Inside Morningstar's 401(k)

See what low-cost gems are in our 401(k).

This article originally appeared in the October issue of Morningstar FundInvestor.

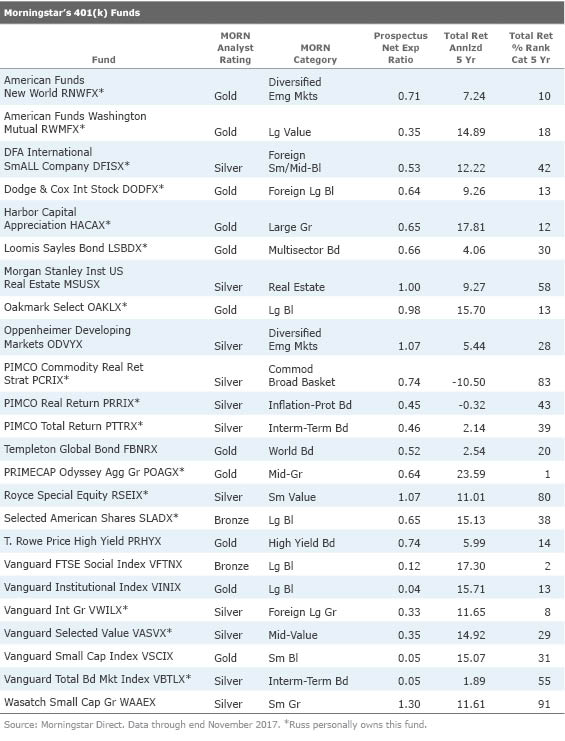

It's been a few years since I walked you through the funds in Morningstar's 401(k). There have been only a couple of changes since then, although there was a big change behind the scenes as we switched providers to Schwab from T. Rowe Price. The move was about services provided--and the respective costs of those services--not the quality of T. Rowe's fund lineup. We still rate many of T. Rowe's funds as Morningstar Medalists.

I'm on the 401(k) committee that selects funds for the lineup. To boil down our mandate: We aim to find well-run, low-cost funds that fill a need for employees. A primary test for funds is that they be medalists. We also want funds with staying power from reliable firms because making changes to the lineup can be costly and time-consuming for employees and administrators alike. The medalist discipline simplifies the process quite a bit.

In total, we have 24 funds plus a money market and a stable-value fund. If that sounds like a daunting number of funds to navigate, we have a widely used managed-portfolio service that selects funds to suit the needs of each investor. This is the default option for employees. In order to provide another simple option, we also have a low-cost target-date lineup built of index funds. Thus, our employees can select one of three tracks depending upon how much help they want with their portfolio.

In an attempt to keep costs as low as possible, we have mostly institutional share classes. But don't be discouraged if you can't get into those share classes yourself. Most of these funds' retail share classes are priced attractively, too, even if they are not quite as cheap as the institutional shares. Four of the funds in our 401(k) are now closed, but we had the good fortune to get in years ahead of their closing dates. In the table, I've marked with an asterisk the funds I own.

What's New

We made a couple of changes as part of the transition. We added our first dedicated global-bond fund in the form of

Templeton Global Bond

FBNRX. We had some foreign bond exposure from

Loomis Sayles Bond

LSBDX but wanted a dedicated global fixed-income fund. This fund, which has a Morningstar Analyst Rating of Gold, is managed by Michael Hasenstab and has tremendous appeal. Hasenstab has built a brilliant record by making value plays in downtrodden countries--often emerging markets. He also frequently makes bets against the euro and the yen. The long-term record is one of the multisector bond Morningstar Category's best, but the fund's aggression makes it a supplementary holding rather than a core investment. I don't own this fund yet, as it just popped up in our lineup in September, but I will likely add it soon.

We removed

We also made a change to our small-cap options in 2016. When Greg McCrickard retired from T. Rowe Price Small-Cap Stock OTCFX, we downgraded the fund to Neutral and switched to

Vanguard Small Cap Index

VSCIX. With an expense ratio of just 0.05%, the fund offered a way to lower employees' costs. The fund tracks the CRSP U.S. Small Cap Index, which aims for companies smaller than the largest 85% by market cap and larger than the smallest 2%.

That leads to an average market cap for the fund of $3.6 billion, which is on the high side for small caps, but that also means the fund has a little more liquidity and should have lower trading costs. Now let's look at the rest of the lineup.

U.S. Equities

American Funds Washington Mutual

RWMFX is boring but effective. American's multiple manager system means it's unlikely that one manager's departure will throw the fund off course. And, nearly all of American's managers stay at the firm until they retire, so change is rather glacial. The fund has a dividend-income mandate and strong long-term performance.

Harbor Capital Appreciation

HACAX is the yin to Washington Mutual's yang. Led by the seasoned team at Jennison, the fund focuses on earnings growth, and that leads it to own quite a lot of tech. The Gold-rated fund owns 38% compared with 33% for the Russell 1000 Growth Index and 30% for the typical large-growth fund. The fund boasts a robust 10.7% annualized 15-year return, but that comes with sizable downdrafts along the way.

Oakmark Select

OAKLX has been a part of our 401(k) almost as long as I've been at Morningstar. We've long known Bill Nygren to be a skilled investor capable of unearthing some great values. The fund came under fire for a poor stretch in the financial meltdown of 2007-09, but we've kept the faith.

PRIMECAP Odyssey Aggressive Growth

POAGX is one of my favorites, as would be apparent from a look at my 401(k) statement. The Primecap team is as good as any growth investors out there. And this is its most aggressive smaller-cap offering. I'm glad it closed to new investors before it got too big.

