PIMCO Income's Fee Hike Doesn't Hold Water

Not many funds or firms could get away with hiking fees as assets explode.

PIMCO implemented a round of fee changes in October, including a sizable hike at

cut

the fees at a couple of funds. But because the funds seeing hikes are larger than those getting cuts, it works out to a substantial fee hike in aggregate.

The fee increase at PIMCO Income is odd considering that the fund is already a behemoth ($99 billion as of Sept. 30, 2017) and has been growing like gangbusters. (Assets in the overall strategy across PIMCO vehicles had surged an astounding 75% to $177 billion for the year to date through September 2017.) If PIMCO had done nothing, it still would have hauled in tens of millions in additional fees (that is, by levying the same percentage expense ratio on its larger asset base).

To be sure, PIMCO Income’s expense ratio has been well below average up to this point and will remain competitively priced even after the fee hike. Indeed, it is unlikely most investors will pay much attention to this change, especially considering the fund is very capably managed and has been a standout performer (factors behind the fund’s Morningstar Analyst Rating of Silver).

Nevertheless, we’re disappointed by PIMCO’s action and the fund board’s apparent assent to it. As we explain further below, the economic rationale for the fee hike seems flimsy, PIMCO’s explanation seems to rely on accounting gimmickry, and shareholders will foot the bill.

"Just Pay Them What They Want" It's here that defenders typically invoke the fund's terrific performance in arguing that, if PIMCO wants to raise its fees to pay the "talent," then more power to 'em. Pay the talent!

This argument conflates two points, however. First, the "talent" would stand to get a very big raise even without the fee hike (that's the beauty of levying a more or less fixed percentage fee on a rising asset base). If one were to apply the fund's 2017 fiscal-year expense ratio to the fund's September 2017 assets, the firm was already looking at roughly an $87 million rise in these fees by sheer virtue of the asset growth it had enjoyed since the spring. Factor in the 0.05% fee hike, though, and fees surge another $50 million.

Second, if PIMCO’s explanation is to be taken at face value and its defenders’ argument accepted, most of the “talent” getting the raise is its admin corps: The fund raised not its management fee but rather its “supervisory and administrative” fee.

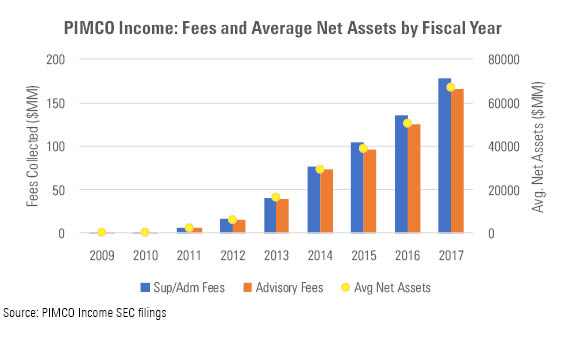

Rock Stars in the Back Office? These admin fees have been a boon to PIMCO in recent years. Over PIMCO Income's past two fiscal years alone, supervisory and administrative fees have rocketed 73% higher, roughly in line with asset growth. The firm collected $179 million in such fees in its most recently completed fiscal year as of March 31, 2017.

To be clear, we don't object to dollar fees rising with assets, though we prefer firms institute percentage fee breakpoints to share economies of scale equitably with investors. But PIMCO seems to be turning that principle on its head--in raising the percentage fee that PIMCO Income levies, it is essentially arguing that its enormous flagship fund is experiencing diseconomies of scale. The question is why.

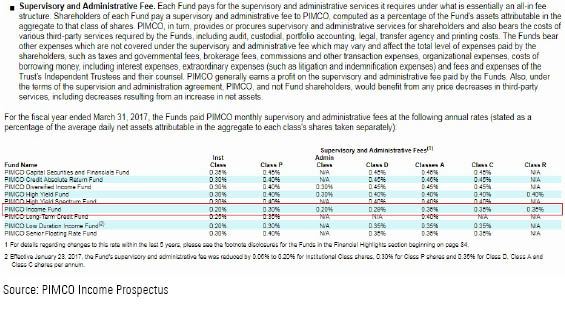

To answer it, we must assess whether these admin costs are fixed and scalable or whether they vary with factors like assets or number of accounts. Here’s how PIMCO itself describes “supervisory and administrative” fees in the funds’ prospectus:

In other words, these are expenses that relate not to the front of the house (where the money is run) or the field (where the funds are marketed and sold) but rather the back office. These are typically commoditized, lower-cost services that fund firms farm out to other providers. Usually, these costs do not account for the lion’s share of a fund’s expenses and are scalable, falling as assets rise.

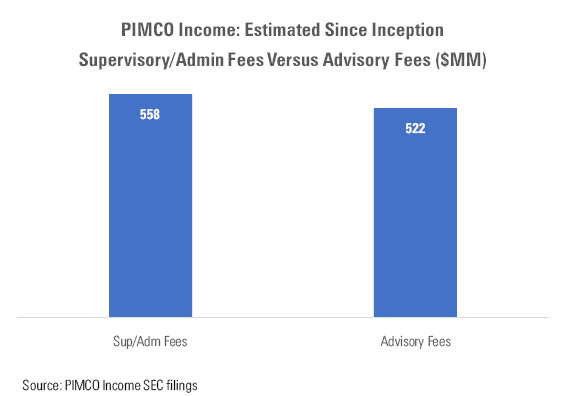

You wouldn’t know that from looking at PIMCO’s numbers, though. From PIMCO Income’s 2007 inception through March 31, 2017, PIMCO had hauled in $558 million in supervisory and administrative fees versus $522 million in management fees.

