ETF Investors Shouldn't Cry for Venezuela's Bonds

No need to panic over default news.

This article was published in the October issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Almost every hard-currency emerging-markets debt exchange-traded fund owns Venezuelan bonds, but investors in those ETFs shouldn't be overly concerned regarding the dire situation in that country.

On the surface, it may seem as if emerging-markets bond ETFs are doomed by the struggles of the Venezuelan government, but the outcome of the situation is not as simple as: debtor defaults, lender loses money. This article examines the current situation in Venezuela as well as other recent emerging-markets sovereign crises from the point of view of an investor in an index fund that invests in emerging-markets bonds. It will also explore the finer details of popular emerging-markets debt indexes and the ramifications for investors facing a possible default by the Venezuelan government.

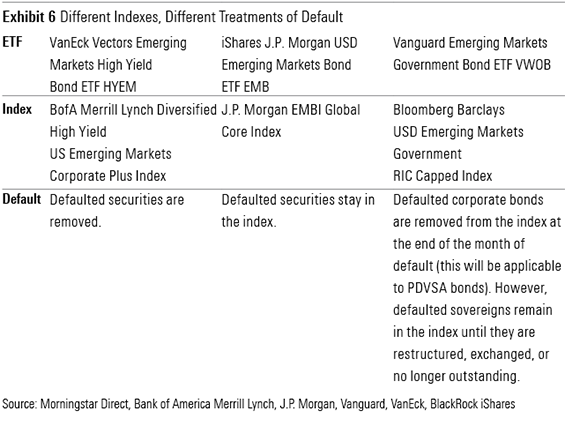

Unlike an actively managed emerging-markets debt fund, the composition of the index an ETF tracks largely dictates the makeup of the ETF's portfolio. Although each index provider has its own take on what constitutes the right benchmark for emerging-markets debt, almost all include Venezuelan bonds. Each index provider also has its own rules and definitions pertaining to defaults and liquidity requirements, making it hard to make apples-to-apples comparisons among a range of index-trackers. Therefore, it is critical to understand the inner workings of these funds' underlying indexes.

At present, there is no meaningful amount of local-currency Venezuelan debt outstanding thanks to the country's hyperinflation. The International Monetary Fund estimated the nation's inflation at 475% for 2016 and predicted it would climb to 1,660% by the end of 2017. Hyperinflation has all but wiped out the value of the country's local-currency debt as the government has kept printing more money to meet its obligations. As a result, the country's bolivar-denominated domestic debt is essentially worthless, which explains why only hard-currency Venezuelan debts are owned by virtually all emerging-markets bond funds.

Popular emerging-markets bond ETFs include

Case Study: iShares JPMorgan USD Emerging Markets Bond ETF EMB EMB replicates the market-cap-weighted JPMorgan EMBI Global Core Index, the most widely followed emerging-markets bond index. We have assigned this fund a Morningstar Analyst Rating of Bronze. This fund's popularity is reflected in its assets under management, which exceeded $11 billion as of October 2017. The index includes U.S.-dollar-denominated sovereign and quasi-sovereign bonds that meet certain size, maturity, liquidity, and country requirements set forth by JPMorgan. It is notable that index membership does not depend on a bond's default status. In fact, the index does not drop a defaulted debt as long as the security continues to satisfy the aforementioned criteria.

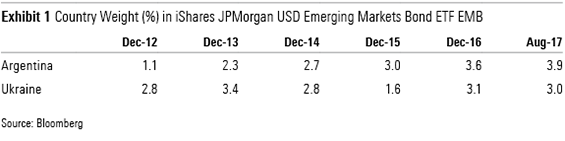

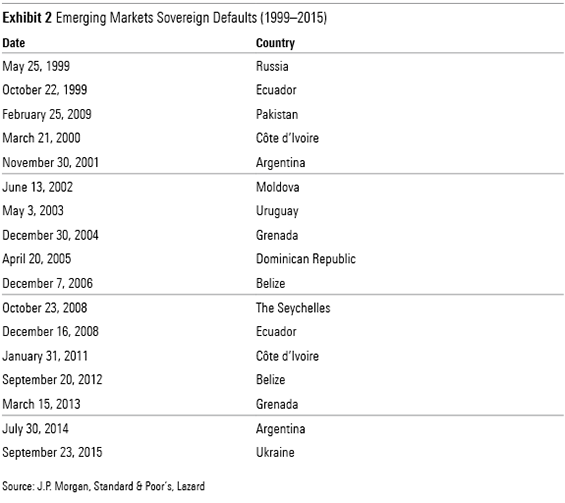

If a bond defaults, the bond remains within the index. But its weighting typically declines as the bond's market capitalization shrinks, reflecting the falling price of the security. Over time, as the bond's price recovers through a restructuring process, its weighting increases. For example, Argentina and Ukraine debts, which defaulted in 2014 and 2015, respectively, had varying weightings in the ETF between January 2012 and August 2017, as shown in Exhibit 1. The weightings, however, were relatively stable despite the turmoil. It's important to note that these are not isolated events. Exhibit 2 lists other notable sovereign defaults.

