Many Alternative Funds Have Disappointed Investors

Do alternative funds have a second act?

The article was published in the September 2017 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

In early 2014,

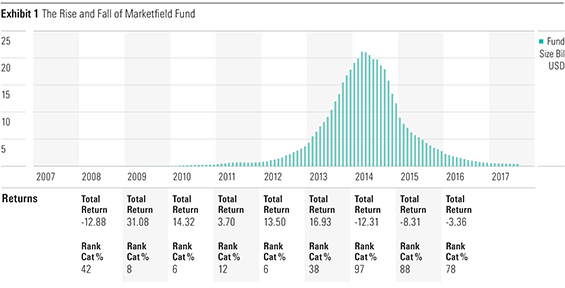

Marketfield is a long-short equity fund that blends macro top-down calls with bottom-up stock selection (recently, it has shifted to a nearly exclusive focus on top-down). From 2008 through 2013, it had a remarkable stretch of outperformance as it handily outpaced its peers each year. In 2009 it trumped the S&P with a return of 31%, and after that returns were excellent until 2014.

Investors and their advisors have sought out alternative funds because noncorrelated assets have the promise of generating positive returns that are not in sync with the stock market. The aim is to have ballast in a portfolio that will give you positive gains when you need them most: in a bear market. That lure draws billions of dollars to alternative funds, and they even tolerate fees that are higher than any other category group.

We liked the fund, too. We rated it Bronze from May 2012 to October 2014. It has been rated Neutral from November 2014 on.

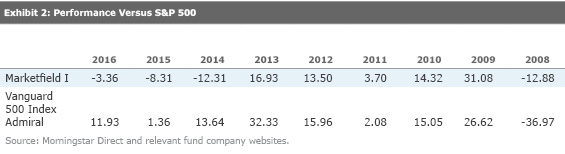

After MainStay acquired the fund, it introduced higher-cost share classes, and yet even more people came. The fund was less than $1.0 billion in 2011, but it took in $3.3 billion in 2012 and a stunning $13.2 billion in 2013. But 2014 proved to be a bitter disappointment as the fund lost 12.3% while the S&P 500 gained 13.7%. In 2015, it lost 8.3% and then lost 3.3% in 2016. The S&P 500 gained 1.4% and 12%, respectively. Thus, the noncorrelated performance delivered losses even as stocks were going higher. Flows quickly reversed direction. The fund shed $7.8 billion in 2014, $6.3 billion in 2015, and $1.6 billion in 2016 as MainStay made a hasty retreat. Thus, investors managed to largely miss out on the fund’s strong performance while selling after poor performance and missing out on a strong rebound so far in 2017.

What happened? Although asset bloat was likely a problem, the fund also suffered from bad macro bets. The past history of funds that try to make big macro bets shows it’s much harder to consistently add value than with issue-selection. But macro bets aren’t correlated with the stock market, so they were central to the fund’s appeal as well.

It’s not alone.

These are extreme cases, but a rapid ascent followed by a quick reversal is all too common in alternatives land. The 30 largest alternative funds as of February 2014 had $121 billion in assets; today, those same 30 have $74 billion, and three no longer exist. Only seven of the 30 have grown, while 16 have shrunk by more than $1 billion.

By comparison, the 30 largest equity funds from February 2014 had $1.9 trillion at that time and have $2.8 trillion today. And all 30 are still around. The story is similar with the top 30 taxable-bond funds, muni funds, and allocation funds, though asset growth was not quite as robust as in equities.

There’s a lot of disappointment in alternatives land for a number of reasons. Let’s look at each.

Belief in the Free Lunch. Whether implied by fund companies or simply inferred by investors who want to believe market cycles can be engineered away, there's a common hope that alternative funds can have nearly all the upside of equity funds without any of the downside. When 130/30 funds first came out, I spoke to many investors and reporters who thought they would be good bets in down markets or up markets—until I explained that 130/30 funds are 100% long and therefore have greater downmarket risk than the typical equity fund, which at least has around 3% in cash.

