Retirees Configure Portfolio to Cope With Unanticipated Expenses

With spending needs spiking, this couple wants another set of eyes on their plan.

At 77 and 78, Helen and Joe can look upon their life with pride.

Both are retired, Joe after a 25-year career in the military and 25 additional years in the healthcare industry; Helen from positions in insurance, banking, and mortgage banking.

"We are enjoying retirement with reading, gardening, traveling, and socializing," Helen wrote.

There are a lot of positives about in their financial position, too. Their biggest asset is their very generous fixed income: The combination of Joe's pension and Social Security brings in $119,000 a year. Joe still does healthcare consulting; in 2016, he brought in another $26,000 in consulting income. They have a $700,000 investment portfolio and another $200,000 in cash.

Yet the couple also have heavy income needs currently. While they don't live extravagantly, they're currently spending everything they're bringing in through pension, Social Security, and Joe's work. Their adult daughter has been ill for two years and unable to work, so Helen and Joe have been providing heavy financial assistance to her.

"Our daughter should be able to go back to full-time employment in the next six months," Helen wrote. But the outlay has been unexpected. In addition, they've been helping their granddaughter, a new grad, gain her financial footing in New York City. They've been using their required minimum distributions from their IRAs to cover those two sets of costs.

They wrote seeking guidance on how to position their portfolio to support their income needs, including RMDs, because the current market environment leaves them scratching their heads.

"Our present concerns are that fixed income does not return much, and the stock market seems to be overheated," Helen wrote.

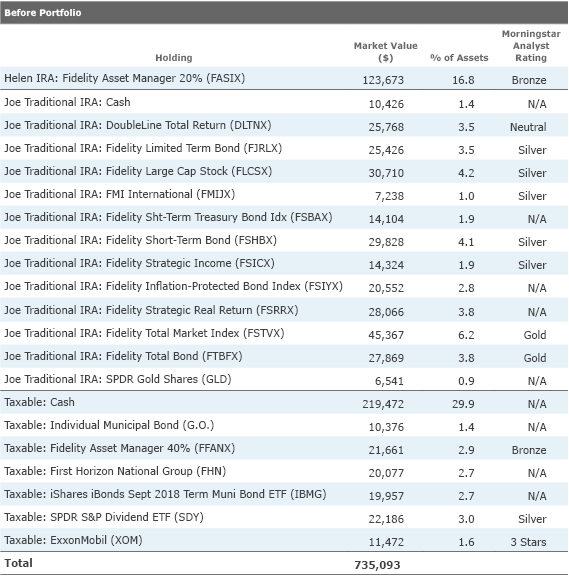

The Before Portfolio Helen and Joe's investment portfolio consists of three main components: IRAs for both of them, as well as a cash-heavy taxable portfolio. In aggregate, their assets are invested very conservatively: Their total asset allocation consists of 38% cash, 33% bonds, 20% U.S. equity, 3% foreign stocks, and 6% other. The portfolio's sector and style-box positioning is unusual: It has 19% in large-value stocks, 26% in large blend, and 18% in large growth; 6% in mid-value, 8% mid-cap core, and 4% mid-growth; and 2% in small value stocks, 15% in small core, and 2% in small growth. (For perspective, a total market index has roughly 24% in each of the large-cap squares, 6% apiece in the mid-cap boxes, and 3% apiece in the small-cap squares.) Their portfolio stakes 27% in the financial sector, 10 percentage points more than the S&P 500. In all, the portfolio skews toward value, small caps, and financials.

