Early Retirees Troubleshoot Potential Vulnerabilities in Their Plan

A long time horizon calls for extra care with withdrawals and asset allocation.

Editor's note: This article is part of Morningstar's 2017 Portfolio Makeover Week.

Catherine and Roberto have a life many of their peers would envy.

At 56 and 58, respectively, they're both retired. After 30 years in higher education, Catherine retired last year. Roberto, meanwhile, was laid off from his position in logistics around the same time; they decided to embark on retirement together. Having spent their entire lives in New England, they decided to sell their home in Massachusetts and purchased a small condo in the Pacific Northwest. They also have their sights set on traveling, especially now that college funding for their two sons is in the rearview mirror. Their eldest, 27, is an engineer in the Midwest, while their 24-year-old son is finishing a graduate program in education.

Catherine and Roberto are also in a strong position financially. Catherine’s pension supplies more than half of their estimated annual cash flow needs of $100,000; her pension payments are also inflation-adjusted. (That $100,000 includes their desired travel expenses.) Meanwhile, they have a portfolio of roughly $2 million, including inherited IRAs from Roberto's parents, Catherine's 457, and various taxable holdings. Required minimum distributions from the inherited IRA provide another one fourth of their cash flow needs. They'll withdraw the remainder of their cash-flow needs from their other portfolio assets.

Yet the pair has questions about whether they're managing their assets as effectively as possible. They recognize that their cash stake, at roughly 20% of assets, is large given their light portfolio spending rate; in addition to the inherited IRA assets, Roberto also inherited a cash-heavy taxable brokerage account from his mother. At the same time, they're concerned about deploying that money into stocks this late in the bull market.

In addition, most of their assets are in accounts that are subject to required minimum distributions; they wonder whether they should be doing anything to ameliorate the tax effects once RMDs commence on Catherine's 457 plan and their traditional IRA accounts. They're also concerned about long-term care costs, should they arise. Is their portfolio sufficient to self-fund long-term care? Roberto's mother experienced Alzheimer's disease and spent more than five years in a long-term care facility, so they're acutely aware of the high costs that such care entails.

Finally, the couple would also like to help their sons avoid some of the financial stresses they experienced earlier in their lives.

"Because of job losses and other struggles at various points and our commitment to saving, we passed up some opportunities along the way and had our share of sleepless nights," Catherine wrote. "We'd like to share some of this good fortune with our kids somehow so they don't wait until their 50s or 60s to feel the pressure release. But we don't want to make them lazy savers, either!"

