Strategic-Beta ETFs Continued to Rake in Money in 2017

Using Morningstar Direct data, we examine the main trends in strategic-beta flows.

As money continued to pour into exchange-traded funds last year, strategic-beta offerings were a big beneficiary of U.S. investors looking to add strategies to their portfolios that do more than track a traditional market-cap-weighted index.

To dig deeper, we've enlisted help from Ben Johnson, Morningstar's director of global exchange-traded fund research, and pulled together a series of charts highlighting some of the main trends in strategic-beta ETP flows in 2017.

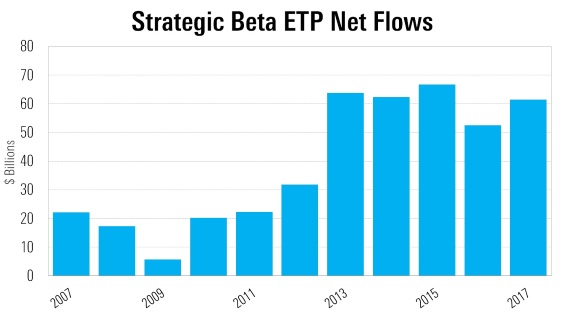

Overall flows into strategic beta funds were $61.5 billion in 2017. That was up from 2016 but down slightly from the annual flows seen from 2013-15.

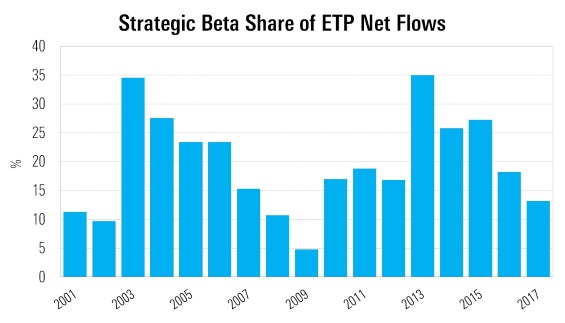

A decline in the relative interest in strategic-beta offerings makes itself known when comparing flows in strategic-beta offerings to those of all ETPs...

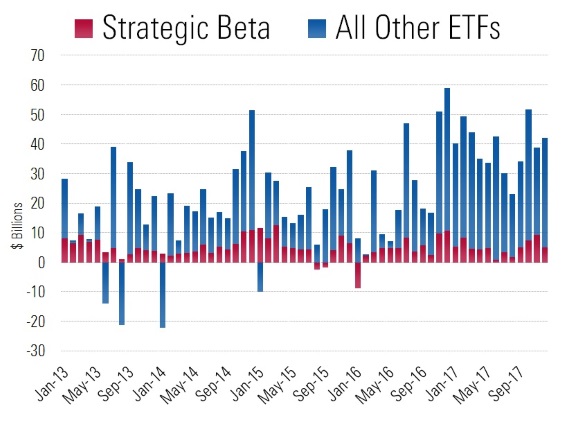

... and here in this stacked chart reflecting monthly flows.

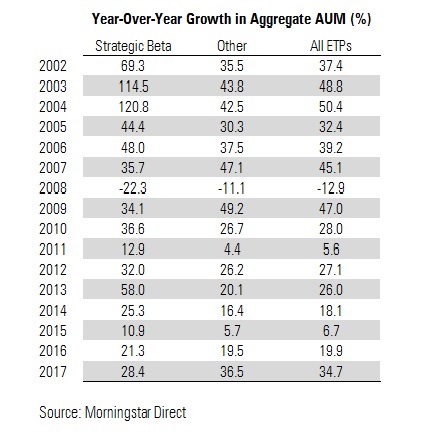

Still, the overall growth rate for strategic beta remains robust.

Within the strategic-beta universe, Ben Johnson notes that what he calls "plain-vanilla" strategies have been the flavor of the year.

