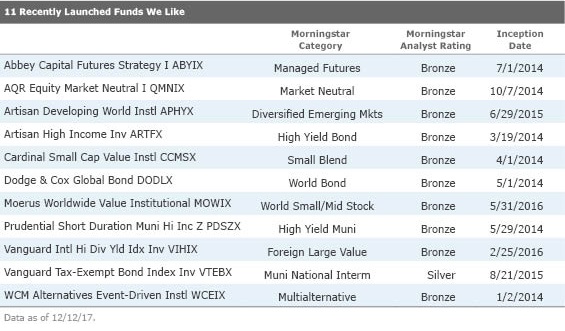

We Have Conviction in These 11 Mutual Fund Newcomers

Proven management teams inspire our confidence in these young funds.

The Morningstar Analyst Ratings, known informally as the medalist rating, are based on our manager research analysts' conviction in the fund's ability to outperform its peer group and/or relevant benchmark on a risk-adjusted basis over the long term.

If a fund receives a Gold, Silver, or Bronze rating, it means Morningstar analysts think highly of the fund and expect it to outperform over a full market cycle of at least five years.

Many times, the funds our analysts have high conviction in are stalwarts whose managers have proved their ability to skillfully navigate a variety of markets and stayed true to their tried-and-tested strategy. But what's happening behind the scenes at newly launched funds with medalist ratings? How can analysts have such high conviction in a fund that launched only a few years ago?

To take a closer look, I used Morningstar.com's

to search our U.S. fund coverage for medalist funds launched in the past four years. Some trends emerged.

In the majority of cases, the management teams running these funds have successful records that extend far beyond their record at their current charge, either at their current firm or another firm. Or, in the case of AQR, our analysts' high conviction in the firm's research-driven, systematic stock-selection process as well as the firm veterans in charge. In many cases, we also see something unique or novel about the process that we believe will translate into peer-beating performance.

In the case of index funds, it's often the case that we will rate an index-tracker highly if the index's construction methodology is straightforward and provides an exposure or style similar to actively managed peers'; the fund is managed in a way that it closely tracks that index; and the investment's costs are reasonable. (Read more about how our passive-investment analysts evaluate indexes here.)

The following funds were launched within the past four years and garner such high conviction from our analysts that they have earned medalist ratings. We take a closer look at three of the funds below.

Manager Bryan Krug is no stranger to high-yield investing, having run

Perhaps not a household name, Moerus Capital Management is a globally focused, deep-value investment shop founded in 2015 by Amit Wadhwaney, John Mauro, and Michael Campagna, all previously members of the international team at Third Avenue Management. Moerus Worldwide Value's manager, Amit Wadhwaney, posted solid risk-adjusted results in his 13 years leading

Managers Roy Behren and Michael Shannon each have more than 20 years of event-driven experience running

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)