32 Undervalued Stocks

With 2017 in the books, our equity analysts name their best ideas in every sector.

The Morningstar Global Markets Index gained a spectacular 22% in 2017. The runup in equity prices has led to some steep valuations in aggregate: The market-cap-weighted price/fair value estimate ratio for our equity analysts' coverage universe was 1.06 as of Dec. 28, indicating that the median stock we cover is overvalued.

Elizabeth Collins, Morningstar's director of global equity research, writes in her fourth-quarter stock market outlook that even though communication services is the most undervalued sector at a price/fair value of 0.93, we don't have any 5-star ratings on communication services companies, and in fact only 12 companies in this sector sport a 4-star rating.

"This speaks to the overall dearth of 5-star or even 4-star opportunities we see today," Collins says.

In the quarter-end insight articles linked below, our equity analysts provide their take on the biggest themes and the best remaining investment opportunities in each sector.

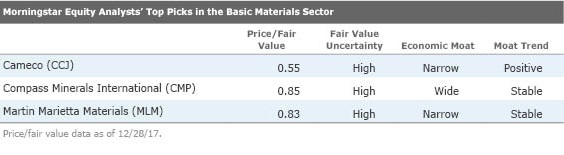

Basic Materials The basic material sector is the most overvalued sector we cover, with a market-cap weighted price/fair value ratio of 1.39. With few exceptions, we continue to see mined commodity and miner share prices as overvalued, propped up by Chinese stimulus, said equity analyst Seth Goldstein. But Goldstein doesn't expect this to last; with China's credit growth slowing, he continues to expect mined commodity prices in general, and particularly for iron ore, to fall materially and for share prices to follow. (Click here for more.)

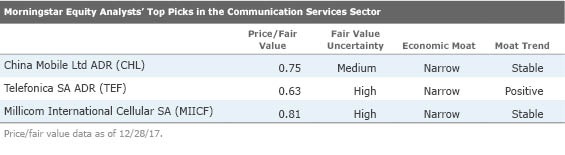

Communication Services

Though the communications services sector is the cheapest sector on a market-cap weighted price/fair value basis, it's only modestly undervalued at 0.93. In his fourth-quarter wrapup on the sector, Brian Colello, director of technology, media, and telecom equity research, gives his take on the future of

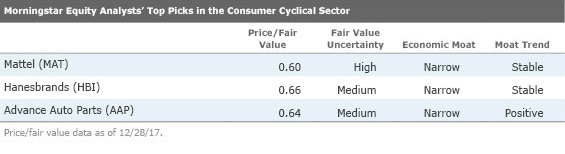

Consumer Cyclical Consumer cyclical sector valuations appear a bit overheated, with a weighted average price/fair value ratio of 1.03 (a slight uptick from last quarter's 0.98), writes senior analyst Jaime Katz. She attributes this increase to relatively stable consumer confidence figures along with an expectation for successful tax reform. Though many retailers continue to cede share to online peers, Katz believes there are some opportunities among consumer cyclical companies that are better positioned to survive these brick-and-mortar troubles than others and have been punished unfairly by the market.

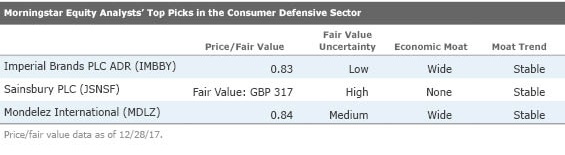

Consumer Defensive Although consumer defensive firms remain laser-focused on driving further efficiencies, these efforts to extract costs have failed to offset languishing top-line trends, says director of consumer sector equity research Erin Lash. As such, Lash isn't surprised that mergers and acquisitions were once again at the top of the agenda in the fourth quarter. Though the sector is now trading about 2% north of our fair value estimates, Lash still maintains that opportunities for long-term investors to build positions in competitively advantaged names persist.

