2018 Won't Be a Fizzy Year for COLAs After All

Because of the way the Social Security cost-of-living adjustment and Medicare premiums interact, millions of retirees will experience flat benefits next year, says contributor Mark Miller.

Riddle me this: The federal government announced that the standard Medicare Part B premium will stay flat next year, at $134 per month. Still, most retirees will pay more for Part B next year than they are paying in 2017.

And riddle me this, too: The annual Social Security cost-of-living adjustment for 2018 has been set at 2%--yet benefits will remain flat for millions of retirees.

The solutions to both riddles can be found in the way that Medicare premiums interact with the COLA.

The 2% Social Security COLA should be welcome news for retirees, considering that low inflation rates kept the annual increases from 2013 to 2015 around 1.5%. No COLA at all was awarded in 2016; this year, the adjustment was a paltry 0.3%. The COLA for 2018 is the highest since a 3.6% COLA was awarded in 2011.

COLAs are determined by an automatic formula tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers. For most beneficiaries, Medicare Part B premiums are deducted from Social Security. And the impact of the Part B premium on net benefits varies due to what is known as the "hold harmless" provision governing Social Security.

By law, the dollar amount of Part B premium increases cannot exceed the dollar amount of the COLA, a feature that ensures net Social Security benefits do not fall. The hold-harmless provision applies to the 70% of the Medicare population enrolled in both programs. Those not held harmless include anyone delaying their filing for Social Security benefits, but others affected include some federal and state government retirees. Affluent seniors who pay high-income Medicare premium surcharges also are not protected from increases that exceed the COLA.

The stingy COLAs of the past two years set the stage for the odd 2018 situation now facing millions of retirees.

The recent flat COLAs meant nonprotected Medicare enrollees shouldered most of the burden of rising Part B premiums; the premiums for this group jumped sharply in 2016 and 2017. This year, they are paying the standard $134 per month, while protected beneficiaries are paying an average of $109. (New enrolees in 2018 also pay the standard premium.)

But the more generous 2018 COLA will spread higher Part B program costs across the entire Medicare population. That contributed to keeping premiums flat for this year's nonprotected enrollees, while the protected group will pay more.

The hold-harmless situation affects people differently according to the level of their Social Security benefit. For example, a high-earning held-harmless retiree receiving $2,700 per month this year would still get a net adjusted COLA of $29. A retiree with a monthly benefit of $1,500 would get a $5 monthly bump. Benefits for everyone receiving $1,250 or less will stay flat.

Retirement Policy Implications The bite of Medicare premiums underscores how healthcare costs are eating into retiree living standards. Out-of-pocket health expenditures for the 65 and older population are 3.5 times higher than they are for younger adults, notes the U.S. Government Accountability Office in a recent report on the nation's retirement system. Yet per capita out-of-pocket healthcare spending by retirees has grown at a faster rate than overall inflation--an average 2.9% versus 2.4% per year from 2002 to 2012. That is expected to accelerate to roughly 4.8% by 2020, and remain at 4% or higher through 2025.

The Medicare-COLA numbers also cast a shadow on a broader debate about how to address Social Security's long-range solvency problems.

The combined Old-Age, Survivors and Disability Insurance trust funds are projected to be exhausted in 2034; at that point, beneficiaries would face a sharp across-the-board benefit cut, or Congress would need to approve an emergency injection of new revenue. An earlier solution could involve new revenue, a reduction of benefits, or a combination of both.

Conservatives favor using benefit cuts to close the gap. The leading Republican-sponsored proposal--the Social Security Reform Act of 2016--would lift the full retirement age to 69, and replace the current inflation measure with the so-called chained CPI, which aims to reflect changes in consumer purchasing patterns in response to inflation. Social Security's actuaries have estimated that a chained CPI would rise about 0.3 percentage points less per year than the current measure.

Progressives propose gradually increasing the payroll tax rate, lifting the cap on payroll subject to taxation. They also would increase benefits modestly by using a more generous COLA formula, increasing special minimum benefit low-wage workers, and lifting the threshold for benefits subject to income taxation.

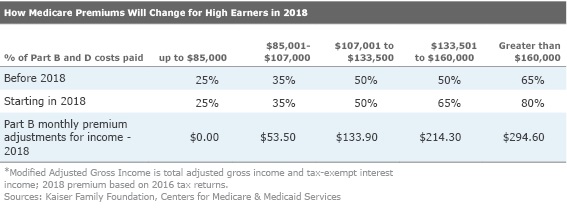

The Bite for High Earners Affluent retirees paying high-income Medicare premium surcharges may need to deal with one other change in the program in 2018. The surcharges affect people with modified adjusted gross income above $85,000 (single filers) or $170,000 for married couples. (Modified adjusted gross income is total adjusted gross income and tax-exempt interest income; for 2018, the premiums are based on your 2016 tax return.)

Here's how this works and how it is changing next year.

The standard Part B premium is set to cover 25% of overall program costs. But higher income beneficiaries pay surcharges that range from 35% to 80% of program cost, depending on their income. Starting next year, people who fall into the two highest surcharge brackets will pay higher percentages of program cost. Next year, the premiums for single filers will start at $53.50 per month, jumping to $294.60 in the highest bracket.

All told, a 2018 that might have been a fizzy year for COLAs looks like it will be somewhat flat, after all.

Morningstar columnist Mark Miller is a nationally recognized expert on trends in retirement and aging. He also contributes to Reuters, WealthManagement.com and The New York Times. His book, Jolt: Stories of Trauma and Transformation, will be published in February by Post Hill Press. The views expressed in this article do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)