Are the Oakmark Funds Prepared for the Future?

The firm has made significant progress in its succession planning but has more work to do.

A version of this article was published in the September 2017 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

How to fill the shoes of a retiring portfolio manager with a long record of success? Asset-management firms have long wrestled with this question. Great managers can’t be cloned (yet), so the best a firm can do is prepare by building a strong team behind them and ultimately choosing one or more successors who have shown promise and will employ a similar approach.

But Harris Associates, the advisor to the Oakmark Funds, faces a more formidable challenge--it may lose three such managers within a decade, and those three lead virtually all of the firm’s strategies.

Clyde McGregor, manager of

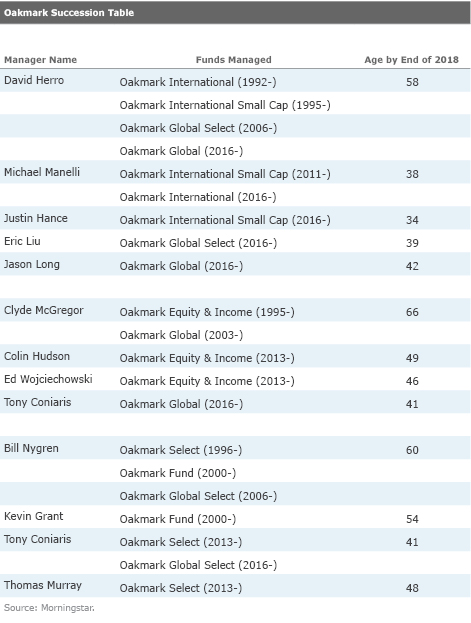

Harris’ structure makes the loss of a single portfolio manager a bit easier to handle--the entire firm uses the same value-driven strategy, and two stock-selection committees, each composed of three senior people (on the U.S. and non-U.S. teams, respectively), determine the list of stocks that each portfolio manager must choose from. But those committees will look substantially different down the road--Nygren and McGregor comprise two thirds of the U.S. committee, and Herro leads the non-U.S. committee. So, the firm’s manager-succession planning deserves a closer look.

Oakmark Equity & Income:

McGregor is the only one of the three managers who has disclosed his retirement plans, but that doesn’t mean investors should head for the exits. True, there have been recent shifts among his comanagers. This fund typically has at least one fixed-income specialist as a manager (the fund typically holds 20% to 40% of its assets in bonds). Ed Wojciechowski, a comanager since 2013, nominally fills that role while also serving as an equity analyst. However, McGregor says that Colin Hudson (also a comanager since 2013) now plays a larger fixed-income role and also serves as an equity analyst, while Wojciechowski focuses on high-yield bonds, which currently make up just a sliver of the fund’s assets. (The fund lost another comanager, Matthew Logan, when he left the firm in 2016.) It is not clear yet who the successor(s) might be when McGregor steps down, but both comanagers are in their 40s. And while neither has been on the fund for very long, each will have nine years’ tenure when McGregor turns 70. So, long-term fundholders will likely wind up with one or more experienced managers here even after McGregor retires.

Oakmark Global: The plan is clearer here. McGregor expects to be succeeded by Tony Coniaris, who was named a comanager on the U.S. side of the fund in November 2016. He is a rising star at the firm--he has comanaged Oakmark Select with Nygren since 2013, served as Harris' co-chair since 2015, and became the third member of the U.S. stock-selection committee at the start of 2017. Coniaris will turn 41 next year.

On the non-U.S. side of Oakmark Global, big changes have already taken place. Robert Taylor steered this portion of the fund starting in 2005, but he retired in September 2016 after 22 years at the firm. Herro, leader of the firm’s international team, joined the fund when Taylor’s retirement was announced. Jason Long, an analyst for Herro for eight years, was named a comanager in November 2016. Long has gradually taken the lead on the non-U.S. sleeve, though virtually every stock is also owned by Oakmark International or Oakmark International Small Cap. It wouldn’t be surprising to see Herro step off this fund if Long does well.

Investors should be in good hands here. While Coniaris and Long haven’t managed funds for long, the firm considers this a best-ideas vehicle for the entire investment team. So even if Coniaris and Long end up running this fund on their own in several years, the fund should still own many of the same stocks as other Oakmark offerings run by veteran colleagues--Nygren and Herro aren’t likely to leave the firm anytime soon.

Oakmark Select: Coniaris could also wind up as the successor at this fund and/or the U.S. portion of Oakmark Global Select. He has comanaged this fund with Nygren since 2013, though a second comanager, Thomas Murray (who will turn 48 next year), is also the director of U.S. research and has been on the fund as long as Coniaris. Succession is particularly important here, as the fund's 20-stock portfolio puts an intense focus on security selection. But Nygren, at age 59, may not leave for a long time, so potential successors should have plenty of time to earn their stripes.

Oakmark Fund: The succession plan is murky at Nygren's more-diversified charge, which holds 50-60 stocks. The only comanager, Kevin Grant, has run it with Nygren since 2000 and is co-chair of the firm along with Coniaris, but Grant (who joined the firm in 1988) is just six years younger than Nygren. If Grant took the helm after Nygren left, he might be joined by a younger comanager. This is another fund where investors probably won't have to worry about a change at the top for quite a while.

Oakmark Global Select: Like Oakmark Select, this is another 20-stock portfolio. However, like Oakmark Global, it is managed by both the U.S. and non-U.S. teams, and the departures of the fund's two well-known managers wouldn't necessarily signal the end of their input. Coniaris was named a comanager in November 2016; Nygren had previously managed the U.S. portion solo. Thus, Coniaris may be the successor here, though Nygren has generally supplied the U.S. picks for this fund from Oakmark Fund, which Coniaris doesn't comanage. The non-U.S. piece of this fund has been managed by Herro since the fund's 2006 launch, but Eric Liu (a portfolio manager on a Japan-only separate account who has eight years' tenure at the firm) was named a comanager in November 2016 to lighten Herro's workload in the wake of Taylor's departure. Liu may ultimately take the lead on the non-U.S. half of the fund but would no doubt continue to mine Herro's non-U.S. charges for ideas.

Oakmark International: This is the non-U.S. team's flagship, so investors should expect Herro to remain a manager here the longest. He has managed it since its 1992 inception, but he has also lost two experienced comanagers along the way: Michael Welsh (comanager from 1995-2005 before retiring), and Taylor (comanager from 2008 until his 2016 departure). Herro's only current comanager, Michael Manelli, has worked on the fund for only one year. But Manelli, who will turn 38 next year, has comanaged Oakmark International Small Cap since 2011 and serves on the international-stock selection committee with Herro. So, while there's no designated successor yet, Manelli appears to have a leg up. Herro is the youngest of Harris' three mainstays and thus may not require a successor for a long while.

Oakmark International Small Cap: Herro has led this fund since its 1995 inception but has seen comanagers depart here, too: Welsh was a comanager from 1997-2005, and Chad Clark comanaged the fund from 2005-09 before leaving. However, we expect more stability here in the future. Herro is gradually ceding the lead role on this fund to Manelli, and Herro also named Justin Hance as a comanager in November 2016--he was designated international director of research in 2015 and is the third member of the non-U.S. stock selection committee. Herro may step down from this fund in a few years, but investors can draw comfort from the fact that the fund's picks would still be vetted by the committee, where Herro would likely remain a member until retirement.

Harris has thus far done a solid job of putting talent in place for the future. None of the above funds have seen an Analyst Rating downgrade because of succession concerns, as we still have a great deal of confidence in the current investment team at Harris. That said, the firm has more work to do to solidify its plans for several funds.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)