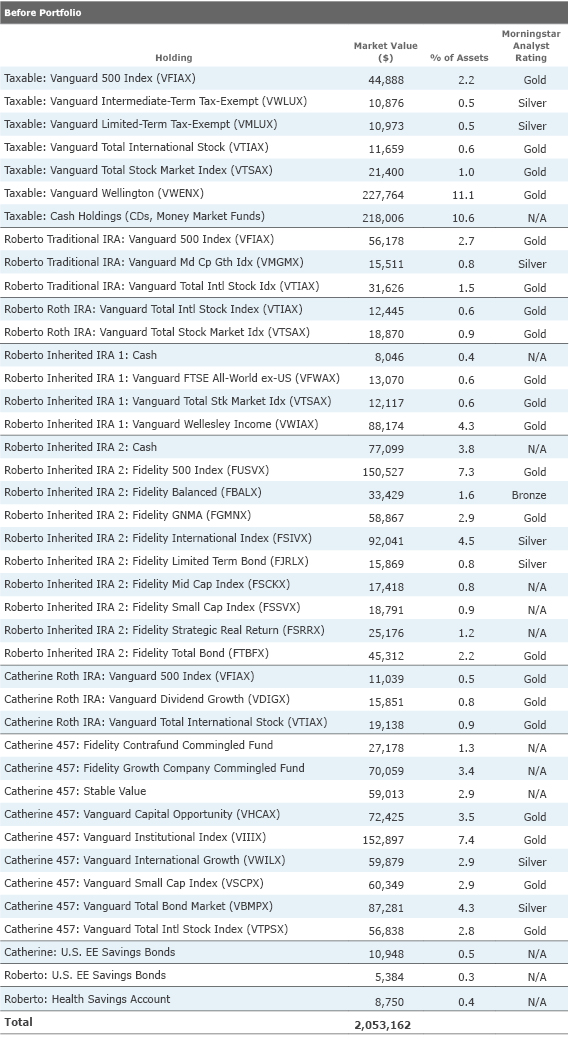

The Before Portfolio As is almost inevitable at their life stage, Catherine and Roberto hold their assets in multiple silos, including taxable accounts, inherited IRAs, traditional and Roth IRAs, and Catherine's 457 plan. Within each of these accounts, they've done a good job of matching asset allocations to their anticipated withdrawals. Accounts with many years until withdrawals--such as their Roth IRAs and Catherine's 457--are equity-heavy. Meanwhile they've maintained more liquidity within those accounts that they're actively drawing from, such as their taxable brokerage accounts and Roberto's inherited IRAs. The couple has also done well on the security-selection front: Nearly all of their holdings are low cost and carry Gold or Silver ratings from Morningstar's analyst team.

Those two inherited IRAs--one from his father and one from his mother--are the couple's biggest pool of assets, at roughly $660,000. (Because these accounts were inherited from two separate individuals, they cannot be combined.) These inherited IRAs consist of a number of fine Fidelity and Vanguard funds and are well diversified across asset classes; the asset allocation for this portion of the portfolio is 55% equity, roughly 30% in bonds, and the remainder in cash and other assets. Required minimum distributions from two accounts totaled about $22,000 in 2017, though that amount will of course increase with Roberto's age.

The next-largest component of their portfolio is Catherine's 457 plan, with roughly $646,000. Her holdings include some terrific mutual funds, such as

The pair also holds a sizable taxable portfolio that is heavy on cash but also includes some fine long-term holdings. Some of those positions are terrific taxable-account holdings--including Vanguard index equity funds and municipal-bond funds.

Their total portfolio's asset allocation is currently about 60% equity, 20% cash and stable value, and 20% bonds and "other." I typically recommend that retirees hold two years' living expenses in cash on an ongoing basis (roughly $100,000 in Catherine and Roberto's case, given their $47,000/year spending rate), but their cash holdings are nearly four times that amount. Their bond weighting is in the right ballpark; my bucket portfolios have included about eight years' living expenses in bonds, and their roughly $350,000 position is right on that mark. Their equity stake, meanwhile, seems light, but they're also wise to consider the timing of bumping up their equity position, given the length of stocks' current bull run.

The After Portfolio One of the key concerns for early retirees like Catherine and Roberto is whether their portfolio will be sustainable over their very long time horizon; to be prudent, they should plan for their portfolio to last 35 years or more. (Catherine would be 91 then, and Roberto 93.) That long time horizon calls for keeping withdrawals modest while maintaining ample equity exposure.

As noted above, Catherine and Roberto are lucky in that her pension is supplying such a healthy share of their living expenses--$53,000 of their $100,000 cash-flow needs. They're withdrawing $47,000 a year from both the inherited IRA and their taxable accounts, an amount that translates into a 2.3% withdrawal rate from their roughly $2 million total portfolio. (Note that I included anything that is coming out of the portfolio as a withdrawal--RMDs, dividend and capital gains distributions, and outright withdrawals.) Given that Roberto will eventually receive Social Security, which will reduce portfolio withdrawals accordingly, their withdrawal rate seems reasonable at this time.