Though the index will hold a defaulted bond, it will remove a bond with insufficient liquidity. Liquidity is measured using bid and offer prices from a third-party vendor, which are provided on a daily and timely basis. The rationale behind the requirement is that an index is meant to replicate market activities including trading. In other words, investors must be able to replicate the index at reasonable costs, which requires liquidity.

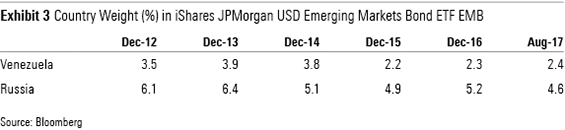

This particular rule could have significant implications to index investors. The U.S. government imposed sanctions on Venezuela in August 2017. Before the sanction, market participants were closely monitoring the actions of the U.S. government. If the sanctions had affected secondary-market liquidity, Venezuelan debts likely would have been removed from the index, which would have caused sales by index-tracking funds. However, the sanction was not severe enough to affect liquidity, and thus no changes were made by the index. The potential removal of Venezuela's debt from the index is similar to the Russia event that unfolded in 2014. That year, the U.S. Treasury Department barred U.S. financial institutions from participating in new bond issuance by Russia. However, the secondary market remained active, and Russian bonds stayed in the index. Again, despite the upheaval, country weightings did not see sharp moves during this period, as shown in Exhibit 3.

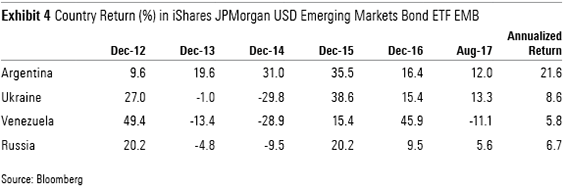

Exhibit 4 shows returns from the countries mentioned above from January 2012 to August 2017.

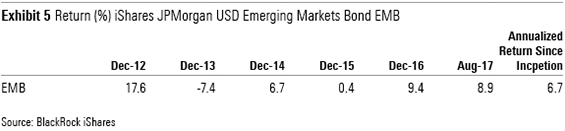

In reviewing the returns of distressed country debts, two things are clear: One, the return pattern is volatile; two, these countries' debts have generated decent returns over the medium term. Investors would have benefited by sitting tight through these tumultuous times. This finding is consistent with how EMB has performed through the years, as shown in Exhibit 5. The fund has generated acceptable returns despite enduring significant risk. For example, the fund's five-year average annualized return of 4.3% though August 2017 was double the return of

Emerging-markets bonds carry a myriad of risks including country, liquidity, and currency risks, in addition to the usual risks facing fixed-income investors, such as credit and interest-rate risk. Ultimately, these returns are some form of compensation to the investors who assume these various risks.

Other Indexes Exhibit 6 compares how different emerging-markets bond indexes deal with defaulted securities. Each index handles defaults in a different manner. As always, it is imperative for investors to conduct due diligence on the benchmarks that underpin these ETFs before investing.

Conclusion Though most ETFs are passively managed, to the extent they are designed to track an index, investors must not be passive when it comes to conducting due diligence on these funds and their underlying indexes. ETFs are essentially clones of their underlying indexes; therefore, there must be emphasis on knowing the rules and requirements of the indexes themselves. Generally speaking, most emerging-markets debt indexes are simply the market-cap-weighted representations of the investment universe. But how they define the investment universe is often very different. Also, index providers have a variety of index rules and definitions guiding index inclusion and exclusion pertaining to defaults and liquidity requirements.

The Venezuelan debt situation is a good reminder for investors how important it is to understand the inner workings of indexes tracked by ETFs. In the process of digging in, investors will recognize that most emerging-markets debt ETFs' Venezuelan exposure comprises less than 3% of their portfolio. Furthermore, a potential default would not trigger these indexes to sell. Investors should take this as another reminder not to jump ship in stormy seas.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)