Campbell's Growth Set to Simmer

But while we foresee some sales improvement, increasing already-high margins is not likely.

Consumer products companies have been plagued by intense competitive pressures exacerbated by consumers’ penchant for shopping the perimeter of the store at the expense of center-store categories. Competition has come from not only branded operators but small, niche peers that have proved more agile in responding to the rapid pace of industry change.

Campbell’s sales and profit performance from the third quarter of fiscal 2016 through the fourth quarter of fiscal 2017 didn’t give investors much to cheer about, with organic sales down at a low-single-digit clip each of the past six quarters and adjusted operating margins averaging in the mid- to high teens.

Although management has seemed to acknowledge the drivers behind the shortfall and the steps needed to reverse course, a pronounced acceleration in margin improvement off these high levels and a return to sustainable sales growth have proved elusive.

We think management has laid out a sound strategic course, focused on extracting costs to fuel investments in new products that are aligned with consumers’ inclination toward convenient, healthy offerings. We don’t think results over the past several quarters signal an inability to drive a modest uptick in sales growth and profits.

Rather, we believe a handful of ancillary factors (concentrated in the Campbell Fresh business, which accounts for 10%-15% of annual sales) have hampered the company’s progress. For instance, in the third quarter of 2016, cold, rainy weather in California constrained carrot yields, weighing on gross margins to the tune of 160 basis points and driving a 4% decline in segment sales.

In the first quarter of fiscal 2017, Campbell Fresh sales sank 6% because of lower volume, as the company suffered from the recall of its Protein Plus beverage product earlier in the year and continued quality issues in carrots. However, we don’t expect these challenges to persist to the same degree going forward, as Campbell is increasing its segment sales from higher-margin consumer products (like shelf-stable beverages, soups, and salad dressings) at the expense of lower-margin commodified fare (which represents around 40% of Fresh segment sales presently, down from more than 60% just a few years ago), such as fresh carrots. Although soup has failed to realize much in the way of improvement, we think Campbell’s future performance isn’t dependent on a material turnaround in its core business.

Further Gains From Elevated Margin Levels Unlikely Following the Kraft-Heinz KHC tie-up in 2015, the implicit mandate for companies across the packaged food realm has centered on extracting efficiencies. Campbell's current cost-saving target of approximately $450 million equates to about 7% of cost of goods sold and operating expenses, excluding depreciation and amortization expense, which generally aligns with the 6%-9% savings targeted at other domestic food and beverage manufacturers.

Campbell capitalized on a significant portion of the low-hanging inefficiencies in its operations. It posted 300- to 400-basis-point jumps in its adjusted gross and operating margins, to nearly 38% and 19%, respectively, between fiscal 2015 and 2017. However, we now see limited opportunity for much expansion from recent elevated levels at the leading soup manufacturer. We think Campbell’s efficiency gains will be eaten up by input cost inflation, an increased allocation toward brand spending, and portfolio mix shifts.

For one, inflationary pressures were dormant in the recent past, but that is beginning to change. Consumer product companies have begun pointing to higher raw material costs as a constraint on profitability over the past few months. We don’t anticipate this headwind to subside, particularly as recent natural disasters are placing even more upward pressure on resin and other commodities. As a result, we expect Campbell to post gross margins approximating 37% each year over our 10-year explicit forecast, about 50 basis points north of its historical five-year average but 60 basis points lower than the adjusted level in fiscal 2017.

From a cost perspective, we think investments to improve the health profile of Campbell’s fare (such as removing artificial flavors and coloring) may further impede margin gains, given the limited supply and outsize demand that exists for these raw materials.

If a more inflationary landscape proves lasting, we don’t think Campbell would be in a position to merely raise prices to offset these headwinds as a means to maintain profitability. Branded manufacturers should be able to garner value from their portfolio mix and pass through these higher costs to customers. However, our analysis shows that Campbell has fallen short in its efforts, failing to price in excess of inflation. We believe its price/mix, adjusted for inflation (as measured by the consumer price index), has averaged around negative 1% during the past five years, among the weakest performance of its peers. However, we believe this aspect of the business is understood in the market. Further, we think Campbell’s dominant share in the domestic soup aisle (around 60%), combined with the resources to reinvest in its brands and entrench its business with leading retailers that depend on top brands to drive traffic, supports the company’s wide economic moat.

Even against this backdrop, we attribute Campbell’s deteriorating brand intangible asset more to category issues. Ready-to-serve soup has fallen victim to increased competition from other simple meal categories, and global category growth has languished, holding about flat to up around 1% on average over the past five years as soup has been losing out to other simple meal alternatives. As the leading player in the space, Campbell has not been immune to these headwinds. After two consecutive years of U.S. soup sales declines (2% in fiscal 2012 and 6% in fiscal 2011), Campbell posted a 5% increase in fiscal 2013, but it has yet to prove this increase is sustainable. Campbell’s soup sales fell nearly 3% on average each year between fiscal 2015 and 2017.