Royce Special Equity

RSEIX is one of those funds that figures to look best (in relative terms) when the markets plummet. Charlie Dreifus is a stickler for accounting details and clean balance sheets. That leads him to companies that remain strong in a recession, and therefore it tends to hold up quite nicely. Yet as is often the case, investors are leaving the fund because performance is sluggish during a raging bull market. We lowered the fund one notch to Silver because Dreifus' retirement might not be that far off.

Selected American Shares

SLADX has been in the Morningstar 401(k) longer than I have. Our patience hasn't been rewarded here as much as it has been in Oakmark Select. The fund tumbled in the financial crisis and has been only OK since. Still, we like this Bronze-rated fund's management pair of Chris Davis and Danton Goei.

Vanguard FTSE Social Index

VFTNX fills the role of providing environmental, social, and governance exposure for employees who want that strategy. The fund's screens have been brilliant lately, as it had trounced the S&P 500 during the past five years, and its 10-year returns are only 10 basis points behind the index--a very respectable performance for this Bronze-rated fund.

Vanguard Institutional Index

VINIX is the institutional version of Vanguard 500 Index. It charges 0.04%. Enough said.

Vanguard Selected Value

VASVX is a fairly bold mid-value fund where Jim Barrow of Barrow Hanley runs 61% of assets. The rest is farmed out to Donald Smith & Co. and Pzena Investment Management. Each plies a different version of a mid-value strategy. And they do so for just 0.35%. Active management doesn't have to cost a ton.

Wasatch Small Cap Growth

WAAEX saw a key transition last year as lead manager Jeff Cardon became an assistant and J.B. Taylor was elevated to lead. Cardon is set to retire at year-end. However, Taylor has an excellent record at

Wasatch Core Growth

WGROX, so we lowered the rating just one notch to Silver.

Foreign Equity

American Funds New World

RNWFX works on three levels. First, it owns some companies domiciled in developed markets that have significant sales in emerging markets. This is sensible, and it tones down the extremes in performance, which is key for skittish 401(k) investors. Second, it is cheap in a place where fund companies tend to charge a lot because they can get away with it. Third, it highlights American's deep analyst and manager bench overseas.

DFA International Small Company

DFISX plays to DFA's strengths. The firm long ago adapted smart ways of trading small caps so that trading costs would be much lower than active and passive strategies alike. And DFA's expenses are a little more than the cheapest pure index funds but still much lower than most active strategies.

Dodge & Cox International Stock

DODFX is well-designed for 401(k)s. This closed fund has low costs, a sound strategy, and tremendous stability of investment professionals. Most of Dodge's analysts and managers spend their careers there. The firm applies the same value approach across the board, so everyone is on the same page. Results have been outstanding.

Oppenheimer Developing Markets

ODVYX is one of the most aggressive funds in our lineup. Justin Leverenz blends themes with issue selection in a benchmark-agnostic portfolio. He favors growth names like

Vanguard International Growth

VWILX has built outstanding performance thanks to low costs and two strong subadvisors. The Silver-rated fund is run by James Anderson of Baillie Gifford and Simon Webber of Schroders. Schroders runs a growth-at-a-reasonable-price strategy, while Baillie Gifford is more focused on growth. The fund does have a sizable emerging-markets stake, so it's got an aggressive side.

Bond Funds

Loomis Sayles Bond

LSBDX is a multisector-bond fund. That means it can invest in a wide range of bonds including high yield, high quality, and foreign. Such wide latitude requires a lot of skill, and managers Dan Fuss, Elaine Stokes, Matt Eagan, and Brian Kennedy have it. The fund's boldness means it sometimes takes a hit, but I'm encouraged at how quickly it has rebounded.

PIMCO Real Return

PRRIX is a nice option for a 401(k) because inflation is a threat to a retirement portfolio. To be sure, that threat has not actually appeared in quite some time. Also, Treasury Inflation-Protected Securities are not very tax-friendly, so you want such a fund to be in a tax-sheltered account. Mihir Worah and Jeremie Banet are excellent managers to guide this fund.

We kept faith in

PIMCO Total Return

PTTRX despite Bill Gross' messy departure, and the fund is stronger now that the storm has passed. Led by Scott Mather, Mark Kiesel, and Worah, the fund surfaces strong ideas from around the firm. I prefer its current $75 billion size to its massive peak near $300 billion.

Vanguard Total Bond Market Index

VBTIX is an altogether different kind of core bond fund. It has super-low costs and a portfolio heavily weighted to government issues. On the downside, one could point out that nongovernment debt has higher yields and therefore return potential. On the other hand, don't you want low costs from the part you allocate to government debt? Thus, one could pair a fund like this with a high-yield fund, a multisector fund, an investment-grade corporate-bond fund, or all three.

Specialty Funds These funds serve as diversifiers and are not meant to be core holdings.

Morgan Stanley Institutional U.S. Real Estate

MSUSX is the only fund in our lineup that is largely off-limits to individual investors. Real estate funds offer a nice diversification from equities and bonds. Like anything with a yield, they have been bid up quite a bit in recent years.

PIMCO Commodity Real Return Strategy

PCRIX is another angle on inflation hedging. Commodities can spike and cause inflation shocks, but they've certainly been muted in recent years. This is another fund run by PIMCO Real Return's team of Worah and Banet. It's a fairly complicated strategy in which they buy commodities index derivatives and short-term TIPS. Thus, you get two inflation-fighting tools in one. Commodities funds have dismal returns of late, but the idea still has merit.

This article provides an overview of the investment options within the Morningstar 401(k) Plan and is not intended as a recommendation of any particular investment to any participant in such plan. Investors--and their advisors-- should assess investment options in connection with their overall financial circumstances.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)