Helen's IRA consists of a single fund, the Bronze-rated

Joe's IRA portfolio is also dominated by bonds and cash. Its largest equity position is the Gold-rated

Meanwhile, the couple's taxable portfolio features a diverse array of holdings: the aforementioned heavy cash stake, an individual general-obligation muni bond from their home state, a fixed-maturity ETF, and shares in

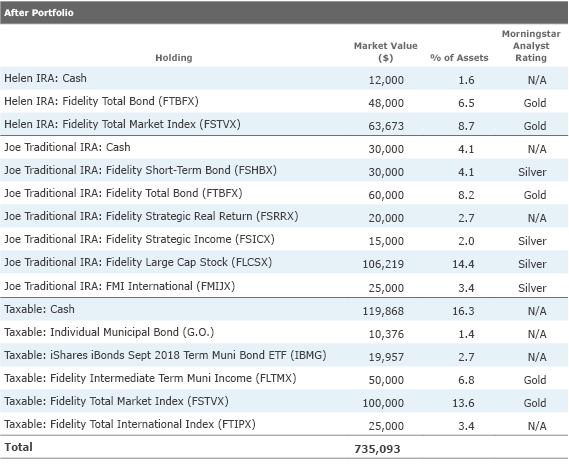

The After Portfolio Helen and Joe are currently limiting their portfolio withdrawals to their RMDs. Given the fact that their IRAs aren't their whole nest egg (they have an additional $300,000-plus in nonretirement assets), their withdrawal rate is well within sustainable levels.

However, their portfolio could be more assertively positioned, given low cash and bond yields today as well as their desire to leave money for their heirs. Not only should their portfolio keep up with inflation but it would ideally grow a bit to benefit their daughter eventually. Thus, I tweaked their portfolio to bump up their equity allocation while maintaining ample liquidity to meet RMDs or other unanticipated expenses. I also adjusted positions to reduce the style and sector risks in the portfolio. The asset allocation of the after portfolio is 36% U.S. equity, 7% foreign equity, 31% bonds, 25% cash, and 2% other.

While Fidelity Asset Manager 20% is a fine fund (and I appreciate the nod toward simplicity), Helen's IRA could benefit from more growth potential than she is likely to get from a fund with such low equity equity exposure. Moreover, the multiasset fund doesn't give her discretion over whether she looks to stocks, bonds, or cash for distributions. I steered enough toward cash to meet two years' worth of RMDs from that account, then segmented it by time horizon from there--another eight years' worth of RMDs in bonds, and the remainder in core equity funds.

I used the same general structure with Joe's IRA. But because it's a larger pool of assets, I included more diversification. I retained the positions in short-term and inflation-protected bonds, for example.

Helen and Joe are spending less regularly from the taxable portfolio, so there's no need for them to hold as large a cash stake there as they currently have in that part of their portfolio. Nor is there a need for them to "bucket" it in the same way I suggested for the tax-deferred IRA portfolios.

Helen and Joe expressed a desire to maintain a still sizable cash reserve of $120,000 in their taxable account, but the "after" portfolio moves any cash in excess of that amount into broad stock and bond positions. Given that stocks aren't exceptionally cheap at this juncture, they don't need to rush to get that cash invested. Instead, they could dollar-cost average into the equity positions over the next few years or even put the money to work in stocks during equity-market downdrafts. (The opportunity cost of holding cash has rarely been lower, in my opinion, although I would have said that a year ago.)

My "after" portfolio also aims to reduce idiosyncratic risk and improve the tax efficiency of this portion of the portfolio. (Of course, Helen and Joe should also be careful not to trigger a big tax bill with the repositioning; consulting with a tax advisor can help them determine their best course of action.) In the interest of reducing some of the stock- and sector-specific risks in the portfolio, I cut the individual stock positions. I also swapped SPDR S&P Dividend for Fidelity's total market U.S. While the former is a solid option (albeit a not-inexpensive one), it has been much less tax-efficient than a broad equity market index fund. I added a dash of foreign-stock exposure, too.

Joe and Helen's current municipal bond holdings have fixed maturities, so there's no need for them to sell them pre-emptively. But because they don't have an imminent spending need from this portion of the portfolio, I like a broadly diversified municipal-bond fund in lieu of the fixed-maturity products. I employed the Gold-rated

Helen and Joe have an important advantage relative to many of their peers: They both have long-term care insurance. While it may not cover their long-term care expenses 100%, it will help ensure that high long-term care costs, should they arise, won't derail their portfolio's sustainability.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)