Fidelity's 2017 Comeback

Its big U.S. stock funds delivered the goods.

On the Mend Perhaps in 2018 I will switch to writing a medical column.

Most of what I have learned in this New Year has involved health. I learned that if one visits a doctor in a panic, having contracted something that feels like a flu shortly before flying to Patagonia for a hiking vacation, and the doctor says not to worry because the flu test came back negative, that the panic may have been justified and the doctor not.

I also learned that after lying down for several days so that the "cold's" 102-degree fever subsided, and then regaining the energy to sit, that one should be wary of full-throatedly adopting Nietzsche's dictum of that which does not kill you makes you stronger, because hopping onto the hiking path may indeed make one weaker without technically leading to death.

Thus begins my initial 2018 column, written from convalescence and laden with distrust for both medical practitioners and German philosophers.

Also Recovering

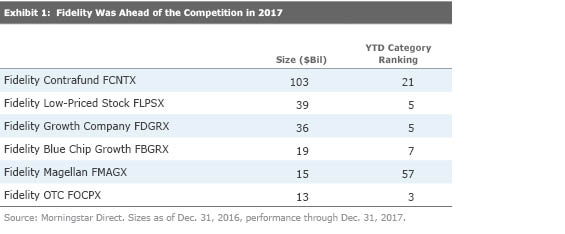

Which leads to today's topic: Another invalid has arisen. After many years of disappointing relative results, and the gradual erosion of its once industry-leading position, Fidelity's actively managed U.S. stock funds showed well in 2017. The chart below portrays the relative-to-Morningstar Category 2017 rankings for Fidelity's six largest active diversified U.S. stock funds (oldest share class, if the fund has multiple share classes). Except for former flagship

It will be objected that beating other companies' funds isn't really the point. If the typical actively run fund costs more than the leading index funds (it does), and usually cannot overcome that expense handicap (it can't), then Fidelity's funds might impress by this measure but appear mediocre compared with the true competition. What matters for active managers is not outdoing each other but besting the index funds.

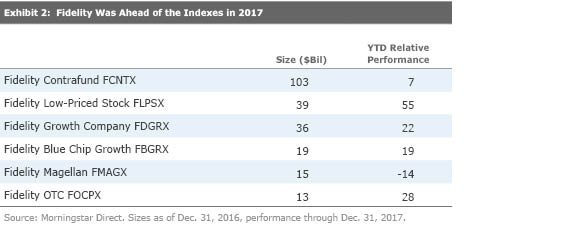

Fair enough. The next chart shows how each fund fared in 2017 against the benchmark that Morningstar uses for that fund's investment category--that is, against a style-specific benchmark that closely (albeit not exactly) matches up with the fund. A positive figure indicates the fund beat the benchmark by that percentage. For example, Contrafund's score of 7 means that its 2017 gain was 7% (not 7 percentage points, that would be an entirely different thing!) above that of its benchmark.

Note that, by this approach, the performance of Fidelity's funds fully reflected their ongoing expenses--implicit trading costs as well as the explicit expenditures reflected in a fund's official expense ratio--while the indexes, being benchmarks, carried no costs at all. True, a major provider's index funds generally perform very similarly to their no-cost benchmarks, but nonetheless the comparison cannot be said to have been created to flatter Fidelity. Aside from Magellan, its major U.S. stock funds outdid their index rivals, sometimes by wide margins. No if's, and's, or but's about it.

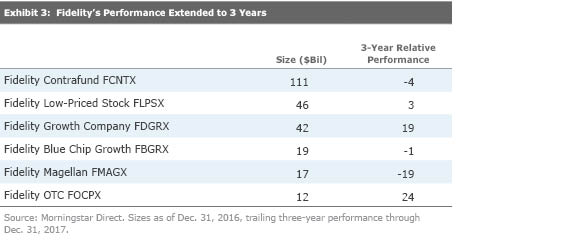

The Bigger Picture Of course, one year isn't very long. Fidelity's stock funds would need to outdo the indexes for three years at the very least to qualify as long-term successes, and their record during that time period is decidedly more mixed. Even with their powerful 2017 showings comprising the final third of their 36-month records, the funds haven't as a group demonstrated their superiority. They haven't been bad by any means--nothing like the "dangerous for your financial health" label that active management's critics sometimes levy against the practice--but their numbers also haven't been strong enough to induce regret into index-fund owners.

(Note: The asset size for the funds differs slightly from those of the previous charts because I measured the funds' sizes at the start of the three-year time period as opposed to the beginning of 2017.)

No Morality Tale I, for one, will not draw a lesson from Fidelity's resurgence. The popularity of Nietzsche's phrase attests to the human desire for redemption. We like to believe that failure breeds success--that from the days spent in the wilderness, wisdom is gained. I think that's unlikely, at least in the field of investment management. I see no benefit to underperformance. What comes from lagging index funds, year after year, is not improvement. It is instead lost assets, as investors find other places to put their monies, and a diminished business reputation.

Nonetheless, news is news. Even if it they are just a blip in an ongoing trend--and they may well be more than that (that I cannot discern a larger meaning in Fidelity's recent performance does not prove that such a meaning does not exist)--Fidelity's 2017 gains merit the attention of this column. They were a significant achievement for a major mutual fund company, and a striking counterexample to the powerful, ongoing narrative of index funds' inexorable triumph.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)