Buy the Unloved

Buying what others have been selling is a winning strategy.

A version of this article was originally published in the January 2018 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

Contrarian thinking doesn't come naturally to most investors. Fund-flow patterns tell us they buy what's done well recently and sell what hasn't. This pattern can become self-reinforcing. Strong flows drive up stock prices, attracting more return-chasing investors and bidding up prices further.

Just as inflows beget more inflows, outflows beget more outflows. Eventually, popular stocks become too expensive and unpopular ones too cheap, and the process reverses itself. Investors who target the least popular areas of the market benefit when sentiment turns.

That's the idea behind Morningstar's "Buy the Unloved" strategy, which we introduced in 1994. This strategy involves investing equal sums in one fund from each of the three equity Morningstar Categories with the largest calendar-year outflows while avoiding those with the heaviest inflows.

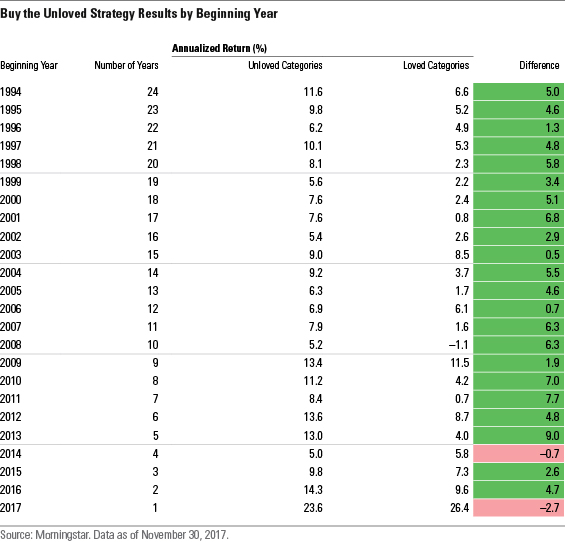

We've tracked the results of the strategy through November 2017 by comparing the unloved categories' returns (as measured by the category average return) with those of the three most popular categories over subsequent three-year periods. After three years, we assume investors rebalance the proceeds into the three most unloved categories of the prior year, hold for another three years, and repeat the process. We also test the strategy's sensitivity to different start dates by measuring results beginning in subsequent calendar years.

Overall, the strategy has been successful. The unloved have beaten the loved by more than 5 percentage points annually from January 1994 through the end of November 2017. Adopting the strategy in later years also resulted in success. (See the exhibit below.) The unloved categories outperformed in 22 of the 24 periods we measured. (One of the periods, beginning just last year, is short. In the other, the four years beginning in 2014, the unloved categories lagged only modestly.) Moreover, favoring the unloved categories generally paid off within three-year rebalancing periods. Indeed, the unloved beat the loved in 77% of three-year periods.

Based on flows into open-end and exchange-traded funds (excluding funds of funds) through December 2017, the unloved categories for 2018 are large growth (an unloved category in every year since 2004), large value, and mid-value. In a repeat of 2017, the most-loved categories are large blend, foreign large blend, and diversified emerging markets.

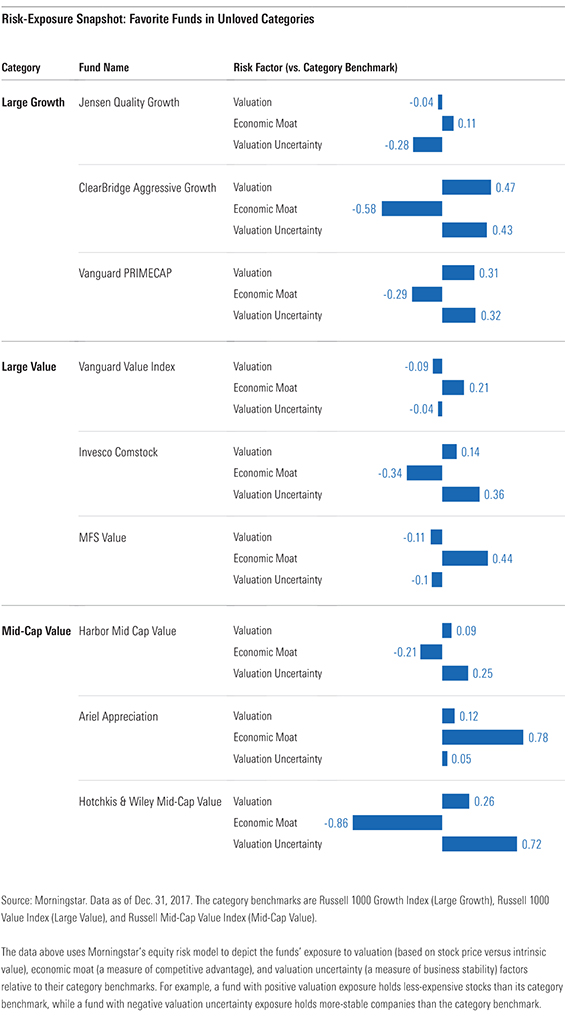

Below, we've identified Morningstar Medalists that we think are likely to fare well in markets favorable to their categories. With large growth tops in performance (or nearly so) among diversified equity categories over five- and 10-year periods, we paid special attention to each contender's valuation profiles. We tapped Morningstar's quantitative risk model, which uses equity analyst research to estimate fund portfolios' exposure to factors like valuation, valuation uncertainty (a measure of business stability), and economic moats (a measure of competitive advantage), to guide us. You'll find a summary of the funds' risk exposures in the exhibit below.

Keep in mind that the "Buy the Unloved" strategy is best suited for the periphery of your portfolio. Implement it in the context of your long-term asset allocation. Consider these funds as ideas for redeploying capital away from your strong performers.

Large Growth

With no exposure to many of the stars of this year's rally, including

Silver-rated

Large Value

With broad exposure to relatively cheap stocks, Silver-rated

Because the Vanguard fund casts a wide net, it holds some stocks with weaker value characteristics. The same can't be said for Silver-rated

Silver-rated

Mid-Value

Bronze-rated

Like Warren Buffett, Bronze-rated

/s3.amazonaws.com/arc-authors/morningstar/d15293c3-7d89-468a-b3ff-f668ac14e26e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)