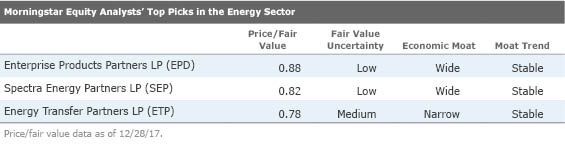

Energy Despite our bearish outlook for near- and long-term oil prices, we see pockets of opportunity in the oil and gas space, says equity analyst Joe Gemino. Energy sector valuations look fairly valued at current levels, with an average price/fair value estimate of 0.98. Crude fundamentals look healthier than they've been for years, largely due to voluntary curtailments from OPEC and its partners, Gemino said.

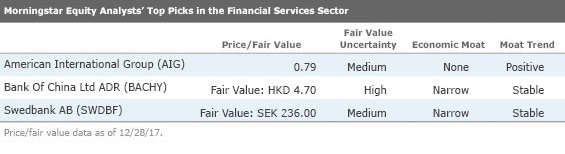

Financial Services The global financial services sector appears to be fairly valued. The overall sector trades at a price/fair value ratio of 1.04, which suggests bargains are limited, writes director of financial services equity research Michael Wong. The cheapest subsectors are global banks and regional European banks, with an equal-weighted (by company) average price/fair value ratio of approximately 0.97 and 0.95, respectively. Read our analysts' regional and industry outlooks here.

Healthcare In aggregate, valuations in the healthcare sector have slightly increased to a price/fair value ratio of 1.04, up from 1.02 at the end of the last quarter and 0.87 at the start of the year, as risks of deflating drug pricing power are abating and new clinical data supports new drugs, says Damien Conover, director of healthcare equity research. Click here to read Conover's take on what corporate tax reform means for the industry, as well as his top picks in the sector.

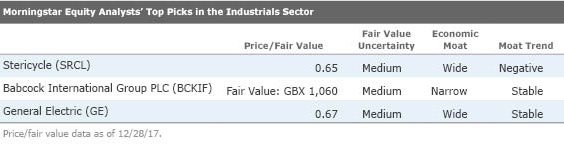

Industrials Industrial stocks climbed higher over the past quarter and currently look rich, with our sector price/fair value estimate at 1.09. Though it's the second most expensive sector in our coverage universe, we have identified a few picks in the sector that we think will reward long-term investors, say director of industrials equity research Keith Schoonmaker and associate equity analyst Eric Anfinson.

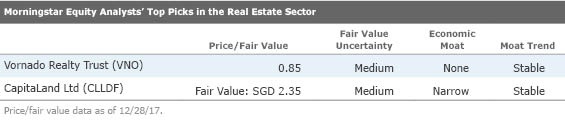

Real Estate Morningstar's real estate coverage was trading at a 4% premium to our fair value estimates as the fourth quarter drew to a close. Equity analyst Brad Schwer says at current pricing, we see attractive investment opportunities scattered across various asset classes within our REIT coverage. In general, reasonably leveraged companies with solid prospects for long-term growth that can weather the natural cyclicality of the real estate markets are our preferred investment vehicles, says Schwer.

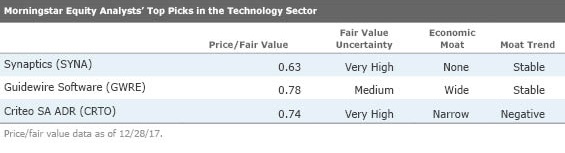

Technology We view technology stocks as overvalued at a market-cap-weighted price/fair value of 1.08, writes Brian Colello in his fourth-quarter technology sector wrapup. In his view, the single most important trend in technology is the shift toward cloud computing, which has ramifications for dozens of stocks across our coverage. The other big trend in technology remains mergers and acquisitions, Colello said.

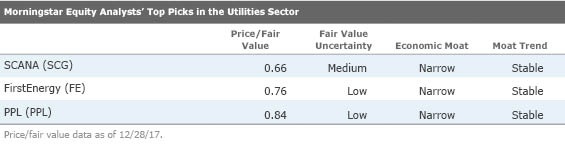

Utilities On a global basis, utilities sector prices remain rich at a 1.08 market-cap-weighted price/fair value ratio. Earnings and dividend growth will be the story for utilities investors in 2018 and 2019, says energy and utilities strategist Travis Miller. Utilities across the world have aggressive investment plans with mostly constructive public policy support. As long as energy prices remain stable, Miller expects 5%-7% annual earnings and dividend growth across the sector during the next few years.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)