Private Equity Outlook: Eyewatering Acquisition Multiples

We expect buyout multiples to remain elevated as several different groups compete to acquire private companies.

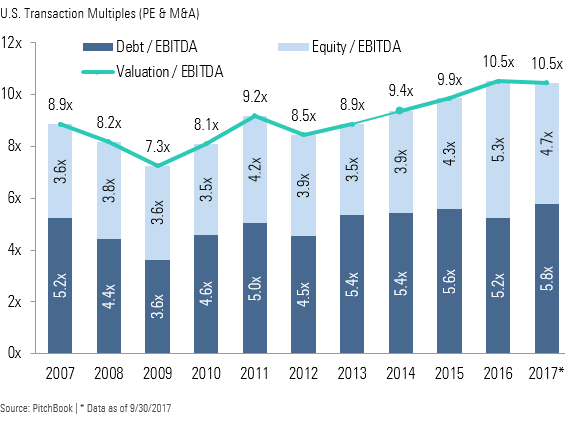

- High levels of competition have propped up acquisition multiples, which remain above 10x EV-to-EBITDA

- Strong private equity fundraising drives dry powder higher.

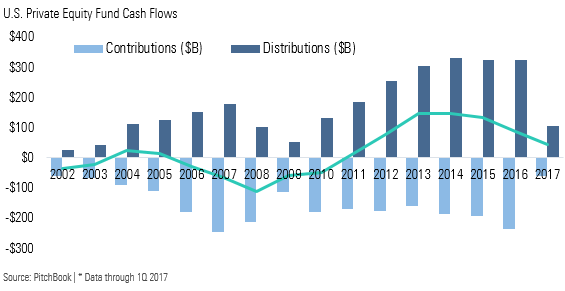

- Much of the recent fundraising activity has been fueled by strong distributions, which have been recycled into new funds. However, as exit activity has remained tepid, we expect this to result in waning net cashflows to limited partners (LPs).

One of the biggest factors influencing private equity, as well as M&A activity more broadly, is the eyewatering level of purchase-price multiples, with the median sitting at 10.5x as we finish 2017. Heading into 2018, we expect buyout multiples to remain elevated as several different groups compete to acquire private companies, which will continue to place upward pressures on valuation.

Although corporate M&A has declined since the boom years of 2014 and 2015, activity remains strong on a historical basis and corporates have been completing enough deals to prevent an easement in valuation multiples. To illustrate, November set the second-highest level of announced M&A deals in two decades.

On the private equity front, 2017 has been another strong year for fundraising, with dry powder for U.S. private equity firms climbing to $565.9 billion. Given private equity firms’ need to put capital to work within a predefined investment period, we expect sustained deal volume and competitive bidding processes for attractive targets to play an active role in keeping valuations elevated.

Although fund sizes have surged and the most successful GPs have attracted capital with relative ease, a stark bifurcation persists in the market as LPs have become more discerning in choosing managers. This has led prominent firms to command an ever-greater concentration of capital, while subpar managers have struggled to justify their existence; indeed, 2017 marked a significant inflection point for the private equity industry, as the number of active investors fell for the first time since at least 2000.

As some traditional private equity firms leave the space, we are seeing rapid growth in the amount of direct deal activity from traditional LPs, such as pension funds, family offices, and sovereign wealth funds, which should serve to further bolster competition and valuations for private acquisitions. And while institutional investors are increasingly doing deals on their own, this has not deterred them from continuing to commit to private capital funds.

As they have grown more sophisticated, however, investors are increasingly looking beyond plain-vanilla buyout funds and instead toward ancillary strategies in areas such as credit, growth equity, and real estate. Part of the shift is that higher risk-adjusted returns are more likely to come through niche strategies, often in the form of smaller funds that face less competition and are able to buy companies at far lower multiples than their larger counterparts.

Perhaps the biggest question for private equity in 2018 is whether the strong momentum of recent years can be sustained. Private markets have a myriad of moving parts, all of which feed back into each other in one way or another. But the variable that truly drives the engine is LPs—without their capital, the industry would all but cease to exist. LP net cash flows from private equity were negative every year from 2006 to 2010, meaning investors were pouring more money into funds than they were taking out.

Since the start of 2016, however, net cash flows have been waning. Fund-level cash-flow data is reported on a lag, but our most-current dataset through the first quarter of 2017 shows net cash flows continue to trend downward. In fact, some LPs have already begun to experience this shift. The Los Angeles City Employees’ Retirement System (LACERS), for example, reported that capital calls outstripped distributions in fiscal year 2017 for the first time since 2012.

This development could have various ramifications for the private equity industry, with the biggest potential impact coming in the fundraising market. Dry powder continues to hover near all-time highs, and if LPs begin to see more of their money flowing into private equity funds than they see coming back, they may be forced to rethink how much additional capital to lock up in the illiquid asset class.

Quarter-End Insights

Stock Market Outlook: A Dearth of Opportunity Amid the Rally Credit Market Insights: Flattening Yield Curve Impacts Performance Basic Materials: The Most Overvalued Sector We Cover Energy: A False Sense of Security for Oil Markets Communication Services: A Deal Eludes Sprint and T-Mobile Consumer Cyclical: E-Commerce a Key Threat for Some, But Not All Consumer Defensive: Hungering for Top-Line Gains Financial Services: Asset Managers Are Forced to Adapt Healthcare: Pick Carefully as Valuations Head Higher Industrials: Pockets of Uncertainty Present a Few Opportunities Real Estate: Slow but Steady Climb Continues Technology: Most Bellwethers Are Overvalued Utilities: A Weak December Could Foreshadow a Tough 2018 Venture Capital Outlook: Dry Powder for Late-Stage Deals Crypto Asset Outlook: Installation Phase

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)