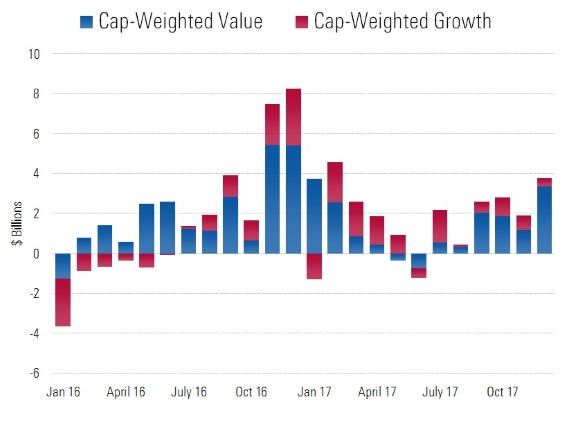

Cap-weighted value and growth ETFs amassed $24.6 billion in net new flows during 2017--about 40% of the total flows into strategic-beta ETPs. Value funds accounted for $15.9 billion and growth funds the remaining $8.7 billion--a notable split given the outperformance of growth strategies of late.

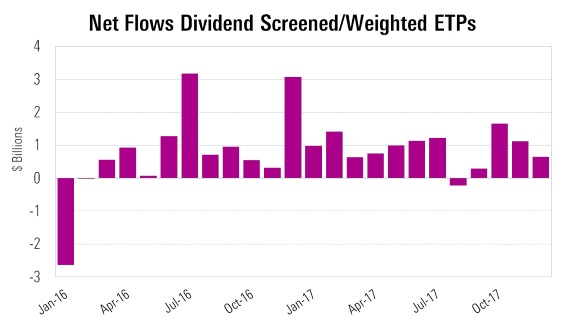

Dividend-oriented ETFs continue to amass assets, despite concerns about valuations and rising rates. Dividend screened/weighted strategic-beta ETPs accounted for $10.6 billion (17%) of 2017 flows into strategic-beta ETPs.

"Investors are still looking to bond-like stocks as a source of income, despite the fact that rates have been inching higher," Johnson says.

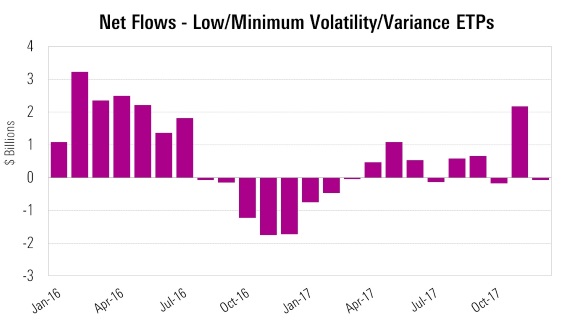

Low-volatility ETFs are having a nasty hangover after hoovering up investors' money in 2016, Johnson notes. Low/minimum volatility/variance funds witnessed $3.8 billion in net new flows during the year. These funds gathered $9.6 billion in net new assets in 2016.

Johnson's take: "Low-vol funds experienced an abnormal period of relative outperformance in early 2016—you normally wouldn't expect them to fare better than the broad market in the middle of a bull run. Their relative performance has since been more in line with what you'd expect. Flows have waned, but remain positive--given that some investors are still wary of full-bore beta in light of current valuations."

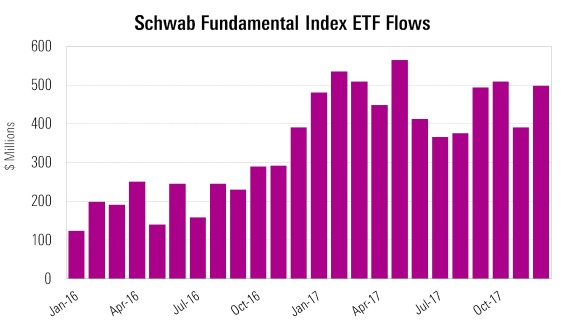

Schwab's Intelligent Portfolios are steering big bucks to their Russell/RAFI-based ETF suite. Schwab's Russell/RAFI ETF suite brought in $5.6 billion in new money over the course of 2017, roughly double their 2016 pace. 2017's take for Schwab's ETFs represented 9% of all flows into strategic-beta ETPs.

"The success of Schwab's RAFI-based ETFs speaks to the growth of Schwab Intelligent Portfolios," said Johnson. "The firm's digital advice platform has been growing steadily and its models feature these funds prominently. It's unlikely that they'd be growing anywhere near as rapidly if they didn't have a seat at the table in these models."

All data courtesy of Morningstar Direct.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)