Sustainable Stock-Pickers: Top 10 High-Conviction Holdings

Like our Ultimate Stock-Pickers series, we take a deep dive into the portfolios of Medalist ESG funds.

In our Ultimate Stock-Pickers articles, we take a close look at the portfolios of some top-rated investment managers to uncover investment ideas these managers and Morningstar's equity analysts find attractive, in a manner timely enough for investors to gain some value.

These articles, written quarterly, take a look at stocks in these "ultimate stock-pickers" portfolios a few different ways. Sometimes we display the top 10 stocks by conviction; sometimes we home in on the top 10 stock purchases. Sometimes we feature the top 10 stocks that were sold from the portfolios, and other times we take a closer look at the top 10 dividend-yielding stocks.

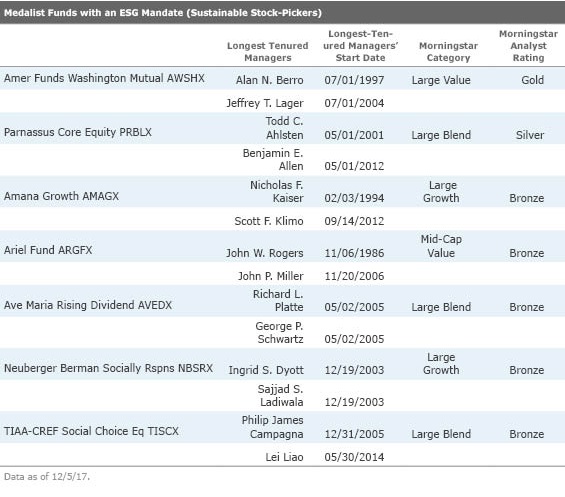

In this series, we'll take a look at the holdings of Morningstar Medalist funds whose managers invest with an environmental, social, and governance mandate. To find them, I screened our fund coverage for U.S. equity funds that have a sustainability mandate (outlined in the fund's prospectus). We excluded index funds; although they use screens to whittle down their investment universe, in many cases a large holding in an index fund doesn't necessarily translate to high conviction, just a large market cap. I also included only one fund per fund family, with the rationale that multiple funds from the same fund family are theoretically more likely to have overlapping stocks because they draw on the recommendations of the same research team. When a fund family offered multiple sustainable funds, I chose the one with the highest rating and the largest asset base. (For instance, I chose Silver-rated

This is the current list of sustainable stock-pickers; just like the Ultimate Stock-Pickers list, it's subject to change as the Analyst Ratings on the underlying funds change and new sustainable funds come under analyst coverage.

As we set the stage for this series of articles, it's important to note that funds following ESG mandates often target different issues. For instance, some funds focus on firms that encourage environmentally friendly practices; such funds would screen out fossil fuel producers and the like. Others focus on firms that promote human rights and diversity, while some shun "sin stocks" such as casinos or producers of alcohol, tobacco, pornography, or weapons. Other funds, particularly those with a religious focus, screen out companies involved in contraception and abortion.

Below we take a look at each fund on our list and explain how the managers implement an ESG focus.

This Gold-rated fund's investing criteria go way back to 1952: They are rooted in rules formed in the Great Depression's aftermath to ensure prudent management of trust funds, explains senior analyst Alec Lucas. Potential investments must clear a number of hurdles, including largely shunning the sale of alcohol and tobacco products. Firms must meet New York Stock Exchange listing requirements, even if they are not listed on the exchange. S&P 500 constituents, however, must make up 90% of the portfolio, which naturally leads to extensive overlap with the index, Lucas says.

This fund has typical socially conscious restrictions: It avoids companies deriving significant revenue from alcohol, tobacco, weapons, nuclear power, or gambling, or those with ties to Sudan, senior analyst Andrew Daniels explains. However, Parnassus also emphasizes positive ESG criteria, believing that such criteria help identify companies likely to outperform industry peers.

This mutual fund adheres to Islamic investing principles. Its investment committee, which includes Islamic scholars, screens out companies that get a significant part of their revenue (generally more than 5%) from products or activities prohibited under Islamic law, including alcohol, tobacco, pork processing, gambling, and borrowing or lending of money, says senior analyst David Kathman. This means that essentially all financials are prohibited, as are companies with a debt/market cap ratio greater than 30%. These restrictions stem from broader principles of Islamic law, or Shariah, which demands equal economic treatment for everybody and prohibits gains in which risk or ownership is not shared. Shariah also discourages speculation, so excessive portfolio trading is not allowed, Kathman said.

Per Ariel Fund's prospectus, the fund does not invest in companies whose primary source of revenue is derived from the production or sale of tobacco products or the manufacture of handguns. "We believe these industries may be more likely to face shrinking growth prospects, litigation costs and legal liability that cannot be quantified," the prospectus reads.

The largest of the Catholic-focused Ave Maria funds, Ave Maria Rising Dividend invests in accordance with the teachings of the Roman Catholic Church, as determined by a Catholic advisory board. That means the fund can't hold stocks having to do with abortion, birth control, embryonic stem cell research, or pornography (broadly defined), or that contribute money to Planned Parenthood, Kathman explains.

This fund's socially conscious mandate keeps alcohol, tobacco, weapons, nuclear power, and gambling stocks out of the portfolio and favor companies with good community, workplace, and environmental records. The managers consider those to be good investment characteristics anyway, Kathman says, so there is no need for many explicit negative screens (meaning that the emphasis is on finding stocks that best fit a set of positive criteria rather than excluding companies).

This fund follows a very defined process. As Kathman explains, first the social investment team at MSCI ranks the stocks in the MSCI Investable Market Index (about 2,600 stocks) according to how well they meet social criteria laid down by TIAA-CREF's social and community investing unit. These criteria vary by industry, but in general they favor firms that are strong stewards of the environment; devoted to serving their communities, human rights, and philanthropy; committed to high labor standards and good employee relations; dedicated to producing high-quality and safe products; and managed in an exemplary and ethical manner. The models are designed to replicate the risk characteristics of the Russell 3000 Index, and the portfolio's sector weightings don't differ too dramatically from those of the index.

The list below contains the top 10 stock holdings by conviction, which means they are held in many of the sustainable stock-pickers' portfolios, and they account for a relatively large position size within those portfolios. In upcoming articles, we will also screen the sustainable portfolios for recent buys and sells, cheapest high-conviction holdings, and highest-yielding holdings.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)