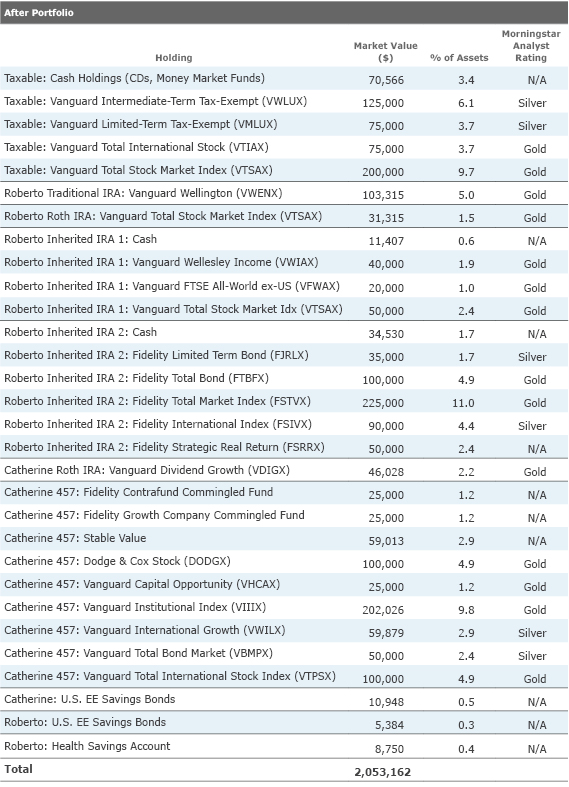

My "after" portfolio includes a reduced cash position and an enlarged equity weighting; the total portfolio's asset allocation is about 65% stock, 20% bond, and the remainder in cash and "other." Given that stocks aren't especially cheap at this juncture, it makes sense for Catherine and Roberto to move slowly to build up their stock position and pare cash; it doesn't make sense to do so when the market is scraping new highs by the day.

I also aimed to make the taxable portfolio more tax-efficient, focusing on equity index funds and municipal bond funds at the expense of Vanguard Wellington. The latter is a superb core holding, of course, but its tax costs could drag on their take-home returns, given that a portion of its income distributions count as ordinary income. (It's best situated in a tax-deferred account, if possible.) Here again, it doesn’t make sense to swap out the fund with the market at a high point; if the market falls, they can reduce their position in the fund with less of a tax cost. And in any case, this should be lower on the priorities list than some of the other to-dos, because the tax-cost differential between the fund and index equity funds isn't enormous.

I aimed to streamline the "after" portfolio as well. While I retained diversified asset-class exposure across larger accounts and those they're actually drawing living expenses from, for smaller accounts like their own IRAs, I employed single holdings versus two or three positions. I also considered rolling Catherine's 457 assets into her traditional IRA, but thought the better of it after taking a closer look at the fund choices she has available. My main tweak with this portion of the portfolio was to scale back positions in Fidelity Contrafund, Fidelity Growth Company, and Vanguard Capital Opportunity. All are great holdings, but they've had a phenomenal run recently and were giving the "before" portfolio a tilt toward growth. I spotted

Regarding conversions of traditional to Roth accounts, Catherine and Roberto should mull a series of partial conversions to Roth accounts--for both their traditional IRAs as well as Catherine's 457 assets. Catherine notes that they've been gradually converting their traditional IRAs to Roth, and they may have even more opportunities to do so if tax reform ushers in lower tax rates. The fact that the market is lofty is yet another reason for Catherine and Roberto to move slowly on the conversion front, as converting assets to Roth when a balance is at a low ebb will cost less than converting when valuations are high.

As with any portfolio exercise, it's wise to troubleshoot any risk factors that could throw a wrench into the plan. One of the biggies for this one is if Catherine predeceases Roberto; he would receive just 25% of her pension in that case, bringing his pension proceeds to just $13,250 a year (at today's levels) and necessitating higher portfolio withdrawals. Of course, his own Social Security benefits would help make up for those reduced pension benefits; deferring filing to his full retirement age or beyond will help mitigate this risk factor.

In a related vein, it's worth noting that, as a public-sector worker with a pension and who didn't pay into Social Security, Catherine won't receive a spousal benefit from Social Security. And if Roberto predeceases her, any Social Security survivors benefit would also be curtailed by her pension. However, her ample pension helps mitigate this risk factor.

Long-term care is another wild card. Catherine and Roberto should work with a fee-only financial planner who's knowledgeable about long-term care to help weigh the options--self-funding, purchasing a long-term care policy, or investigating a hybrid annuity/ long-term care or hybrid life insurance/long-term care policy. The big risk for couples like Catherine and Roberto is if one spouse requires care in a facility outside the home, thereby reducing assets available for the "well" spouse. From this standpoint, the prospect of self-funding seems too risky for my comfort level, particularly given that this couple has a strong desire to leave money for their sons.

The question of how much help to provide adult children is a highly personal one. Catherine and Roberto provided college funding for their sons so that they could emerge from school debt-free, which is a tremendous gift that will keep on giving. Because their financial plan is solid but not without risks, my bias would be to not gift to their sons pre-emptively but rather wait for another major life event for their sons--such as the birth of a child or a first-time home purchase--to offer up any additional financial help.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)