As a result of these challenging category dynamics, we think Campbell will need to up its brand spending to reignite its top line and support the brand intangible asset source underlying its wide economic moat. Management has suggested it is opting to focus on more-impactful innovation, instead of its prior strategy, which centered on bringing an abundance of new fare to market. Despite the hit to profits, we view this spending as crucial, as we doubt intense competitive pressures will subside. However, we don’t anticipate that merely marketing the new fare will be enough to fix an eroding competitive position and languishing sales. We expect that when Campbell brings new products to market that are more aligned with consumer trends, it will also ratchet up its promotional and advertising spending in an effort to drive trial of its new offerings.

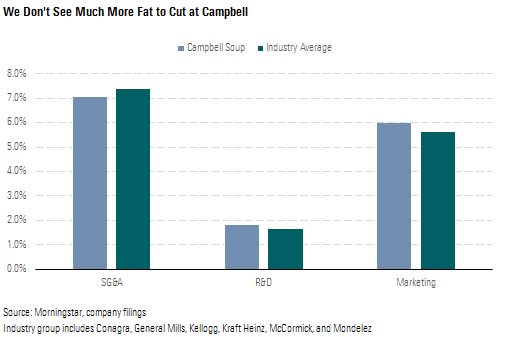

We forecast marketing to tick up to 6% on average over the next 10 years (from less than 5% in fiscal 2017) and research and development to approximate 1.8% of sales (about $160 million each year, or about 60 basis points above fiscal 2017). Whether this level of spending will be sufficient to offset competitive pressures and ensure Campbell’s products win with consumers at home and abroad is debatable. To frame this debate, we compared our cost forecast for Campbell with a group of industry peers.

Campbell’s cost of goods sold generally aligns with the industry average, but its selling, general, and administrative expense, at 7% of sales, is already a tad below the 7.4% of sales we estimate its peers to spend. This indicates to us that Campbell doesn’t have significant excess fat to shed beyond the current restructuring plans. In addition, we expect that Campbell will direct a slightly higher level of spending behind its brands in the form of R&D and marketing (we expect other industry players will spend 20-40 basis points less than Campbell annually over the upcoming decade).

Finally, despite elevated growth prospects, we believe extending its reach further into the natural and organic aisle will leave Campbell hungering for further profit gains, given that the category’s margins are in the high single to low double digits, materially below the company’s mid- to high teens margins on an aggregate basis and the mid-20s its soup offerings boast. We don’t believe Campbell’s natural and organic margins are artificially low or suggest inefficiencies in its supply chain; instead, we think they generally align with others in the industry, such as Hain Celestial HAIN, Pinnacle Foods PF, and WhiteWave (before its purchase by Danone DANOY). As a result, we believe the change in Campbell’s business mix (we expect Campbell Fresh will approximate nearly 13% of sales by fiscal 2027 from just 11% a few years ago) could constrain its ability to expand profitability in line with its recent pace in the longer term.

When taken together, we think these factors will keep consolidated operating margins at 18%-19% over the course of our explicit forecast, modestly trailing the 19%-plus we foresee for a group of its industry peers but still above the midteens that have historically characterized its operations.

Soup Struggles Have Slowed Sales Growth We attribute Campbell's stagnant top line--particularly its inability to reignite growth in its core soup lineup--to lackluster innovation, which centered on renovating (for example, reducing sodium content) as opposed to bringing compelling new flavor profiles to market, leading to lack of interest from the customer base. This is a particular challenge, given the minimal switching costs in consumer products.

Campbell has shifted its segment reporting structure over the past few years, so the historical perspective is limited, but even so, soup sales--which account for around one third of its consolidated base--have slipped at a nearly 3% clip on average annually over the past three years, falling from nearly $2.9 billion in fiscal 2014 to just less than $2.7 billion in fiscal 2017.

However, we don’t think this entirely reflects Campbell’s ability to compete in this aisle, as its share of U.S. wet soup (where we believe the company garners more than three fourths of its soup sales) has ticked down a mere 30 basis points since fiscal 2014, with its share at nearly 59% as of the end of July. This modest contraction in share has gone to the benefit of lower-priced private-label offerings, which realized a 140-basis-point share gain over the same horizon but still control only 14% of the category. These pressures could be compounded as European hard discounters Aldi and Lidl, which stock an outsize proportion of private-label fare, further penetrate the U.S. market. However, we think Campbell’s more focused spending on product innovation to better align its mix with evolving trends is beginning to bear fruit and ultimately should enable the company to withstand these headwinds.

