Investors Experience Higher and Rising Fees for Liquid Alternative Funds

Bucking the trend observed in other asset classes.

Investors, on average, continue to pay significantly higher fees for alternative mutual funds.

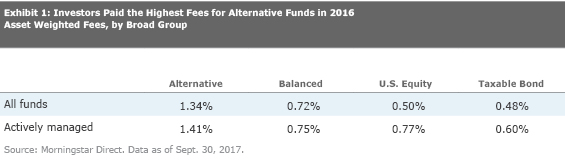

In 2016, investors paid an asset-weighted average of 1.34% for alternative mutual funds (which includes open-end funds and exchange-traded funds), which was significantly higher than the asset-weighted average of 0.72% for balanced funds, 0.50% for U.S. equity funds, and 0.48% for taxable-bond funds (see Exhibit 1). Among just actively managed funds, fees paid for alternative funds were still about double that of other fund categories.

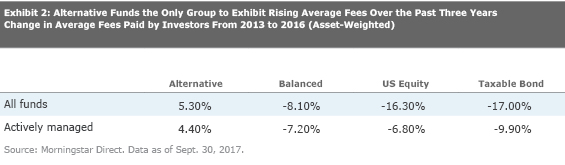

Even more notable, despite their higher fees, alternative funds were the only group of funds to exhibit rising costs to investors (see Exhibit 2). For categories of funds such as balanced, U.S. equity, and taxable bonds, overall fees paid by investors have been trending down over the past three years, thanks to strong flows out of more-expensive share classes and into cheaper share classes, as well as strong flows out of actively managed funds and into low-cost passive funds.

Investors buy alternative funds for diversification, or, more specifically, for their low correlations to equities and bonds and potential alpha. These traits are difficult to capture in a (potentially lower-cost) passive vehicle, which may explain why alternative funds have not experienced large inflows into passive funds and outflows out of active funds, which have been observed in equity and bond funds. And since alpha and low correlations are hard for managers to provide, alternative funds tend to be priced to reflect this "scarcity premium."

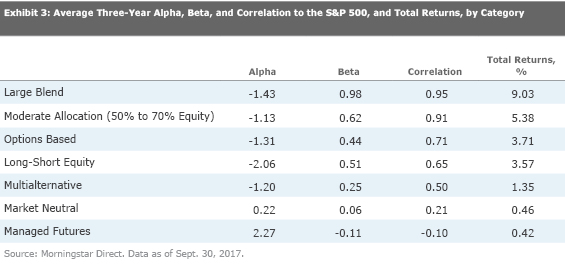

However, investors should assess if an alternative fund is indeed providing something "scarce." A fund’s correlation to the S&P 500 can be found on Morningstar.com or Morningstar Direct. Long-short equity and options-based funds tend to have higher beta, which generally results in high correlations and higher returns in a rising market, relative to other categories of alternative funds. These funds can be considered more as equity substitutes, and when their fees are viewed in this context, as a group, they seem expensive given their large pricing premium to equity funds. Managed-futures and market-neutral funds, on the other hand, tend to have low beta, with managed futures exhibiting slightly negative correlations to the S&P 500. These funds’ fees can be viewed in the context of their diversification benefits (for example, how the fund performed during an equity market downturn) and their historical returns versus their stated target.

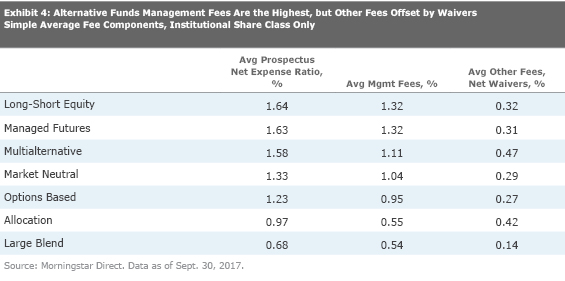

There are also operational reasons why alternative funds are more expensive, and investors should evaluate if these higher costs are justified within the context of the fund’s targeted return and performance profile. Exhibit 4 is a table of average expense ratios (of institutional shares) by Morningstar Category. The prospectus net expense ratio is broken into two parts: the management fee (the amount paid to the fund management company to manage the fund) and the remainder, which includes all other fees (administrative fees, legal and audit fees, and so on), net any waivers in place. Relative to allocation funds (which have higher fees than equities funds because they hold different assets), alternative funds still carry significantly higher management fees and overall fees.

Among alternatives funds, managed-futures and long-short equity funds carry the highest advisor fees. Managed-futures managers may justify their higher fees by saying they hold a large variety of instruments (derivatives for equity market indexes, fixed income, currencies, commodities, precious metals) that trade on many exchanges, which can be costlier to manage. Some of these funds may also be capacity-constrained, especially if the manager trades less-liquid instruments. And historically, managed-futures strategies’ returns have exhibited very low correlations to that of equities.

But managing a long-short equity fund is similar to managing a market-neutral fund, so it is not obvious why there is a large gap in advisor fees or why long-short equity funds are expensive on an absolute basis. It is possible (but not reasonable) that long-short funds are priced according to their return potential, which tends to be higher than that of market neutral, as the former has more exposure to equity markets, whereas the latter tends to have a beta closer to zero. With such high fees, it is not surprising that the long-short equity category's three-year average alpha has been negative 2.06, significantly lower than the market-neutral category average of 0.22 (see Exhibit 3).

Shorting can also be costly. Funds that take short positions, such as long-short equity funds, market-neutral funds, and some multialternative funds, will include an expense line in their SEC filings for dividend expenses and borrowing expenses for securities sold short. This is because funds that short stocks have to pay back any dividends they receive. Funds also incur borrowing costs, which can be higher if the security shorted is difficult to access. For the larger long-short equity funds, this line item tends to be between 50 and 100 basis points. These costs are removed from the annual report expense ratio in Morningstar products, as they are variable and are already reflected in the performance of the fund. Other additional costs that alternative funds may have are acquired fund fees, which is more common in multialternative funds that are structured as funds of funds.

For some context, mutual fund pricing within the more traditional asset classes tends to reflect one or more of the following considerations: capacity (for example, small-cap funds carry higher fees partly because they have lower capacities relative to large-cap funds) or process and portfolio complexity (higher fees may be needed to pay for a large investment team or expensive technology/data). Sometimes, return potential is used to justify a certain fee range; for example, bond funds, with a lower return potential, are typically less expensive than equity funds. However, equity fund’s higher return potential isn’t really a good reason for higher fees, as almost all the returns come from beta exposure to markets and not manager skill. In fact, large-blend funds, on average, had low alpha (after fees) relative to most alternative funds (see Exhibit 4). (Alpha is a measure of the fund’s returns after removing the contribution from market exposure, or beta. Funds with a relative low beta should be evaluated more on their correlation and total return potential than on alpha). On a total return basis, large blend significantly outperformed, thanks to its exposure to equity markets.

High fees and additional costs render most liquid alternative funds as relatively unattractive investments. But there are some funds worth holding (see the list of Morningstar Medalists by category here.) Investors using alternative funds should determine what role the fund will play in a portfolio (a portfolio ballast, a source of uncorrelated alpha, and so on), assess the fund's ability to deliver this objective, and determine if the fees are justified.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)