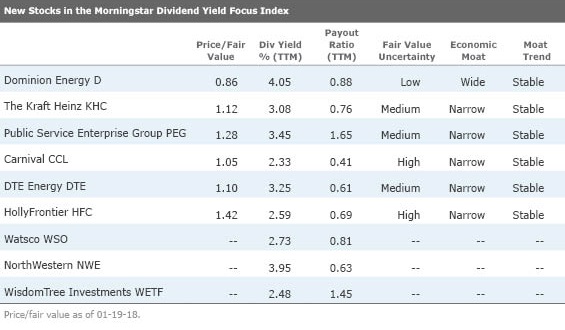

New Dividend-Payers in the Index In the table below, we show the newest entrants to the Dividend Yield Focus Index, which pass our strict requirements for high yields, sustainable competitive advantages, and financial health. (Note that the dividend yields listed below are backward-looking and could change.)

We added nine stocks to the index during the latest reconstitution.

Currently, only one stock looks cheap relative to our analysts' estimate of intrinsic value.

Dominion Energy recently changed its name from Dominion Resources. But more importantly for investors, the company has also made a strategic pivot, explains equity analyst Charles Fishman. Since 2010, it has focused on the development of new wide-moat projects with conservative strategies, exited the exploration and production business, sold or retired no-moat merchant energy plants, and made significant investments in moaty utility infrastructure.

Fishman expects wide-moat businesses to generate roughly half of Dominion's operating earnings by 2021, up from 30% in 2016. The remaining earnings primarily come from narrow-moat regulated gas and electric utilities in states with long histories of constructive regulatory frameworks, solid sales growth, and high-return investment opportunities.

Not only does Dominion earn a wide economic moat due to the fact that a material share of its earnings coming from nonultility business with sustainable competitive advantages, it also sports a fair value uncertainty rating of low. This means that our analysts believe they can more accurately predict the company's future cash flows, which results in greater confidence in our $87 fair value estimate.

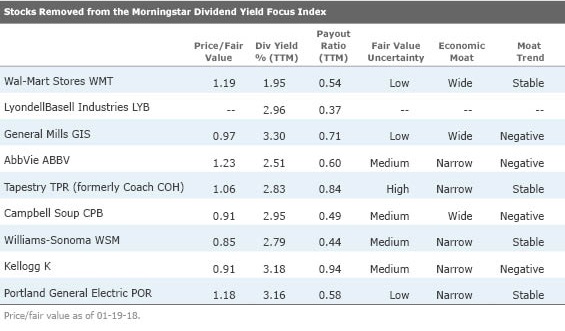

Stocks Removed from the Index On the flip side, nine companies were removed from the index.

There's no arguing with Wal-Mart's competitive advantage: We award the company a wide economic moat stemming from its cost advantage and intangible assets. As the largest retailer in the world, with approximately $500 billion in annual revenue, Wal-Mart has significant bargaining power as it procures merchandise from suppliers and vendors, and as a result, it can offer its customers lower prices than many of its competitors, says equity analyst John Brick. But with the stock trading at an 18% premium to our $88 fair value estimate, we think prospective investors should wait for a wider margin of safety.

The other eight companies on the list were removed because their distance to default ratios crept into a range that we weren't comfortable with.

Distance to default is another other safety-oriented metric that we use to build the index. True to its name, it's focused on financial health. Distance to default uses option-pricing theory to measure whether a firm is falling into financial distress. It's gauging whether the value of a company's assets will fall below the sum of its liabilities. If a company is in distress, the dividend is at risk and there's trouble ahead. So, like moat, distance to default is another important screen for this index. (To read more about distance to default, click here.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)