Our Ultimate Stock-Pickers' Top 10 High-Conviction and New-Money Purchases

This period saw the return of our top managers into household, blue-chip names.

By Joshua Aguilar | Associate Equity Analyst

For the past nine years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers but are also timely enough for investors to get some value from them.

In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment.

With over 90% of our Ultimate Stock-Pickers having reported their holdings for the third quarter of 2017, we have a good sense of what stocks piqued their interest during the period. While the story of 2017’s second quarter was active management's retreat to lesser-known names in the face of stretched valuations for more recognized names, the story of the third quarter was our top managers' return to well-known, blue-chip names. That said, many quarterly commentaries continued to highlight the issue of valuations after a nine-year bull market.

Our own coverage, which we believe is moatier than the collective universe of equities, currently trades at an aggregate price/fair value of 103%, as it did during our previous early read article for the second quarter. This continues to be far removed from the post-financial-crisis levels, where our own aggregate price/fair value assessments reached as low as 55%.

This perception of stretched valuations has continued to have reverberations in the stock-picking environment. Overall activity levels once again dropped after a consistent drop from their high during the final period of last year. Moreover, this marks the most precipitous drop in overall activity levels since the change from the post-election rally of the fourth quarter of 2016 to the first quarter of 2017. The drop-in activity levels represent the lowest level of activity in seven periods. Additionally, our top managers once again remained net sellers, as was the case in the previous six periods. That said, of all the previous periods, this marked the first period where buying activity nearly reached a level of parity with selling activity. However, the number of top managers that made new-money purchases during the period remained comparable to last period. As was the case during the second quarter, many of the positions that were initiated during the second quarter were relatively small, although a few new-money positions were also high-conviction purchases, including wide-moat rated

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities highlighted in this article could have been made as early as the start of July, with the prices paid by our managers being much different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

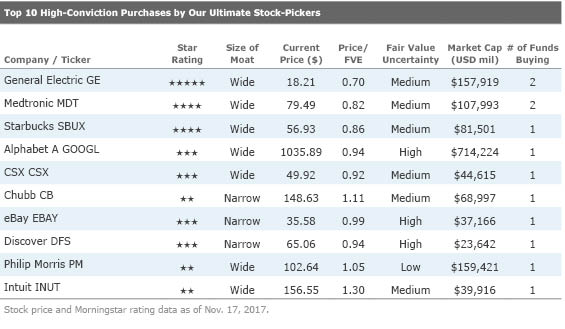

Looking more closely at the top 10 high-conviction purchases during the third quarter of 2017, the buying activity was similarly diversified compared with last quarter, with some concentrated consumer bets in both the consumer cyclical and consumer defensive sectors. Once again, the only name that stuck out to us from this list, on the basis of valuation, was wide-moat behemoth

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

- source: Morningstar Analysts

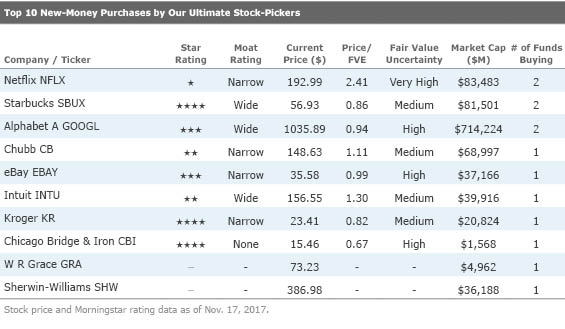

Once again, there was a moderate amount of crossover between our two top-10 lists this period, including wide-moat rated GE, Alphabet, and Intuit, as well as narrow-moat rated eBay and Chubb. As was the case last period, no stocks had at least two funds initiate a high-conviction, new-money position.

Top 10 New-Money Purchases Made by Our Ultimate Stock-Pickers

- source: Morningstar Analysts

This quarter saw a higher number of interesting and arguably more well-known stocks on both of our top-10 high-conviction and top-10 new-money purchase lists trading at discounts to our analysts’ fair value estimates. As such, there are a few names on either of these lists that might warrant a place on an investor’s watch list. We are also including a name we believe is significantly overvalued relative to the market's valuation as well as the assessment of two of our top managers.

From a valuation perspective, General Electric is the most attractive name to make our top-10 list of high-conviction purchases and remains at the top of our list of high-conviction purchases as it did last period. The firm has been in the news recently after it cut its dividend, a move that was well anticipated by analysts prior to the announcement given the firm's cash shortfall. Shortly after the announcement, Morningstar analyst Barbara Noverini trimmed her fair value estimate for the shares to $26 from $29. At current prices, this reflects a 30% discount to Noverini's fair value estimate. Noverini reduced her valuation after the company's investor day revealed a lower earnings base than she anticipated for the beleaguered power segment. Power operating profit is expected to fall an additional 25% in 2018, and as a result, Noverini is resetting her long-term expectations for improvement in the power segment off a lower base. As such, Noverini found it prudent to lower her midcycle operating margin assumption on the segment to 11.4% from her previously anticipated 15.6%. Her revised assessment now incorporates lower equipment margins as price competition intensifies in power generation markets as well as lower service profitability due to ongoing challenges in transaction services.

