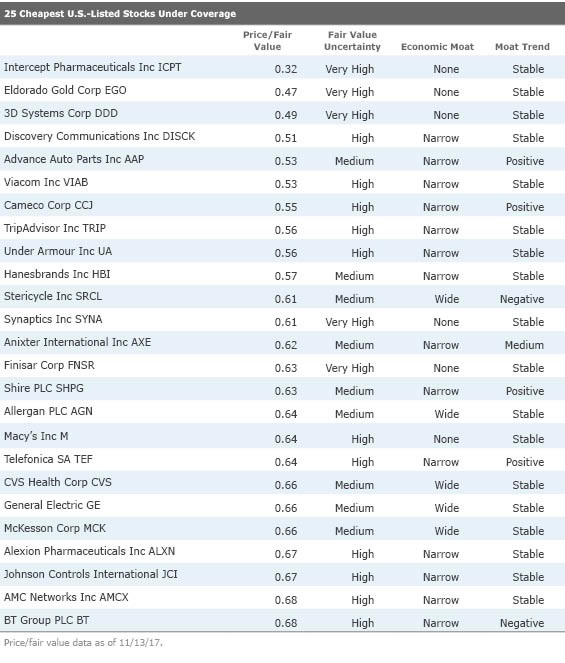

25 Cheap Stocks

Whether you prefer higher-quality companies or more speculative fare, there's plenty of good ideas on our list.

This week I kept things simple. I screened our entire domestic coverage for the 25 cheapest U.S. stocks using only one input: price/fair value.

To be sure, the Morningstar fair value estimate is a pretty robust data point on its own. To determine a stock's fair value estimate, analysts create a detailed projection of a company's future cash flows, resulting from our independent research of companies' income statements, balance sheets, and capital investment assumptions. We use scenario analysis, in-depth competitive advantage analysis, and a variety of other analytical tools to augment this process.

Screening our coverage universe for stocks trading at the lowest P/FVs resulted in a pretty diverse list. Some companies on our "cheap list" have fair value uncertainty ratings of medium while others are high or very high--the lower the uncertainty rating, the more tightly our analysts can gauge the fair value of a company because they can estimate its future cash flows with a greater degree of confidence. And vice-versa.

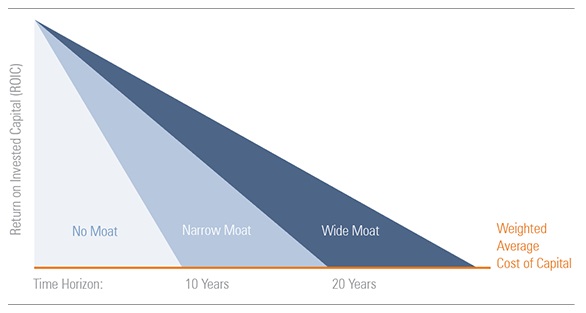

The list also contains companies with wide or narrow economic moats, as well as a handful of firms with no moat. The moat concept refers to how likely a company is to keep competitors at bay for an extended period. An economic moat is a structural feature (intangible assets, switching costs, network effect, cost advantage, and efficient scale) that allows a firm to sustain excess profits over a long period of time. We define excess profits as returns on invested capital above our estimate of a firm's cost of capital, or weighted average cost of capital.

The more of these structural advantages the company has, the wider and deeper the moat (and the better positioned it is to prevent a competitor from taking market share or eroding its margins). Wide-moat companies are those in which we have very high confidence that excess returns will remain for 10 years, with excess returns more likely than not to remain for at least 20 years. Companies with a narrow moat are those we believe are more likely than not to achieve normalized excess returns for at least the next 10 years.

Without a moat, profits are more susceptible to competition. We believe low-quality, no-moat companies will see their normalized returns gravitate toward the firm's cost of capital more quickly than companies with moats.

If you're a more quality-focused investor with a very long time horizon, you may want to focus on stocks that have moats and lower fair value uncertainty ratings. Others might see a good investment opportunity in some of the no-moat firms on the list that are trading at deep enough discounts to fair value to compensate for their higher uncertainty.

Here's our full list, followed by a closer look at three of the companies.

This biopharmaceutical firm is focused on drug development for chronic liver diseases, using its proprietary bile acid chemistry. Its key program, obeticholic acid is being evaluated in the potential megablockbuster indication of nonalcoholic steatohepatitis. It received approval as Ocaliva in the orphan indication of primary biliary cholangitis in patients with an inadequate response to, or unable to tolerate, ursodiol, the only other approved therapy in the space. While PBC is an attractive opportunity on its own, the clear value driver for the firm is NASH. NASH is a potential $30 billion market opportunity as it is a common but serious liver disorder linked to obesity and diabetes with limited current treatment options. While many firms are vying to address this disease, OCA is a leader in this pipeline race, alongside Genfit's elafibranor, both of which are expected to release pivotal interim data by the end of 2018.

Potential investors should note that the stakes are high: Intercept's dependence on the prospect of one drug candidate feeds into our very high uncertainty and no-moat ratings for the company. Kelsey Tsai

We judge 3D Systems' printer business lacks an economic moat; patent expirations, alternative technologies, and sluggish industrial demand have eroded intangible asset values and lowered customer switching costs. We believe moaty aspects remain in its proprietary materials, software, and direct manufacturing units, however.

The firm is making steady progress toward becoming a one-stop solutions provider in additive manufacturing. It possesses the broadest range of 3-D printers and printer materials and offers a full menu of related services, including software, materials, service, and direct manufacturing of on-demand custom parts.

3D Systems has become a significantly larger full-service firm, and the next few years likely will be judged by its ability to commercialize new innovations, streamline operations, and deepen penetration of its most critical customers, end markets, and products. David Silver

We believe current trading levels for narrow-moat Advance Auto Parts provide a sufficient margin of safety for investors looking to take a position in a company poised to capitalize on favorable long-term industry dynamics. While the acquisition of General Parts has proved far more challenging than anticipated, we think the difficulties have obscured the benefits that Advance should gain from its substantially stronger position in the faster-growing professional market segment, which accounted for 58% of its sales in fiscal 2016.

As the company refocuses on operational improvements throughout the business and improves parts availability, we anticipate it will benefit from a persistent industry trend favoring consolidation, as larger parts retailers are able to deliver superior service to professional and do-it-yourself clients alike more economically than their subscale peers. In our opinion, clients' desire for high levels of on-demand parts availability, along with DIY customers' needs for advice and services from trained in-store staff, should insulate Advance and its peers from digital-only competitors. Zain Akbari, CFA

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)