The Dangers of the Status Quo in Investing

Sometimes, investor inaction can lead to poor outcomes.

This is the 10th article in the Behavioral Finance and Macroeconomics series, exploring the effect behavior has on markets and the economy as a whole and how advisors who understand this relationship can work more effectively with their clients.

Status quo bias is an emotional bias that predisposes people facing an array of choice options to elect whatever option ratifies or extends the existing condition (the status quo) in lieu of alternative options that might bring about change. In other words, status quo bias operates in people who prefer for things to stay relatively the same.

There have been numerous studies testing the idea that people would rather leave things the way they are (maintain status quo) versus making a change. These studies have been performed in the realms of politics, ethics, health, and investments, just to name a few.

Let's consider a simple example in the field of medicine. A study was completed with asthma patients. They were offered the chance to try a new medication that would potentially be more effective than the current medication they were taking. Most participants in the study decided to stick with their original medication instead of trying the new one.

Why is this? In some ways, the status quo bias can be boiled down to the old adage of "the devil you know versus the devil you don't know." Sometimes we stick with things even though we know they may be flawed. This, of course, is not a rational way of behaving.

When it comes to investing, adhering to the status quo bias--by taking no action--can lead investors to hold investments inappropriate to their own risk/return profiles. This means that investors can either take excessive risks or invest too conservatively, both of which often result in poor outcomes given the investor’s goals.

Why do investors fall into this trap? Sometimes, investors simply become complacent and think existing conditions are simply going to "go on forever." This belief can lead them to take no action on, say, interest rate changes or stock market trends, even if doing so would better align their portfolios with their goals. So when conditions eventually do change, their portfolios suffer, and a less than desired financial outcome is the result.

In today's market, status quo bias is taking place on a grand (macro) scale. In particular, investors have enjoyed a bull market in bonds for the past 25 to 30 years. Some investors' portfolios are not ready for the fact that interest rates are likely to rise next year, given the Federal Reserve's December rate increase and statement regarding 2018. However, status quo bias will likely persist, and investors will keep the bond portions of their portfolio static--even if it would be a better fit for their goals and/or cash flow needs to shorten their durations or allocate some of those dollars to, say, cash.

Status quo bias is an emotional bias that can be exceptionally strong and difficult to overcome. Educating your clients is essential to overcoming this bias. For example, if you can demonstrate to your clients the downside risks of holding bonds when interest rates rise, you may be able to motivate them to change their behaviors.

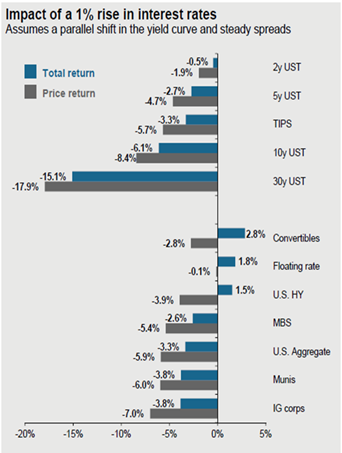

The following data can help in this area: It illustrates how a 1% rise in interest rates can impact the returns of various bond investments, assuming a parallel shift and steady spreads. In this scenario, the total return on the 30-year Treasury bond would be negative 15%!

Source: JP Morgan Asset Management

This image illustrates the dangers of sticking with the status quo. Without warning, the outlook for a given investment can change, and we as advisors need to be sure our clients are ready.

The author is a freelance contributor to Morningstar.com. The views expressed in this article may or may not reflect the views of Morningstar.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)