Just to reiterate: PIMCO Income levies reasonable percentage fees. The amount it has collected, while eye-popping in dollar terms, is actually less than what the typical fund would have hauled in assuming the same asset base over time.

Yet, it’s slightly absurd that PIMCO would charge more for back-office services than it would for management itself. After all, PIMCO’s brand is based on the claim that it provides among the best money management available and that it deserves to be paid a premium level of advisory fees for those services. If you judged from these two expense line items, it’s the unnamed “supervisors” and “admins” who are the real rock stars at the firm.

When the Back Office Is the Front Office In truth, these fees have been mislabeled for a long time, something we began pointing out years ago. Even former "bond king" Bill Gross got in on the act, mocking the practice in a lawsuit in which he sought damages from PIMCO stemming from his 2014 ouster from the firm (a suit the parties later settled).

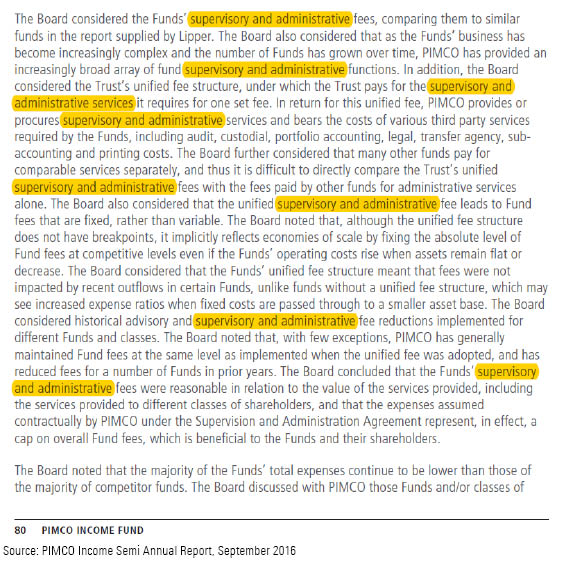

In its defense, PIMCO has argued that the nature of its corporate structure makes it too difficult to sort out the difference between its investment management and servicing functions, causing a blurring of the two. We’re dubious, though, for how else would the fund’s board assess the reasonableness of the administrative fees that PIMCO is levying? Indeed, the board riffs on those very fees each year in laying out its rationale for approving the contract that governs the administrative services that PIMCO renders, as shown in the example below (which is taken from the funds’ most recent semiannual report).

Curiously, the board, in explaining its rationale for approving the contract, cites the fact that the “unified supervisory and administrative fee leads to Fund fees that are fixed, rather than variable.” If this is so, then why did PIMCO and the board deem it necessary to jack up PIMCO Income’s fees by another $50 million (by our conservative estimate)?

The PIMCO Income Fee Hike: Explained (Sort Of) PIMCO has pointed to a variety of reasons that it needed to raise PIMCO Income's fees, but its primary justification has been the added effort of managing the fund's so-called level-dividend strategy (which looks to keep the fund's payouts as steady as possible without eating into principal) as the fund's assets have soared. The firm notes that the bond market has expanded, as has the diversity and complexity of instruments used in the portfolio, and with that demands on the firm.

What demands are we talking about? These include the tasks of estimating future dividends and the additional associated costs of audits, board reporting, and the like. In particular, PIMCO notes that it provides ongoing senior management oversight of the fund’s level dividend strategy along with the ongoing development of proprietary technology and processes that facilitate tax-lot level analysis and enhanced risk reporting.

PIMCO has understandably focused attention on higher operational costs in justifying the fee hike, but we happen to know that the firm and the fund’s board have also taken into account both the impact on its profitability and whether raising fees would still keep the fund in line with its competitors’ pricing.

Given the opacity of the process--PIMCO won’t say how much weight is given to each factor--there’s no way to parse out how much of the change it has attributed to each. But profitability and price competition are clearly bottom-line determinants of whether any firm is willing to push through fee increases, and it’s a hair nettlesome to think that the board would focus much on whether a fee hike is particularly good for PIMCO.

What Say You, Board? Alas, we're not expecting PIMCO Income's longtime manager, Dan Ivascyn, to leave his post for the greener pastures of the firm's back office. The distinction PIMCO is making between front- and back-office fees is superfluous anyway.

What concerns us is that this ambiguity seems to give the firm curtain behind which to make less-than-shareholder-friendly fee hikes. After all, it’s probably easier to raise admin fees than management fees given that the optics aren’t as bad, and admin expenses can be more easily tailored to each share class (whereas management fees are more or less the same across the board). To put it bluntly, we doubt PIMCO would have hiked fees in this manner if not for the cover of its fee mislabeling.

Given this, it’s time for PIMCO’s board to step in and put this pretense to an end. PIMCO should correctly label fees to promote transparency and comparability. That, in turn, should prevent questionable fee hikes like this one--which stands to cost shareholders tens of millions--from occurring in the future.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)