Beyond its efforts to innovate in its existing soup portfolio, Campbell has not shied away from pursuing deals to extend its exposure to faster-growing areas of the category. Most recently, it bought natural and organic soup manufacturer Pacific Foods in a $700 million all-cash deal earlier this year. While relatively small on an aggregate basis at around 2% of Campbell’s total sales base, the deal affords Campbell another means of bolstering its shelf space in the natural and organic aisle, which has been winning at the expense of traditional center-store categories, growing at a midteens rate versus the latter’s low-single-digit pace. Further, with more than $200 million in annual sales, this tie-up is poised to bolster Campbell’s share in an on-trend part of the U.S. soup category, approximating a high-single- to low-double-digit percentage of the company’s total soup sales once the deal is officially completed. Therefore, we see Campbell’s share of the U.S. wet soup category jumping to the low 60s in fiscal 2018 and holding around 63% over the course of our explicit forecast.

This outlook is derived from our thinking surrounding the trajectory of the overall U.S. soup category. We believe that while conventional soup is charting a course for continued sales declines over the next decade (2% each year), growth will improve in the natural and organic arm (3%-4% each year). On the basis of management commentary, industry sources, and our own estimates, we think that organic soup represents just more than a third of the domestic soup category and that the U.S. soup market is poised to grow around 1% over the course of the next 10 years, in line with the 10-year historical average. Although we think Campbell is showing signs of more effectively aligning its mix with evolving consumer trends and has communicated early signs of success with innovation, we don’t think these efforts stand to drive outsize growth but rather should forestall further erosion. As such, we anticipate Campbell will chalk up gains that generally mirror this pace.

Outside the United States, Campbell has historically failed to cook up significant gains when it comes to its core product. Its past efforts to expand in two of the world’s largest soup markets, Russia and China (which account for around 32 billion and 320 billion servings of soup each year, respectively, far in excess of the 14 billion servings of soup consumed annually in the U.S.), fell flat. Unlike the U.S., where consumers tend to use ready-to-eat soup as a meal alternative or a cooking aid, the bulk of soup consumed in Russia and China--which together account for around 50% of the world’s soup consumption--tends to be homemade. Campbell failed to garner a meaningful foothold and previously exited Russia in 2011 after losing money in the region for more than five years. However, we now think the company’s focus on partnering with local players can improve its prospects beyond its borders, although it will still derive more than two thirds of its soup sales from its home turf.

We believe the remaining two thirds of Campbell’s portfolio includes other sources of growth (such as Pepperidge Farms, Goldfish, Tim Tams, Pace, and Prego), and management has been prudent in diversifying operations to encompass other types of packaged food, particularly those with a health and wellness bent. In the aggregate, we think these other offerings should enable Campbell to absorb periods of contraction within its core franchise.

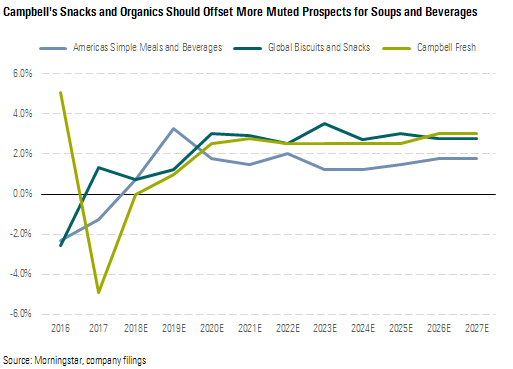

We forecast top-line growth in the Campbell Fresh business (10%-15% of total sales) to approximate 3% annually on average between fiscal 2018 and 2027. This lags the mid- to high-single-digit growth that characterizes the natural and organic category because the company derives about 40% of the segment’s sales from commodified offerings--such as raw carrots--as opposed to faster-growing branded fare (although this mix has trended down from more than 60% just a few years ago as management has intentionally focused on higher-margin offerings). We anticipate that the global biscuits and snacking segment (around one third of total sales) will see 2%-3% sales growth over the course of our explicit forecast, as Campbell’s leading brands in the aisle benefit from consumers’ desire for convenient snacks.

This growth far outpaces the 1%-2% growth we anticipate for Campbell’s Americas simple meals and beverages segment, which accounts for just more than half of consolidated sales and houses U.S. soups, sauces, and simple meals as well as North American beverages. Our forecast for reported growth in this segment is modestly positive in fiscal 2018 (80 basis points) but includes a nearly 3% benefit from acquisitions. This is offset by a 1% reduction in volume and 1% retreat in prices to account for Campbell’s inability to secure promotional shelf space during the all-important soup season at a leading U.S. retailer, which is likely to curtail Campbell’s soup sales this year, weighing on consolidated results by about 1%. Despite the negative implications surrounding the lost placement this year, we think this suggests Campbell is attempting to expand its top line with an eye toward profitability rather than securing growth at any cost, which we view favorably.