Noverini now believes GE will be a multi-year turnaround. With the dividend cut in half, significant restructuring planned for the power segment, and no imminent breakup of the industrial conglomerate on the table, Noverini now believes maximum pessimism has been reached. With the recent dividend-cut announcement, Noverini believes that the firm's shares are trading at a level that implies that the portfolio is incapable of returning to meaningful earnings growth. That said, she does not believe this reflects the company's long-term potential, considering that 70% of GE's revenue and 85% of GE's earnings come from businesses that dominate their respective markets. While Noverini acknowledges that 2018 will be messy, as earnings exhibit a lot of accounting and restructuring noise, she asserts that GE's collection of assets can return to healthy free cash flow generation over the long run under CEO John Flannery's superior management.

In contrast to some market observers complaining over GE's current lack of transparency, Noverini likes that Flannery's messaging repeatedly addresses questions she considers most important to investors. While she acknowledges that cutting the dividend is painful, she counters by pointing out that it frees capital to allocate toward the restructuring sorely needed to right-size the power segment. Noverini takes Flannery's highlighting of $20 billion of assets earmarked for divestiture over the next two years as a sign of purposeful redirection of capital and management attention toward businesses with strong potential for secular growth. Lastly, like

Also of note on our list of top 10 high-conviction purchases is wide-moat coffeemaker Starbucks. The stock currently trades at a 14% discount to our analyst's fair value estimate.

“During the quarter, we bought…Starbucks, the well-known coffee chain. We believe Starbucks can compound its earnings for many years to come, as the company continues its global expansion, penetrates the consumer packaged goods market, and launches new food and drink initiatives. At the time of our purchase, the stock was trading at a discount to its historical valuation and at a five-year low relative to the overall stock market. The issue many investors are worried about is a deceleration in growth. Our view is that Starbucks’ loyalty program and capabilities to innovate will lead to improved earnings growth over time.”

In his most recent note, Morningstar consumer strategist R.J. Hottovy addressed investor concerns regarding the firm's future growth prospects. Heading into the stock's fourth-quarter update, Hottovy writes that he focused on two questions: (1) Would U.S. comp trends (a measure of same-store sales growth for stores open at least one year) recover from recent weakness?; and (2) How significant would the changes to its longer-term growth algorithm prove? At first blush, Hottovy admits that the answers to both questions were disappointing. He points out U.S. comps increasing only 2% and expectations of EPS growth of "at least 12%" falling short of mid-teens market expectations. While Hottovy concedes that he'll likely shave a dollar off his $66 fair value estimate to account for new growth targets, he still sees several positive takeaways.

First, adjusted comps featured a 1% increase in traffic, the best performance in six quarters and still ahead of low-single-digit declines across much of the industry. While Hottovy is not anticipating a return to the 7% U.S. comps average from fiscal 2012-16, he still sees a path to the 3%-5% longer-term comp guidance, including opening mobile order and pay to nonmembers of Starbucks' loyalty program, new beverage/food innovations, streamlined restaurant operations, and eventually, new upscale restaurant formats. Second, Hottovy points out that Starbucks is reaching the point where China is large enough to be a major growth engine. Hottovy still believes that the company's prior goals for the China/Asia-Pacific region--including $6 billion in revenue by fiscal 2021--are in play. Lastly, Hottovy believes that Starbucks has quietly become an under-the-radar capital allocation story, including plans to return $15 billion to shareholders in dividends and buybacks over the next three years. He assigns the firm's management with an exemplary stewardship rating. While Hottovy acknowledges the coffee chain's most recent results have been uneven, he doesn't think the stock deserves to be trading at a discount of 23 times earnings relative to other quick service restaurant brands, which are currently trading at 26 times earnings.

As for investor woes over top-line growth, Hottovy points out that Starbucks plans to open 2,300 net new stores globally in fiscal 2018--roughly the same number as fiscal 2017--including 1,100 locations in the China/Asia-Pacific region, 900 locations in the Americas segment, and 300 locations in the Europe, Middle East, and Africa segment. On an organic basis, he believes that management's outlook calling for high-single-digit revenue growth appears realistic based on expectations for 4% global comps and roughly 8% unit growth. That said, management points out that measures to streamline its business should result in 2 to 3 additional points of top-line growth for the year. As for margins, Hottovy believes that management's margin expansion projection lines up with his modeling assumptions and will be backed by streamlined operations as well as expense leverage. He points out that this puts the company on track to come in at or slightly ahead of its adjusted earnings per share target for the year.

