AQR: The Vanguard of Alternative Investing?

It is and it isn't.

Different Drum Alternative investments are different. Not just in what they buy and how they perform (where, of course, acting differently is the whole point), but in how the industry operates. The rules that govern other segments of the fund business often don't apply to alternatives.

For example, exchange-traded funds have yet to make their mark. Whereas with initially domestic stocks, then international stocks, and now taxable bonds, ETFs have siphoned customers away from traditional mutual funds, they are an afterthought with alternatives. True, leveraged ETFs have sold pretty well, and they are in the alternative Morningstar Category for lack of a better option, but they are not true alternative funds in the sense of being uncorrelated with the major markets. The real thing--categories such as long-short credit or managed futures--hold less than $4 billion in ETF assets.

In a related point, active investors dominate in this space. ETFs, after all, rely on indexes, and alternatives don't easily lend themselves to indexing. They are strategies. We can measure the U.S. stock market, then create an index to replicate that measurement. We can't do the same with a market-neutral strategy. To be sure, we can build an ETF by devising a representative strategy, then call our invention an "index." But, clearly, such a construction is less natural than a marketplace index, and investors have responded accordingly.

Because index funds pose little competitive threat, expense ratios for the leading alternative funds are far higher than elsewhere in the industry. These days, the vast majority of conventional fund sales go into funds that have expense ratios of less than 0.60%--usually much less. With alternatives, on the other hand, a 1% expense ratio is considered low-cost. Most of the larger funds have expense ratios approaching 1.5%, which would doom them were they not alternatives.

One AQR to Rule Them Given all these differences, it's not surprising that, for alternatives, industry leadership is upside down. The giants are absent. Among them, Vanguard, BlackRock, Fidelity, Capital Research, and T. Rowe Price run a grand total of $7 billion in alternative mutual funds. In contrast, the management firm AQR controls $29 billion. It is, one might say, the Vanguard of the alternatives business.

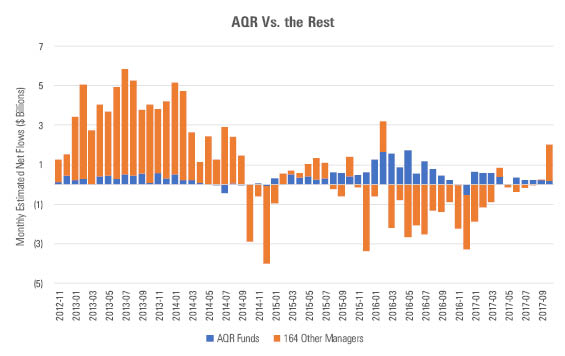

- Source: Morningstar Direct

The chart above illustrates the net monthly sales since January 2012 of alternative mutual funds. AQR is shown in blue, and all other companies combined in orange. AQR took a while to gather momentum--of course, so did Vanguard back in its day--but starting about three years ago, AQR moved into first place. Since then, it has steadily gathered new assets while its rivals have mostly suffered net redemptions. (As is the nature of aggregations, the orange bars hide the occasional outliers; it's not as if every fund company besides AQR has being losing alternatives assets. Rest assured, though, AQR has comfortably led the way.)

The chart below shows how AQR has succeeded. It depicts AQR's four best-selling funds of the year, which have attracted $4 billion in new assets, counting all share classes. As portraying the results of multiple share classes of the same fund is messy (and adds no useful additional information), I have selected just one share class per fund (the highest-selling share class). The funds' relative total returns, as measured by their trailing three-year category rankings, are in blue. Their costs relative to category are in orange. For both bars, higher is better. The best-performing fund would have a blue bar that reaches 100, and the cheapest fund would have an orange bar at 100.

Blue-Ribbon Returns

AQR won the old-fashioned way: Its funds beat everybody else's.

Its expenses haven't been bad, either. Three of the four funds are cheaper than the norm, with AQR Managed Futures Strategy being among its category's lowest. Clearly, though, the funds' performance has been their main attraction. Also, this illustration favors AQR, because three of those fund share classes are institutional, and the fourth is an R6 share class, which is priced even below the institutional classes. (R6 is a "clean" share class, meaning that it does not share any revenue with the companies that distribute AQR funds.) If retail funds are removed from the picture, AQR's cost advantage declines.

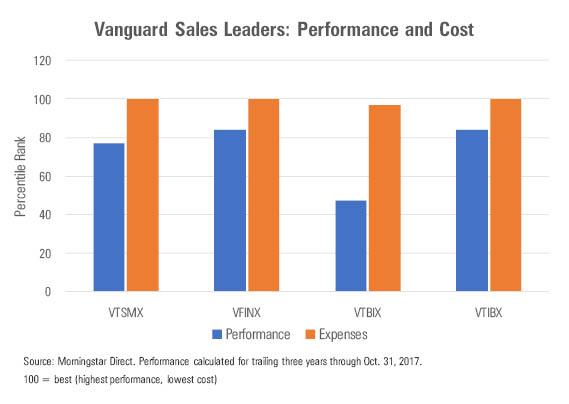

Orange-Ribbon Costs Now, let's look at Vanguard's chart. As with AQR's figures, Vanguard's are generated from its four top-selling mutual funds during 2017, with the blue bars representing relative total returns and the orange bars showing relative expenses.

It's almost certainly what you expected: The orange triumphs. Just as three of AQR's four blue bars scored 100, three of Vanguard's orange bars are 100. Vanguard has dominated costs as AQR has dominated performance. The fourth orange bar registers 97, because it portrays a retail share class, but at 0.15% of annual assets,

The blue bars also follow the customary Vanguard formula. None of them threaten the 100 mark, because index funds don't generally place first in their categories, but three of the four funds place in their category's top quartile. That is a typical achievement for a bargain-priced index fund: Land somewhere near the first quartile for three years, then gradually move up the rankings over time, because the expense advantage is ongoing, while relative performance comes and goes.

Half True Which, rather neatly, brings us to the conclusion. Is AQR the Vanguard for alternative investing? Yes and no. Yes, in that AQR rules its (much smaller, albeit highly profitable) roost. The nonconformity of alternatives has enabled somebody besides Vanguard to prevail within that portion of the industry, and AQR has become that somebody. No, in that AQR's formula is different. It relies on performance, not costs, which means that AQR faces the greater challenge of the two firms in maintaining its supremacy. Staying cheap is not hard. Staying number 1 most certainly is.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)