High Fees. Hedge funds have historically charged 2% of assets and 20% of profits. Although that's starting to come down, some firms crossing into the mutual fund world to launch alternative funds have kept something similar to the 2%, though you can't also charge a percentage of profits in a mutual fund. If you're running a strategy that generates 5% annualized, that 2% is a huge cost for shareholders to bear.

Complexity.

Many alternative strategies are incredibly complex. Naturally, it’s harder for advisors and investors alike to set realistic expectations for such funds. Our alternatives analysts invest quite a bit of time understanding very involved processes. Consider this snippet from our process description of

This fund's process relies on the systematic use of trend-following models in multiple asset classes, subject to a standard deviation target of 12% (with a 17% maximum). The process combines conventional multitrend models (25% of the risk), adaptive horizon models (40%), and short-term models (35%). They work in tandem to produce entry and exit signals to profit on sustained market trends on the upside or the downside. Adaptive horizon models are one of the differentiating factors here, as they analyze previous market patterns and modify positioning if the past patterns provide clues for the future. It's an adaptive process where management evaluates the models' efficacy across multiple horizons in an effort to optimize long-term strategic shifts with new information. The process is a combination of conventional methods and more distinctive ideas.

Investors tend to go in expecting the work of genius, and they go out when the fund loses money, thus proving that the manager is human after all. Of course, complexity also means high fees, so the alternative fund world loves complexity even if it makes for bad results.

Short-Termism, Part 1. The pace of change in the alternative fund space is amazing. Funds get launched, change strategies, and then get liquidated in the space of three years. In addition, alternative fund companies are often looking for a quick score and sell themselves to another firm or go around buying other firms with strong records. The result is you have a lot of funds where the current manager has a very short record, so you don't have much to go on for a huge number of funds. The average manager tenure in alternative is 4.4 years, versus 6.8 years for equities.

Short-Termism, Part 2.

There is no second act in alternatives, because investors and advisors bail at the first sign of trouble. If investors are looking at three- and five-year performance in the rest of the fund world, 12 months seems to be everything in alternatives.

Low Yields. Many absolute return strategies were designed when yields on bonds were significantly higher than they are today. Now that yields on almost everything are low, the strategies don't work very well. In addition, fees haven't come down as much as yields, so managers would have to be practically magical to match past performance from the higher-yield era.

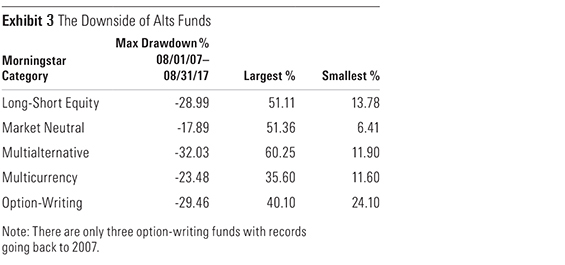

Finding Good Alternative Funds So, how can you wisely use an alternative fund? Let's start with being realistic about the downside. I looked at the maximum drawdown for funds with records dating back to July 2007. Sure enough, it doesn't look like a free lunch at all. There's a big survivorship bias here, as the worst funds naturally were killed off, so I wouldn't consider this a worst-case scenario but a pretty bad scenario.

Next, do the same things you do for any other fund. Look for low fees, good management, a sound process, and a good parent company. Process is probably the trickiest bit. You don’t necessarily need to understand every little detail, but you need to understand it well enough to see how it will work in your portfolio and how you can judge performance. If you can’t, move on.

Finally, don't forget that high-quality bonds are another asset that isn't correlated with the stock market. If you have an equity-heavy portfolio, simply adding a high-quality short- or intermediate-term bond fund could do the job for you. They have low costs and produce positive returns most years. Even their down years are usually pretty small. You can find all of our recommended alternative funds on this page. Just select Alternatives on the lower left-hand side.

Editor’s Note: This article was updated after publishing to add text and a table to clarify Marketfield’s performance versus the S&P 500.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)