We forecast around 2% sales growth in the aggregate over the next 10 years, in line with management’s 1%-3% annual long-term sales target. Nearly 60% of this increase results from increased volume and favorable mix as Campbell extends the distribution of its fare into underpenetrated categories and channels, with the remainder from higher prices to reflect efforts to bring more on-trend innovation to the shelf, which may come with a higher price tag.

Efforts to Diversify Could Bolster Prospects Campbell CEO Denise Morrison has pursued a number of tie-ups since taking the helm in August 2011. Acquisitions over the past five years have included Bolthouse Farms (a domestic seller of fresh carrots and superpremium beverages) in July 2012 and Plum Organics (a U.S.-based manufacturer of premium organic foods for babies and children) in May 2013. Given the paltry revenue each contributed to the underlying business, we never believed any of the deals stood to enhance Campbell's sales base but rather think the benefits came from beefing up exposure to faster-growing areas of the store. Because smaller, niche operators have proved more agile in adapting their mix to changing preferences, we also believe Campbell could gain added insights into how to respond to evolving consumer trends in a timelier fashion. We think the inability to do this has plagued companies throughout the grocery store industry, and we view efforts to grease the wheels of the innovation cycle positively.

Although these efforts appear to us to be a prudent way to build out Campbell’s portfolio to include businesses with more attractive growth prospects at relatively fair acquisition multiples (when the terms of its deals were disclosed), we expected that expanding further into this realm would not bolster the company’s competitive prowess but rather support it. We think the price premium that natural and organics tout could wither if supply catches up with demand or if consumers lose confidence in the quality of organic products, which is a possibility if the designation becomes too wide and deep to be well regulated, as has happened with products labeled “natural.”

Campbell’s efforts to diversify haven’t been limited to product breadth. Management has also sought to extend the distribution of its fare beyond the traditional grocery channel through a handful of investments and partnerships. We’ve viewed attempts to extend the placement of its products further into the e-commerce channel as a judicious way to ensure that Campbell’s products are being stocked where consumers are shopping. One such example includes Peapod using Campbell’s cream of chicken soup and Swanson vegetable broth for its chicken pot pie meal kit. While this is by no means material in terms of its contribution to Campbell’s prospects, we think the insights that can be gained regarding packaging and distribution could facilitate further expansion in this channel.

Campbell isn’t stopping there, as it also announced a $10 million investment in Chef’d earlier this year. Chef’d, founded in 2015, differentiates itself from its subscription-based peers with a more ad hoc business model, allowing customers to order as many (or few) meals as they’d like at any time from hundreds of options. We view the meal kit services category as another means through which packaged food companies, including Campbell, can position products in front of consumers, supporting their brand intangible asset while also affording further perspective surrounding supply chain logistics of the faster-growing e-commerce realm.

Purchasing grocery products online hasn’t amassed much traction in the U.S., accounting for just a low-single-digit percentage of total sales, but we foresee the barriers to broader consumer acceptance breaking down as retailers invest in their own online platforms and consumers become more comfortable buying food online, the likelihood of which has increased following Amazon’s AMZN purchase of Whole Foods earlier this year. We forecast U.S. online grocery sales to grow 18% to $14.2 billion in 2017, roughly on pace with 2016, as grocers refine their meal kit plans and take a closer look at their direct-to-consumer strategies. However, we anticipate that in 2018 and 2019, growth will reaccelerate to 23% and 26%, respectively, driven by the halo effect of meal kit services on online grocery sales (not to mention Amazon’s own grocery aspirations).

To participate in the growth of personalized nutrition, Campbell in January launched Habit, an online, science-based, individualized health solution that aims to determine each person’s genetic makeup to put together unique physiology, lifestyle, and health goals. Rather than just providing consumers suggestions on foods they should eat to better their wellness profile, management suggested to us that this service opens the door to offering meal kits tailored to an individual’s biology. This product strikes us as unique in the marketplace today, and although tests are now available across the U.S. (with the exception of New Jersey, New York, and Rhode Island), the meal kit service is still limited to the greater San Francisco area at this juncture. We don’t believe this launch is likely to materially alter the company’s financial trajectory or enhance its competitive positioning in the near term.

And despite its recent tie-ups, we doubt that Campbell’s thirst for deals has been quenched and expect it will apportion excess free cash flow (which averages in the low double digits as a percentage of sales annually) to make acquisitions. Campbell has been a prudent capital allocator in the past, with valuation multiples shelled out for its recent tie-ups striking us as reasonable (when terms of the deals were disclosed). Also, returns on invested capital have exceeded our cost of capital estimate in each of the past 10 years. We think management will continue operating with this level of discipline.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)