Multitaskers Balance Retirement Investing, College Funding

How to balance saving for the future when the here and now is so expensive?

Editor's note: This article is part of Morningstar's 2017 Portfolio Makeover Week.

At 39 and 40, respectively, Eric and Lindsay are classic multitaskers.

They know they need to be saving for their own retirements, but they also want to plan for college for their two children--a 1-year-old daughter and a 2-year-old son. How should they balance the two goals, and are 529s really all they're cracked up to be?

Eric, a contractor in the technology sector, has been investing in earnest for a few years, but would like a second set of eyes on their plan.

"The more I learn," he wrote, "the more I'm aware of my ignorance. I would like to simplify my portfolio and understand what each piece is doing and why."

To further complicate matters, this young family needs to make some changes on the housing front; their 2-bedroom home is bursting at the seams.

"We will soon need to buy a new home or build an addition," Eric wrote, "as we have already outgrown our current space." The couple live in a very expensive housing market, so upsizing carries a big price tag. Eric and Lindsay are earmarking roughly $165,000 in cash for their next housing move. While they mull their next steps, the money they have sitting in cash is earning next to nothing. "Is there a safe way to invest this money?" Eric asked.

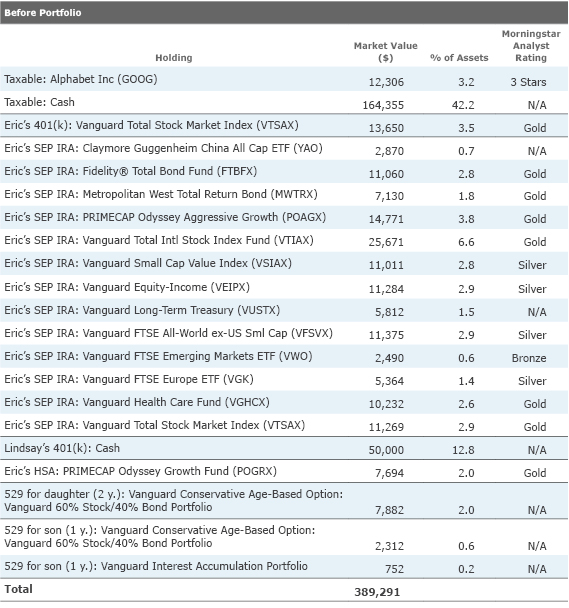

The Before Portfolio Setting aside the money the couple have earmarked for their home purchase and the 529s, their total asset allocation for their retirement-related assets (about $215,000) is 26% cash, 12% bonds, 42% U.S. stocks, and 20% foreign stocks. They have a large allocation to large-cap growth stocks, at 30% of assets; large-value and large-blend stocks are 19% and 20%, respectively. The portfolio's style-box positioning is otherwise conventional, albeit with a slight emphasis on small-cap stocks relative to the broad market (12% versus 9%).

The couple's main retirement assets are in Eric's SEP-IRA. SEPs are for independent contractors and employees of small businesses that do not have 401(k) plans; contributions are tax-deductible. The beauty of a SEP-IRA is that, like an IRA, contributors aren't wedded to a preset menu like 401(k) participants are; they have broad discretion over their investment choices. Most of Eric's holdings hail from Vanguard: He has a mix of index products and actively managed funds. He also owns two fine bond funds within his SEP, as well as

The couple also have the aforementioned cash stake--earmarked for their home upgrade. In addition, Eric holds a taxable brokerage account with a single stock--

