Dodge & Cox: Built to Last

The firm retains its Positive Parent Pillar rating.

Dodge & Cox sets a high bar for the asset-management industry. Its many investor-friendly attributes continue to earn the firm a Positive Parent Pillar rating.

The San Francisco-based firm was founded by Van Duyn Dodge and E. Morris Cox in 1930, near the beginning of the Great Depression, which forced patience on the young startup, and this has been ingrained in its investment and commercial culture for more than 85 years. Today, Dodge & Cox veterans Dana Emery and Charles Pohl continue to lead the firm and funds with a long-term horizon as CEO and chairman, respectively, and as lead members of the investment team.

But there are no stars here--an intentional and enduring characteristic of the firm. Each fund is run collaboratively by one of five investment policy committees, whose members average more than 20 years at the firm. But these five committees--which each have six to eight members--don't do it on their own. Indeed, the firm boasts a deep analyst team with impressive levels of experience. As of June 2017, the firm had 32 industry analysts and managers on the equity side, and all but three have been at the firm for more than five years. What's more, there are 28 fixed-income team members with similar levels of experience. Nearly all of the analysts and managers have spent their entire careers at Dodge & Cox, and they rarely leave for any reason other than retirement.

The depth doesn't end there. It's worth noting that the firm supports its analysts via an extensive research associate program: Every analyst has an associate who works for two to four years between college and business school. This process allows Dodge & Cox to thoroughly vet prospective talent, and some return to join the analyst ranks after business school. Overall, the team's depth and collaborative approach help mitigate key-person risk. Its research-team design has also helped the firm find the best fits for its team-oriented and humble culture, giving Dodge & Cox among the best track records on portfolio-manager development and retention.

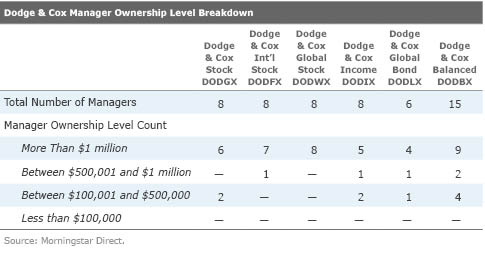

How Dodge & Cox Aligns Incentives The investment team's financial incentives are appropriately aligned. Dodge & Cox's portfolio managers invest heavily alongside their fundholders, helping to align their interests with investors'. Specifically, 18 of the firm's 23 investment policy committee members have at least $1 million invested in the strategies they help manage; and all members have at least $100,000 invested. A breakdown of manager ownership levels across its fund lineup is shown below.

On a related note, Dodge & Cox is 100% owned by employees, which allows its investment team to participate in the economic success of the firm, to an extent. Investment personnel can be invited to become owners of the firm after several years and only rarely is someone not extended an invitation--its rigorous recruiting process already ensures that new hires fit comfortably within the firm's consensus-driven investment culture. Equity in the firm, which partners buy at book value, can become a significant portion of compensation and gives employees incentive to stick around. As partners approach retirement, they begin to sell their shares back to the firm (again at book value) and no former employees are allowed to maintain an equity stake. Currently, there are 75 equity owners of Dodge & Cox.

Long-term employee ownership has produced another benefit: It has allowed the firm to avoid the short-term pressures that often face public companies on Wall Street. This has been borne out in Dodge & Cox's approach to product development, which is rigorous and sensible. In fact, the firm has rolled out just six funds since its 1930 founding. The most recent is a global fixed-income offering--Bronze-rated

In recent years, Dodge & Cox has focused on globalizing its business, in the same measured way it has run its U.S. operations. The firm opened one small shareholder-servicing office in London in 2009. It has since launched four UCITS options--clones of

A Solid Partner for Patient Investors Of course, no firm exists without vulnerabilities, and Dodge & Cox is no exception. The firm generally practices one long-term, value-oriented approach to investing. While long-term performance has been very strong, its funds have suffered bouts of sluggishness or disappointing results. It's thus important for investors to share the firm's long-term investment horizon. Further, the firm's success has meant its small cadre of funds can grow to be quite large. To be sure, the firm's $297 billion in assets under management as of June 2017 was nowhere near some of the world's largest players. Nonetheless, capacity management can be a real challenge for some portfolios. Over its history, Dodge & Cox has indeed closed funds to new investment to protect the integrity of the funds, but it needs to remain vigilant as it expands to other markets.

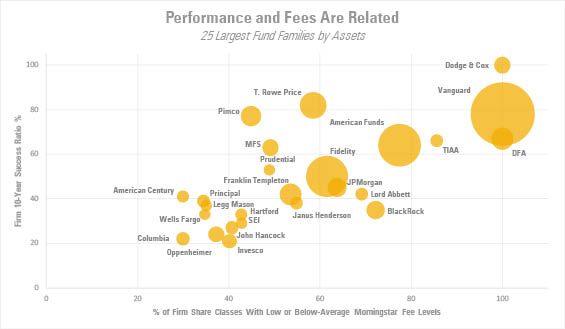

The firm has managed itself well, though, and has succeeded by simply and tangibly putting its fundholders' interests first. Consider fees. The chart below shows the largest 25 U.S. investment firms by U.S. open-end fund assets under management and demonstrates a clear linear relationship between performance and fees. The chart plots low or below-average fees against a firm's success ratio, which measures the percentage of a firm's mutual funds that have both survived (for Dodge & Cox, that's all of them) and ranked in the top half of their respective Morningstar Categories over the period. Impressively, Dodge & Cox looks perfect. Not only do 100% of its share classes earn Morningstar Fee Levels of Low, but its 10-year success ratio through October 2017 was also 100%, meaning the four Dodge & Cox funds that are more than 10 years old have all outperformed. Dodge & Cox Global Stock and Dodge & Cox Global Bond--which don't yet have 10-year track records--have also produced benchmark- and category-beating results since their inceptions.

Source: Morningstar Direct. Data through October 2017.

All told, Dodge & Cox's strong investment culture, long-term orientation, and investor-friendly practices make it a shining example of what a mutual fund family should be. What's more, the firm is built to last, and long-term investors who partner with it make a good choice.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)