The Financial Plan Is Dead

Long live financial planning.

Tell me if this story sounds familiar.

You've signed a new client, you've asked them the right questions, and you feel like you have a handle on the financial details. You take that information, and you build a beautiful financial plan that fills a two-inch binder perfectly. It's amazing! But guess what? We only know one thing for sure about this plan: It's wrong. We just don't know how or by how much.

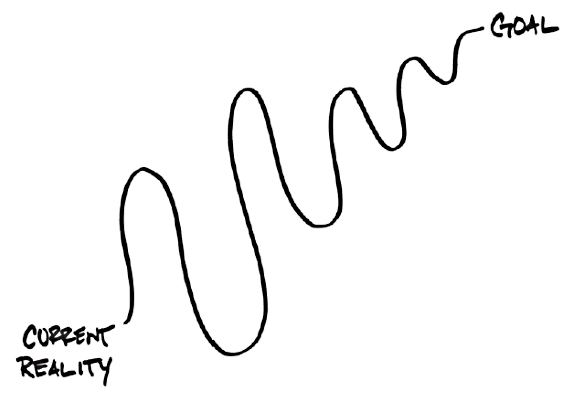

Don’t get me wrong. We need to create a starting point for our clients. But instead of telling clients they need to know exactly what they’ll spend on their utilities 20 years from now, we need to help them embrace the idea of guessing. Things will change, but with every decision we make, we’ll be a little less wrong.

This reality means we need to draw a clear line for our clients between the plan as a product and the process of planning as a relationship. Think about the implications. It changes almost everything about your business.

Conversations, pricing models, ongoing client interactions—things shift when it becomes about the ongoing process of financial planning and less about the financial plan. I know it seems like a small difference, but here’s why it matters.

1 Life Isn't Static It's so important to write things down, to identify our clients' current reality and where they want to go. But we need to stop pretending that what we put on paper won't need to be changed or updated in a year, let alone a decade or two. Focusing solely on a financial plan blinds us to the truth that clients need the process of financial planning—identifying their values and goals—more than a spreadsheet that shows projected returns over 20 years.

2 You Are More Than a Financial Plan I can't emphasize this one enough. By presenting our services as a product (the financial plan), we train clients to see us as nothing more than a salesperson. We are so much more than that! We are experienced professionals who can help clients deal with many of the emotional decisions they need to make around money. A binder or even an algorithm can't help your client avoid the classic mistake of buying high or selling low. You can.

3 Financial Plans Assume People Behave I'm sure one of these days a client will walk into your office and that person will never make a mistake. But for the rest of your clients comes a hard truth. Mistakes will happen. Emotions will trip up even the smartest people. Adjustments will need to be made. Now, please show me in the financial plan you built where you predict when and how a client will make a mistake. Nothing there, right?

By embracing the process of financial planning, we can lessen the anxiety around these mistakes. Instead of fearing that one bad decision ruins everything, clients understand that you’ll help them adapt. You’re prepared to suggest alternatives to help them get back on track. In short, you’re ready, willing, and able to help them fix their mistakes. That’s a powerful message to share with clients.

Again, to be clear, I’m not saying you shouldn’t produce a financial plan. Far from it, in fact. As I noted earlier, everyone benefits from putting values and goals down on paper. But don’t get sucked into the idea that a thick plan equals “value.” Your value, the real reason people benefit from working with you, goes beyond paper, and it starts by embracing the ongoing process of financial planning. Ready to get started?

This article originally appeared in the December/January 2017 issue of Morningstar magazine.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)