Where the Moats Are

These sectors are home to the greatest number of narrow- and wide-moat companies.

We recently examined our equity coverage to see which sectors have the greatest concentrations of companies with wide and narrow moats.

I often talk about moats in this column, so forgive me if I sound like a broken record. For those of you who aren't familiar, the idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period.

One of the keys to finding superior long-term investments is buying companies that will be able to stay one step ahead of their competitors, and it's this characteristic--think of it as the strength and sustainability of a firm's competitive advantage--that Morningstar is trying to capture with the economic moat rating. A company that has generated capital higher than its cost of capital for many years probably has a moat, especially if its returns on capital have been rising or are fairly stable.

There are the five main things that can give companies economic moats, which we refer to as moat sources.

- Network effect: Lots of people are using the service.

- Intangible assets: Patents, brands, regulatory licenses, and other intangible assets can prevent competitors from duplicating a company's products, or allow the company to charge a significant price premium.

- Cost advantage: Firms with a structural cost advantage can either undercut competitors on price while earning similar margins, or they can charge market-level prices while earning relatively high margins.

- Switching costs: When it would be too expensive or troublesome to stop using a company's products, the company often has pricing power.

- Efficient scale: When a niche market is effectively served by one or a small handful of companies, efficient scale may be present.

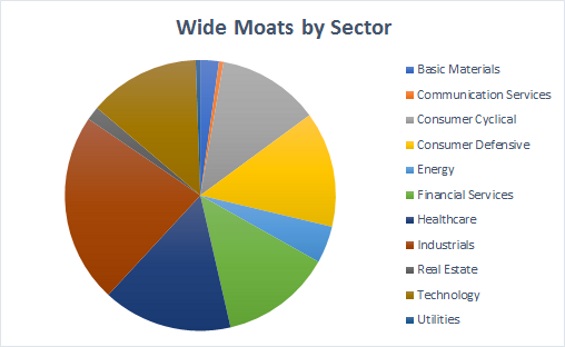

Where the Wide Moats Are The wide-moat stocks in our coverage break down like this.

The sector with the most wide-moat firms is industrials. Firms in this sector have a wide variety of moat sources, perhaps because the sector is so wide-ranging. For instance, payroll solutions provider

The healthcare sector is also widely represented among wide-moat firms. Pharmaceutical companies such as

Wide-moat tech firms tend to have intangible assets, network effects, or switching costs, depending on the type of firm.

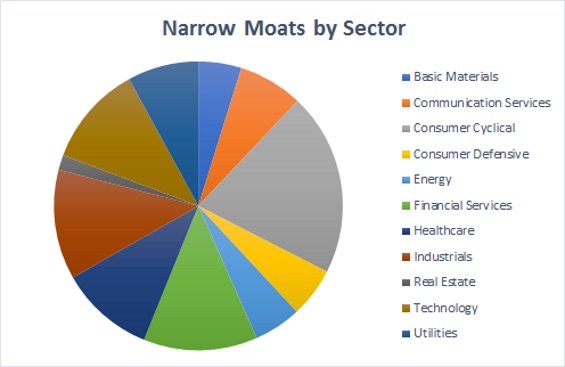

Where The Narrow Moats Are Narrow moats break out a bit differently, with consumer cyclicals far and away the most represented sector.

Intangible assets are the most common moat source for these companies. For instance, casinos such as

Within the financial services sector, narrow-moat banks' competitive advantages often stem from cost advantages and sometimes from switching costs. For instance, Plunkett believes

Publicly traded asset managers in the financial services sector such as

Note: Since its original publication, the tables and charts in this article have been updated to include a wider universe of stocks.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)