Why Unicorns Are Overvalued (and the Industry Knows It)

Complex capital structures make properly valuing private firms more difficult than it may seem at first glance.

By Anthony Mirhaydari

This article originally appeared on PitchBook.com.

The rise of private market unicorns [firms valued at more than $1 billion] is well known--rising from 40 in the U.S. when the term was coined four years ago to more than 120 now. The cumulative unrealized value of current U.S. unicorns is approaching $600 billion, per PitchBook data. Exit times are lengthening, giving rise to a dynamic I've dubbed the "zombiecorn" as VC-backed companies stay private for far longer than has been seen historically.

But what if it's all built on a lie?

Research by Will Gornall at the University of British Columbia and Ilya A. Strebulaev at Stanford suggests unicorn valuations are overstated by 50% above fair value on average when one compensates for various distinctions between common and preferred shares and "riders" granted to late-stage investors. These provide for different cash flow and control rights, including IPO return guarantees, vetoes over down-IPOs and seniority over other investors, among other perks.

The problem is that inflated late-series post-money valuations are created when the price of, say, a Series D round is applied retroactively to all prior series--ignoring the fact that a "vanilla" Series A equity share isn't the same as a "deluxe" late-stage share full of extra rights and protections.

The research from Gornall and Strebulaev revealed that 15 unicorns in the U.S. are carrying valuations more than 100% above fair value. So it's a big deal. If the rise of zombiecorns is a symptom, overvaluation is the underlying condition.

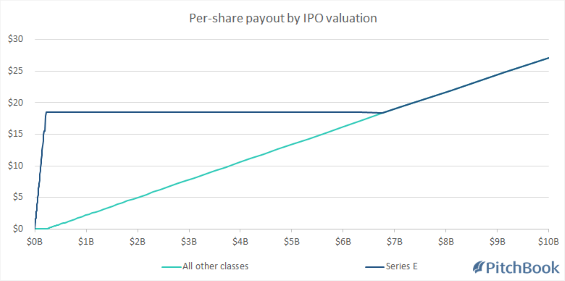

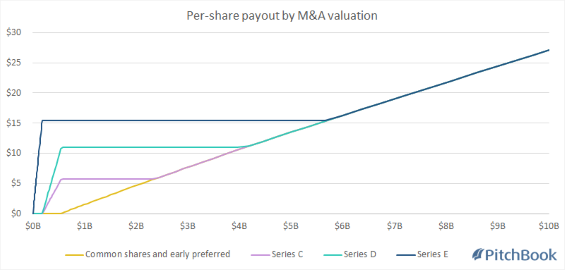

Square's Series E payout under different exit scenarios

(Note: For illustrative purposes only. This analysis only takes into account liquidation preferences; other deal terms would further alter the payout under different scenarios.)

The charts above illustrate this dynamic, using Square's pre-IPO capital structure as an example to look at the payoff to investors in different exit scenarios. Clearly, not all equity is equal. So, it shouldn't be valued at the same level.

Following the lead of Gornall and Strebulaev, here are more details on Square's October 2014 financing round as an example:

- The company raised $150 million by issuing 9.7 million Series E preferred shares for $15.46 each.

- These shares have the same payoff as common shares issued previously if the company had a successful exit, but also had additional value-adding protections if things went poorly.

- Specifically, the Series E shareholders were promised at least $15.46 per share in a liquidation or acquisition and the equivalent of at least $18.56 per share in an IPO. Both claims were senior to other shareholders.

- After this funding round, the company's $6 billion post-money valuation was calculated as follows: $15.46 (Series E price) x 388 million (estimated total number of shares in all classes, options, warrants, etc.). This despite the fact just 9.7 million Series E shares were issued.

- When Square IPO'd in November 2015 at $9 per share, 42% below the Series E price, those shareholders were contractually protected and received extra shares until they got $18.56-per-share worth of common stock.

Why is this allowed to happen? Mainly, this homogenous capital structure assumption isn't technically wrong in most cases, as long as the exit is strong. It's only if one assumes a difficult, lower-value exit that the difference between the back-of-the-envelope calculation and true Platonic ideal that breaks down each individual share class value widens.

Industry professionals seem well versed in the valuation distinctions. Mercer Capital, for instance, recently published a white paper on using the option pricing model to "reliably estimate the value of different economic rights in complex capital structures."

They admit, however, that this strategy cannot account for certain riders such as "differential voting rights, price protection or ratchet provisions, drag-along and tag-along rights, pre-emptive rights," as well as "complex anti-dilution provisions, including guaranteed minimum returns in the event of an IPO that go beyond the protections offered by traditional price ratchets."

All that sounds hard And it is. Mercer Capital recommends making a "discrete adjustment" to valuation estimates when these rights are present; 409A tax valuations also tend to offer a truer picture of actual value, but they're done with the idea of lowering tax burdens.

A survey conducted by Gornall, Strebulaev and others a couple of years ago found that 91% of VCs think unicorns are overvalued. People are aware of what's happening. There is just no impetus to change the status quo.

After all, why put all that effort in, just to lower the value of these companies and diminish the hype? Everyone from investors to entrepreneurs and employees with share options want valuations to keep rising. And thus, the lie perpetuates.

This could then explain why many unicorns are suffering disappointing post-IPO performances since the capital structure simplifies and equity shares become more or less equally valued (with companies like Snap, which IPO'd with a multitier share class structure, an exception).

The removal of those late-series rights deflates the valuation back toward fair value, and the fear of this could explain why so many unicorns seem scared to go public--preferring instead to push deeper and deeper into VC rounds. Like Uber.

Who are the victims here? For one, startup employees with junior share class holdings unaware that those big-time late series valuations may not fully apply to them should things take negative turn. This is something we could be on the verge of seeing play out with SoftBank's tender offer for Uber shares, which is expected to come in at a 30% discount to the company's last private valuation amid ongoing scandals and lawsuits.

The lesson: Sometimes, even in these frothy market conditions, things really are too good to be true.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)