Turning over to our list of new-money purchases, we think narrow-moat rated

“The retail industry is undergoing profound structural shifts driven by the rise of e-commerce, shifts in consumer tastes and broad declines in store traffic. While the grocery category is partially insulated from these changes given the nature of the product and the shopping experience, we understand that the industry is highly competitive and not immune from broader trends. Nonetheless, we believe Kroger can effectively leverage its size and scale to sustain a leadership position in this changing landscape. In our view, the Company stands out among peers given: i) its demonstrated ability to consolidate a still-fragmented food retailing market, ii) its forward-thinking approach to using technology to improve the shopping experience and store operations, iii) its pioneering use of sophisticated data analytics, and iv) its expansive private label program, which drives margin benefits and provides value to consumers. These key competitive advantages and Kroger’s ability to invest behind them have been critical in the recent period of food cost deflation, which has put enormous pressure on smaller, sub-scale players, many of whom have been forced out of the business.”

Morningstar analyst John Brick covers the name and largely agrees with this competitive analysis. He believes Kroger possesses additional cost advantages over foes deriving from both its national and local scale. Brick furthermore concurs with BBH's assessment that Kroger also benefits from strong data analytics, which enables it to tailor its merchandising mix and promotion to more effectively align with customer preferences. He believes that the combination of its cost edge and intangible assets position it well to compete with other mass merchants as well as alternative outlets including e-commerce and the hard discounters Aldi and Lidl. Overall, Brick thinks these sources of competitive advantage should continue to drive returns on invested capital of nearly 9% over the medium term, above his 7% cost of capital estimate.

Elaborating more on the firm's cost advantage, Brick thinks this moat source is driven by Kroger's ability to turn items 14 times, which exceeds those of other brand name competitors that typically range between 10 to 12 times. This high turnover of inventory enables higher volume to leverage fixed store costs, thus reinforcing Kroger's ability to provide customers lower prices. Brick believes that evidence of this advantage can be gleaned from Kroger's sales per square foot, which stands around $650, among the highest across the retail defense space. For comparison purposes, only Costco is higher at $1,100. Additionally, when attempting to garner cost advantage in the razor-thin margin grocer space, Brick argues that regional market share becomes an important metric as opposed to national size. Brick points out that consumers make decisions in terms of where to shop based primarily on location. To Brick, regional market share dominance is important for three reasons: (1) to leverage fixed costs and scale distribution centers on a local level, (2) to fend off competition by making it costly and risky for others to enter after Kroger amasses sufficient share in a region, and (3) to leverage marketing capabilities and other overhead spending.

Brick also views Kroger's private-label mix, which is vertically integrated in its supply chain, as a cost advantage over other retailers. With its penetration of private brands at 26% of sales versus the industry at 18%, Brick thinks Kroger is able to provide its customers with lower-priced fare that helps to boost the firm's overall margin profile. Brick also believes this offering is differentiated as this process garners a higher level of quality control. In addition, Kroger is in a solid position to take the offensive in online grocery with around 650 click-and-collect locations and 2,800 economic grocery store fronts, or "fulfillment centers," should the industry head further toward home delivery.

One new-money purchase that topped our top 10 list and has been popular with the market has run contrary to our own thinking. Both Oakmark and

Moreover, while Macker concedes that Netflix posted another strong quarter in terms of subscribers as the firm beat its guidance, both revenue and segment contribution came in only slightly above Macker's projections. Mirroring historical experience, Macker adds that the firm continues to burn cash at an accelerated pace, with a free cash flow burn of over $1.5 million in the first three quarters of 2017, versus a loss of over $1.0 billion over the same period last year. Further, even as the firm recently announced a price increase for certain monthly subscribers, which was not surprising to Macker given the firm's cash burn and need to invest in further content, the timing of these price increases was surprising to Macker, given that this was the third such hike in the last three years. As such, Macker believes that many subscribers will continue to pay the increased price but at the same time thinks churn will spike and that the price increase will make competing services look more attractive to potential subscribers.

While management remains adamant about its plan to enhance long-term free cash flow by investing heavily in proprietary content over the near term, Macker believes this production increase will continue to weigh on both free cash flow and operating margins over the near to medium term. He points out that the firm suffered a free cash flow loss of $608 million in the second quarter versus a loss of $254 million in the same quarter a year ago. While original content does have a positive impact to subscriber growth, Macker counters by making two points. First, external data reveals that Netflix viewing highlights third-party content, particularly network shows, as the most popular to current subscribers. Second, while original content may have a long shelf life, Netflix will eventually be forced to continually add new shows to retain viewers, as in the case with broadcast networks. Highlighting the behavior of viewers, Macker points out that the firm's most well-known and popular content tends to be prestige dramas, like House of Cards, which is less prone to repetitive viewing compared with beloved sitcoms, such as The Big Bang Theory and Friends. In conclusion, Macker thinks that these reasons underpin management's warning that the firm expects negative free cash flow for "many years."

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: As of the publication of this article, neither Joshua Aguilar nor Eric Compton has any ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)