Morningstar's Take on the 4th Quarter

Stocks soared in the fourth quarter (and all of 2017) as corporate tax cuts became a reality. Plus, fund category and index return data.

This article has been corrected to reflect the correct returns for the Morningstar US Market Index and the Dow Jones Industrial Average.

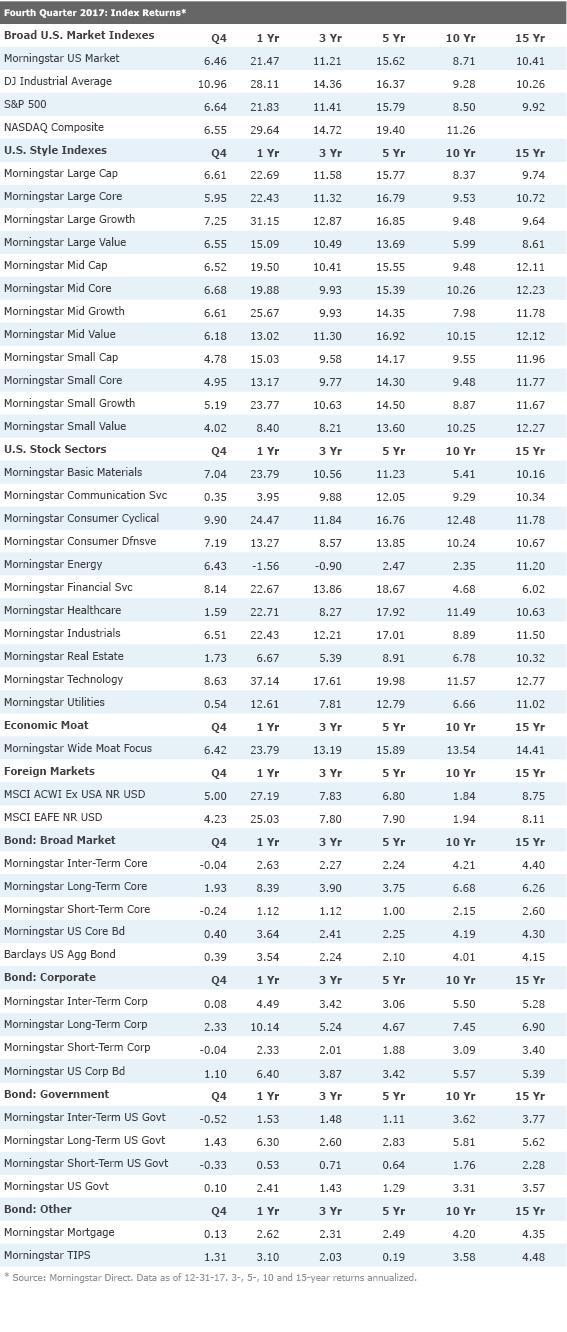

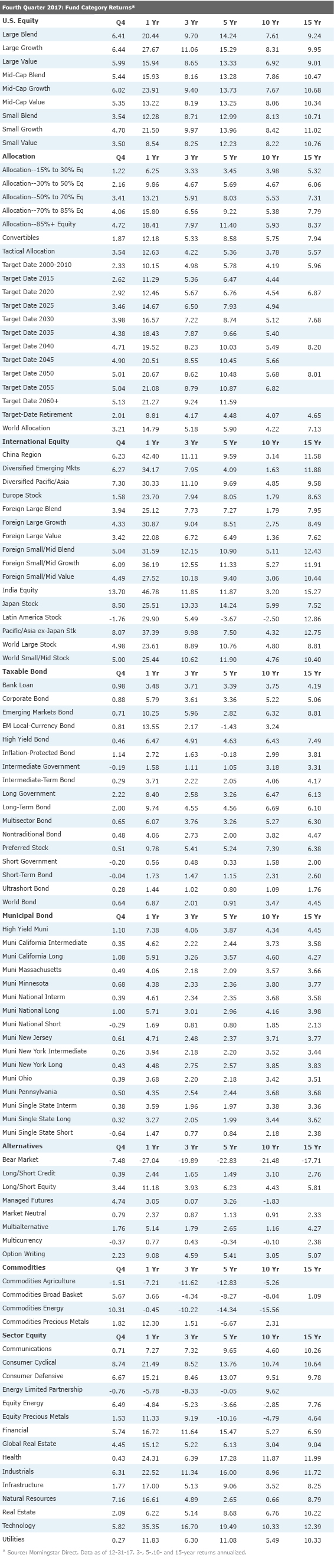

Stocks continued their climb higher in the fourth quarter as the tax bill became reality and as generally upbeat economic data gave the green light to the Fed to raise rates again. The broad-based Morningstar US Market Index rose over 6% in the quarter and has gained over 21% for the year.

Morningstar's analysts have provided an in-depth review and outlooks across equity sector, fund categories, and private markets. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Stock Market Outlook A Dearth of Opportunity Amid the Rally 4- and 5-star stocks are harder to come by in today's market, but a few stock-specific stories are still out there.

Stock Sector Outlooks Basic Materials: The Most Overvalued Sector We Cover Propped up by Chinese stimulus, mined commodity and miner share prices remain overvalued.

Energy: A False Sense of Security for Oil Markets The inevitable resumption of production growth in the U.S., coupled with expansion in Libya and Nigeria, will likely nudge crude stockpiles higher again in 2018.

Consumer Defensive: Hungering for Top-Line Gains Even amid sluggish growth, pockets of value remain for long-term investors.

Consumer Cyclical: E-Commerce a Key Threat for Some, But Not All Although some retailers continue to cede share to online peers, some protected businesses should deliver rising profitability.

Communication Services: A Deal Eludes Sprint and T-Mobile But both firms still need scale to compete long term against Verizon and AT&T.

Healthcare: Pick Carefully as Valuations Head Higher Innovation and redeployment of capital are factoring heavily in the sector.

Financial Services: Asset Managers Are Forced to Adapt Major competitive and regulatory developments with asset managers prevail, while interest rates are a key trend for financials in general.

Utilities: A Weak December Could Foreshadow a Tough 2018 Utilities valuations appear to have peaked, but investors should remain cautious.

Technology: Most Bellwethers Are Overvalued M&A, cloud competing are the hot topics in tech.

Real Estate: Slow but Steady Climb Continues Though fairly valued overall, we see attractive investment opportunities scattered across various asset classes.

Credit Market Insights Flattening Yield Curve Impacts Performance Fixed income performance was mixed as the yield curve compressed to its flattest level since before the financial crisis.

Private Market Insights What's Next for Crypto Assets? As cryptographic tokens proliferate and institutional investors find new ways to access them, the frenzy should only continue in 2018.

Venture Capital Outlook: Dry Powder for Late-Stage Deals We expect to see a further bifurcation of VC activity between the late stage and the softening angel and seed space.

Private Equity Outlook: Eyewatering Acquisition Multiples We expect buyout multiples to remain elevated as several different groups compete to acquire private companies.

Data Report

Open-End Fund Category Returns Index Returns Download Data (Excel)

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)