How Should Younger Investors Think About Social Security?

We outline some scenarios for Social Security that younger investors can use to determine their own savings rates.

Note: The following is part of Morningstar.com's Retirement Matters Week special report. A version of this article appeared on Aug. 18, 2016.

Q: If you're a younger investor--in your 20s, 30s, or even 40s--how do you factor Social Security into your retirement savings equation?

A: This is an important question for younger investors, and a topic that is hotly debated. You've no doubt heard the admonition that young investors must be as aggressive in their savings as possible, because their full Social Security benefit may not be there when they need it.

But what does that mean, exactly? Is it safe for younger investors to assume their full benefit will be available to them when they enter their golden years? Or should they estimate that there will be only a reduced benefit? Let's explore some realistic scenarios for Social Security that a younger investor can embed into her financial plan.

How Do I Determine My Benefit? First, let's discuss how to determine your estimated monthly benefit amount. This will involve creating an account at www.SocialSecurity.gov if you haven't already done so; it's actually pretty quick and easy to set up an account. Here you can see your estimated monthly benefit, in today's dollars, based on your actual earnings history. This estimated benefit might seem very low, but don't worry: This is only the first step. These estimated benefits assume that you'll continue to work and make about the same as you did in 2014 or 2015 in every year until you retire, and they don't factor in any cost-of-living increases. For that reason, these estimates are more helpful the closer you are to retirement.

Let's move on to our second job, which will help younger savers in accumulation phase get a more accurate picture of what their retirement benefit will be decades from now. You can use either the Retirement Estimator tool, found here, or one of the other enhanced Social Security calculators, which you can access here.

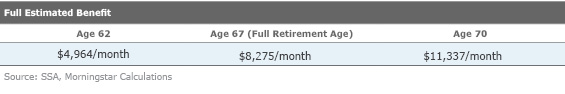

For purposes of illustration, I created a fictional person, made up some salary data for her, and plugged it into SocialSecurity.gov's Quick Calculator. Let's say the heroine of our example, Martha, was born Jan. 1, 1980. She entered the workforce in 2002, with a starting salary of $40,000 a year. Let's assume she got a 2% increase in salary in every year, but switched jobs to a higher-paying position in 2006 ($55,000), and then again in 2010 ($75,000). Then in 2015, she took a job paying $100,000. Here are Social Security's estimated payouts for Martha, in inflated future dollars, if she decides to collect benefits at different ages.

(Note: Social Security's Quick Calculator gives you the option of viewing your estimated benefit in today's dollars or inflated future dollars. I am using future dollars because the final step outlined in this article, which involves using another calculator to determine your ideal preretirement savings rate, requires that you input your Social Security benefit in future dollars.)

And remember, her early retirement benefit if she applied for benefits at age 62 is about 70% of what she would get if she waited until her full retirement age of 67, which is only 87% of what she could get if she waited until age 70. (See this article for more on this.)

How Much Will Be There? According to the trustees' report, Social Security's trust funds will have solvency through 2034. But that doesn't mean that Social Security benefit payments will disappear completely.

"A lot of times you'll hear 'Social Security bankrupt in 2034,'" said Andrew Salata, a public affairs specialist with Social Security. "[But] bankruptcy is not the complete picture because Social Security after 2034 will still have payroll tax dollars. We will have used up our trust fund, our extra money that we've been collecting.

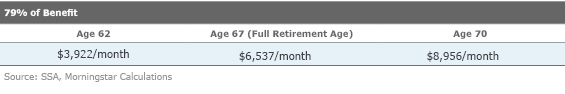

"So if nothing changes between now and 2034, we still will be able to pay out Social Security benefits, but it will be at a rate of 79% because that's what our payroll tax dollars will cover. So in effect everyone will receive 79% of their benefit."

Should you assume that your benefits will be reduced by more than one fifth? Applying the 21% haircut to Martha's estimates yields:

Morningstar columnist Mark Miller believes that it's unlikely that "nothing will change," however. He and others believe there are plenty of levers available to Congress; rather than cut benefits radically, Congress is more likely to impose some sort of means-testing on benefits, adjust the amount of income that's subject to Social Security, or increase full retirement ages.

"Seventy-nine percent assumes no action by Congress to fix the gap," Miller said. "So, it depends somewhat on your forecast on what Congress will do. My opinion: There is zero chance that this will not be addressed and repaired. Why do I say this? Can you imagine any legislator wanting to go back to retirees in his/her district to explain why he/she permitted a 20% cut in their benefits to occur?"

Nonetheless, many financial planners do recommend taking the conservative tack of assuming a reduced benefit. After all, it's better to be safe than sorry with retirement savings, as there are no loans available to fund retirement.

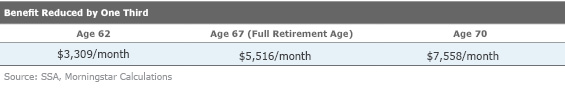

"From our perspective if [a person is] under 45, we use a one-third deduction in the benefit that comes out of SocialSecurity.gov or what some of the calculators suggest would be the benefit," said financial planner Mark Balasa of Balasa Dinverno Foltz. Though he says this estimate can vary depending on other individual circumstances, "in the standard setting for running projections, we reduce it by a third."

So, reducing by one third, Martha can incorporate a monthly benefit of $5,647 (adjusted for COLA increases) into her savings plan, which will certainly require her to increase her savings rate.

How Much Should I Save? Let's turn back to the original question. Now that we've come up with estimates of Martha's Social Security benefits payable in 2047, let's find a way to incorporate that into her financial plan to come up with a savings rate that makes sense.

The Social Security website recommends another calculator you can use to run a simulation. (Groan ... I know. This is the last calculator I'll take you to, I swear.) This one is called Ballpark E$timate from ChoosetoSave.org. It's a pretty simple calculator, but it's helpful because it allows you to control the inputs: You can customize the inflation rate, annual salary growth rate, and the return rate you expect to receive on your investments both before and during retirement. You can also run different scenarios to determine your target savings rate--with the full Social Security benefit, and with a reduced rate.

For Martha, I used the following inputs: I said she planned to retire at 67, and wanted to replace 80% of her income. For her life expectancy, I used the number supplied by the Social Security Administration; for a person born around 1980, at full retirement age of 67, life expectancy according to the Social Security Administration is around 87 years for males and 89 for females. I used an annual 2.9% inflation assumption, an annual wage growth assumption of 4%, and rates of return before and in retirement of 7% for both. (Note: Using higher numbers for inflation and wage growth will result in a higher target savings rate, while putting in higher numbers for the expected return will result in a lower target savings rate.) I also assumed Martha had already saved $100,000 for retirement in her 401(k) or other defined contribution plan.

As a final step, I ran the simulation with Martha's full Social Security estimated benefit of $8,275 per month, and then again with the estimated benefit reduced by one third. With the full Social Security benefit, Martha can expect to replace 47% of her final wages including income from Social Security. The calculator recommends that she save 11% of her total salary to get to her desired 80% income replacement rate. Figuring in a reduced Social Security benefit, Martha can only expect to replace 37% of her preretirement income. The calculator suggests that she increase her savings rate to 14% of her total salary.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)