Long-Short Equity Fees Ate Your Alpha

Many long-short equity managers have stock-picking skill, but not enough to clear their high fee hurdles.

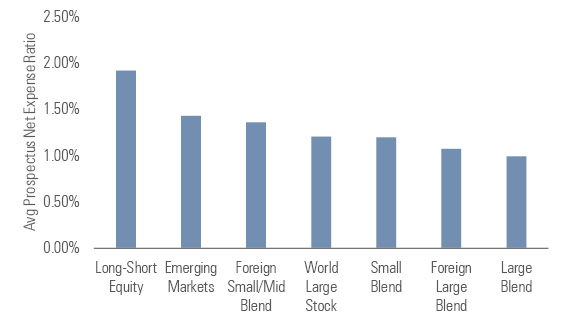

We recently highlighted the rising fees in alternative mutual funds. In 2016, investors paid an asset-weighted average fee of 1.34% for alternative mutual funds (which includes open-end funds and exchange-traded funds), which was significantly higher than the asset-weighted average of 0.72% for balanced funds, 0.50% for U.S. equity funds, and 0.48% for taxable-bond funds.

We won’t have the 2017 results for fees until annual reports are filed in early 2018, but Exhibit 1 makes clear that the gap between subgroups of these funds—long-short equity funds and traditional equity funds—is significant.

In this article, we’ll take a closer look at just how much these fees are costing investors by examining the before- and after-fee alpha that long-short and market-neutral managers produce.

Source: Morningstar Direct data as of 11/30.

Alpha is the excess return a manager generates after accounting for its exposure to broad markets, otherwise known as the fund’s beta. The higher an equity fund’s expense ratio is, the higher the hurdle to deliver this “holy grail” of investing to shareholders. If a manager isn’t generating alpha after fees, an investor would generally be better off using a low-cost passive option. For investors that look to long-short equity funds mainly for the lower-volatility profile, that can be replicated by moving money from a long-only passive fund or active manager to cash.

The traditional market beta from the capital asset pricing model indicates the extent to which a portfolio is exposed to the market (in this case represented by market-cap-weighted exposure to global equities). The portfolio return that is related to beta represents compensation for bearing market risk. But there are other betas, or risks, and many alternative funds specifically target stocks with certain beta/characteristics like value, momentum, and smaller market caps.

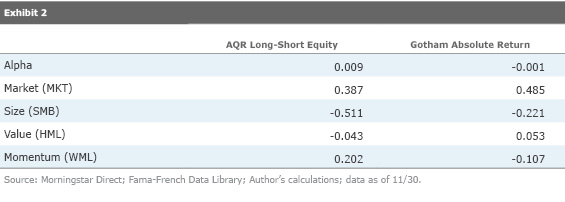

We can see if managers have added value beyond these traditional betas by running a multiple regression analysis to see which portion of a fund’s average monthly return was attributable to traditional betas and what could be considered excess returns. To illustrate this, Exhibit 2 shows the composition of the average monthly return for

AQR Long-Short Equity and Gotham Absolute Return are both long-short equity funds; this is apparent in the funds’ exposure to the market (MKT) factor, which measures sensitivity to the broad global equity market movements. To quality for the long-short equity Morningstar Category, funds must have an equity market beta of between 0.3 and 0.8. One way to think of the sensitivity to the market factor is, assuming a constant beta exposure over the next month, AQR Long-Short Equity could be expected to deliver roughly 38% of the global equity market’s return for the month. Gotham Absolute Return could be expected to return 48% of the global equity market’s return.

Both the long-short equity funds have a negative sensitivity to the size factor (SMB), which indicates their monthly returns would be negatively affected if small companies were to outperform large companies. Neither has a significant exposure to the value (HML) factor, while AQR Long-Short Equity has a positive sensitivity to the momentum (WML) factor and Gotham Absolute Return has a slight negative sensitivity. Knowing a fund’s sensitivity to different well-known factors is useful for setting performance expectations for different market environments, especially when evaluating funds that are part of a diverse or heterogeneous group of alternative strategies.

Alpha is the ultimate goal, though; it’s the proverbial cherry on top of the beta cake. As Exhibit 2 shows, AQR Long-Short Equity had positive alpha, or a portion of its monthly returns that aren’t explainable by exposure to the other factors, while Gotham Absolute Return’s alpha was slightly negative. Alpha can primarily be driven by stock-picking, such as picking the momentum stocks that outperform the average of the stocks with the highest momentum, or by picking smaller companies that outperform the Russell 2000 Index, a common benchmark for small-cap equities.

Of course, it’s no secret that picking stocks is hard, and trying to pick stocks that are going to underperform is just as hard as picking stocks that are going to outperform. Just like investors in traditional equity funds, long-short investors shouldn’t settle for returns that are composed of traditional betas less fees.

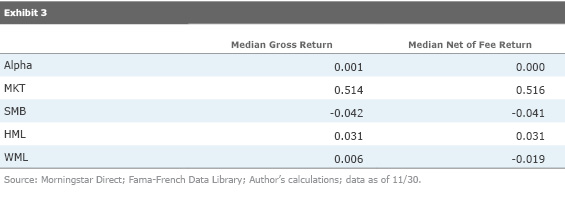

To gauge the impact of fees, we measured each long-short equity fund with at least a three-year track record twice, once using its gross returns, which includes transaction fees but excludes other fees like management and back office fees; and once using the net of fee returns. Exhibit 3 shows the results.

The median before- and after-fee returns tell an unsurprising tale. Before fees, the median long-short equity fund seeks out returns in excess of its exposure to traditional betas. The returns may appear small since we’re looking at the breakdown of the average monthly return, but compounded over time, that could grow into a meaningful stream of returns.

After fees, however, those excess returns evaporate. The median alpha shrunk to microscopic levels. Long-short equity managers could lower fees and pass on more of their skill to shareholders. Given the trend in flows for the category—excluding AQR, which is on its pace for a third straight year of net inflows—lowering fees might be the best way to win back investors.

Associate Analyst Kathryn Wing contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)