Should You Be Concerned About Exposure to Defaulted Venezuelan Bonds?

It’s been a tough month for these bonds, but it’s a small allocation for most emerging-markets bond funds.

The International Swaps and Derivatives Association declared that Venezuela defaulted on its sovereign bonds and the debt of its state-run oil company Petroleos de Venezuela, or PDVSA, on Nov. 16. That was nearly two weeks after Venezuelan President Nicolas Maduro announced intentions to restructure the country’s debt pile of more than $60 billion, prompting a further sell-off in the already low-priced bonds.

Over the past few years, Maduro’s mismanagement of PDVSA has led to a crippling recession and shortages of food and medicine despite the country’s massive crude oil reserves. And Maduro’s recent takeover of the legislature led to U.S. sanctions on trading newer bonds and dividend payments from Citgo (PDVSA’s U.S. oil-refinery arm) back to Venezuela.

Venezuela had serviced its sovereign and PDVSA bonds against an increasingly dire economic situation and dwindling pile of reserves (estimated under $10 billion) up until late October. At that point, it fell into grace periods on two bonds for both the sovereign and PDVSA that expired on Nov. 13. That spurred S&P to declare a selective default on the same day that creditors met with government officials in Caracas. In that meeting, creditors were not told of any reforms that the country would undertake in a restructuring agreement.

Although Venezuelan debt pops up in small ways (<1%) in some multisector, core, and nontraditional bond funds, investors in emerging-markets bond funds are the most likely to have exposure to Venezuelan debt. These funds typically use the JPMorgan Emerging Markets Bond Index, or EMBI, as a benchmark, which focuses on hard-currency (USD or EUR) denominated sovereigns and quasi-sovereigns. For the first 10 months of 2017, the index had a roughly 2.5% stake in Venezuelan debt.

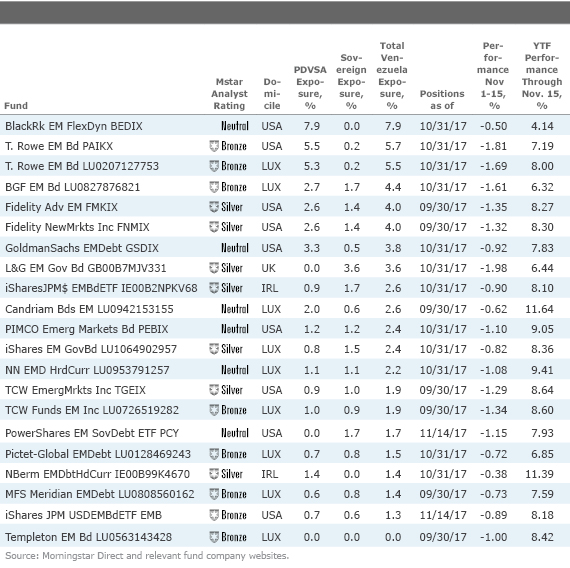

The following table shows all U.S. and Europe-domiciled funds in the emerging-markets bond category with a Morningstar Analyst Rating, as well as

The benchmark’s Venezuelan bonds slid by 8% in aggregate for the year to date through October, and Venezuela was the only country in negative territory for the period (the index and typical emerging-markets bond fund were up by 9% and 10%, respectively). For much of the year, most PDVSA and Venezuelan sovereign bonds had been trading at 30-50 cents on the dollar, by far the cheapest bonds in the index, with a yield of more than 30%. In the few days leading up to Maduro’s announcement on Nov. 3, the bonds were already selling off. They took another hit right after, especially the shorter-dated bonds and the sovereigns, putting most of them in the $0.20 range.

Diverse Viewpoints, Diverse Stakes Leading up to the recent turmoil, several longtime Venezuela investors found ample reason to stay the course. Some even added to their positions on weakness. BlackRock Emerging Markets Flexible Dynamic had the largest stake on the list of rated funds (7.9% as of Oct. 31). The team behind that fund sees three possible scenarios: In the first, Maduro begins to negotiate a restructuring but also continues to service all debts. In the second, Venezuela runs out of cash and defaults on both PDVSA and the sovereigns. Lastly, the team thinks that Venezuela could selectively default on the sovereign in order to prioritize payments on PDVSA's debt, thereby avoiding a legal fight that could have an impact on the oil industry. Given these views, the team has been focused on longer-dated PDVSA bonds (2027 maturity), arguing they'd be likely to benefit most under any of these scenarios.

Other emerging-markets bond managers have exercised caution. Neuberger Berman EM Debt Hard Currency had an underweighting to Venezuela (1.4% as of October 2017) as a result of the team’s deteriorating outlook. That fund’s position was entirely in PDVSA bonds, as these were trading at a higher discount than the sovereign (30 cents to the dollar) in October. Currently, the team fears further downside risk, arguing that the odds of a successful debt renegotiation by the current regime are close to nil. In addition, Pictet-Global Emerging Debt had an underweighting in the 1–5 year maturity bucket and an overweighting in the 5–10 year maturity range (1.5% total in Venezuela as of Oct. 31), where it believes there is less downside risk and greater upside potential in case of a regime change and/or favorable debt-restructuring terms.

Not all emerging-markets bond funds own Venezuela, however. Templeton Emerging Markets Bond, which is benchmark-agnostic, hasn’t owned Venezuelan debt since mid-2014 because its management team was discouraged by the country’s lack of transparency. I covered more details on some of these funds’ positionings in September.

Emerging-markets bond exchange-traded funds can still own defaulted Venezuelan debt, and positions will be adjusted based on market estimations of the value of the restructured debt. That said, Venezuelan bonds could come out of the index if they fail to meet liquidity requirements for inclusion. While not currently an issue, a lack of liquidity could become a bigger problem if the United States imposes more-severe sanctions on trading.

Don't Panic In any case, this situation could take a long time to resolve. Ukraine's far less complicated sovereign bond restructuring took the better part of a year. Maduro's stranglehold on the government is a major roadblock, and so are U.S. sanctions. As long as those sanctions are in place, U.S. business entities can't participate in any restructuring. Oil prices are another key variable here.

Investors in core and global bond funds have little to fear, as most of these funds haven’t owned Venezuelan debt. For investors with exposure to dedicated emerging-markets bond funds, the recent turmoil isn’t reason to sell. The already low-priced Venezuelan bonds’ recent sell-off hasn’t done much to damp these funds’ solid gains for the year to date. Venezuelan bonds have taken many hits over the past five years--several traded in the $0.80 to $1 range in 2012--so current prices already incorporate a lot of bad news. And some veteran managers see good long-term potential from these very low bond prices.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)