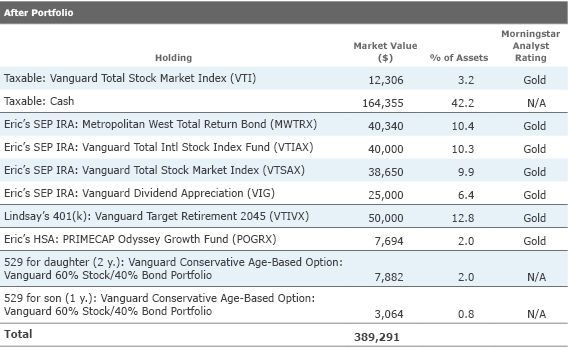

The After Portfolio With two young children, busy work lives, and a move or remodeling project in their future, it's an understatement to say that Eric and Lindsay have a lot going on. My bias would be to simplify their investment portfolio to enable them to focus on the big-picture priorities: saving and investing as much they can for their retirements and for college, aggressively allocating those long-term assets to high-returning (at least over the long term) equity assets, and transitioning to a more livable home.

Job 1 for this couple is to take a close look at their budget and come up with a target monthly savings rate. Couples often wrestle with whether to contribute to college funds or save for their own retirements; I'd argue that building their retirement nest egg should be this couple's top priority. They can deploy any gifts to their children from family members or friends into the 529s; because they're starting so early, those contributions will enjoy a long time to compound. My preference is to save for college in a 529 rather than a non-college-funding vehicle. Even though Eric and Lindsay's home state doesn't give them a tax break on their contributions, the money grows on a tax-free basis and withdrawals for qualified higher education expenses are also tax-free.

Regarding their ongoing retirement-plan contributions, it's wise to emphasize those vehicles that provide the best tax breaks for them; they can then put their contributions on autopilot. In Eric and Lindsay's case, that's Eric's SEP-IRA and Lindsay's 401(k). (Roth IRAs are off limits for them: Their earnings are too high to allow for direct contributions, and Eric's SEP-IRA assets make the backdoor maneuver ill-advised.) Eric has been contributing about $45,000 a year to his SEP per year for the past few years, a good clip.

They'll also want to keep a close eye on their emergency reserves, making sure that they have an ample amount to cover income disruption, unexpected home repairs, and any healthcare-related outlays, assuming that they are covering some of them out of pocket. Unfortunately, there are few ways to earn a safe return that's much higher than 1% right now, and this is true for both their home-related cash as well as their emergency reserves. Online savings banks are generally the best source of safe yield right now.

Within their long-term portfolio, I streamlined their holdings, starting with Eric's SEP-IRA. Eric described his risk tolerance as "very high," so I maintained an aggressive equity allocation, as well as a fairly high allocation to foreign equities. However, I reduced the idiosyncratic risk in the portfolio, focusing on basic international and U.S. equity index funds for the bulk of it. Because Eric is concerned about lofty market valuations, I also steered a portion of his SEP to

Eric's two bond funds are both great, but they fulfill similar roles. For that reason, I maintained exposure to a single well-diversified bond fund,

Because Lindsay is a hands-off investor, it makes sense to deploy her old 401(k) assets into a simple target-date fund within an IRA. Vanguard's target funds are best of breed: very low cost and sensibly asset-allocated.

While Eric has ventured into individual stocks with his taxable brokerage account, Alphabet is already well represented in his portfolio via his total market holdings. The stock has already performed incredibly well, too. My thought would be to steer that amount into a tax-efficient equity ETF that is better diversified, will be less volatile, and that Eric could readily make future contributions to.

I like that Eric is using the HSA to augment his long-term retirement assets, and he has chosen a terrific fund to invest in. If Eric and his family plan to spend any part of the HSA for ongoing healthcare expenses, however, it's wise to set aside some liquid assets in place of Primecap Odyssey Growth.

The asset allocation of the long-term portfolio is still aggressive, with 50% U.S. equity, 26% foreign stock, 21% bond, and the remainder in cash and other. The portfolio's style-box and sector allocations are, not surprisingly, more in line with the broad market's than was the case before.

Last but not least, Eric and Lindsay will want to be sure to attend to their Ps and Qs. Eric notes that they already have life insurance, but disability coverage is well worth investigating as well. Disability insurance can be expensive for contractors and sole proprietors, but it's well worth considering for Eric, to ensure that a disability doesn't hinder their entire financial plan.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)