Investing for Sustainability and Impact

5 funds that achieve impact alongside competitive financial return.

If you are interested in sustainable investing, chances are you would like your investments to have an impact alongside competitive financial returns.

What we now call sustainable investing used to be mainly about avoiding the bad guys: tobacco companies, weapons manufacturers, the worst polluters, other "sin" stocks, and the like. Not everyone agreed on who the bad guys were, nor was there always an investment rationale for these exclusions. They were often more about aligning portfolios with an investors' values than they were about improving investment performance.

Next came more holistic evaluations of companies based on a host of environmental, social, and corporate governance, or ESG, issues that help identify risks and opportunities that traditional financial analysis finds difficult to value but that are nonetheless material to an investment. ESG ratings providers, such as our partner, Sustainalytics, provide much of the raw material for asset managers to incorporate ESG analysis into their investment processes. In the United States, the Sustainable Accounting Standards Board has developed an industry-specific classification of material ESG issues to guide company disclosure of appropriate information for investors. ESG analysis is now employed by virtually all of the world's largest asset managers, primarily as a risk-mitigation tool. The Morningstar Sustainability Rating is, in essence, a measure of the ESG risk embedded in a portfolio, based on the ESG ratings of the companies it holds.

Another facet of sustainable investing--impact--has gained significant traction this year, spurred by investors themselves and by those who want to mobilize investors to focus on how their investments can help solve global problems. Impact was the dominant topic at the Principles for Responsible Investment's PRI in Person conference in Berlin in September and at the Conference for Sustainable, Responsible, Impact Investing in San Diego, which I attended last week.

Technically, impact investing has been around for a while. The not-for-profit Global Impact Investing Network has been in existence since 2009. Impact investments have been primarily about providing capital to projects that have direct, measurable environmental or social impacts. These investments require a financial return, but in some cases at below-market rates, and their use have been largely limited to high-net-worth investors and institutions.

But that's all changing. The idea of investing for sustainability and impact resonates with many investors. In a recent global investor survey of more than 22,000 investors, Schroders found that sustainable investors see positive impact and financial returns going "hand-in-hand." Two thirds of Americans in the survey said they are interested in sustainable investing mainly for its impact or for both impact and financial return. Only one third said they were interested in it solely for financial return.

Some Ways You Can Have an Impact First of all, simply investing in funds that incorporate ESG considerations into their selection and portfolio-construction process has an impact. It signals to companies that investors believe sustainability issues are important and encourages companies to take them seriously. When companies take sustainability issues seriously, they do so because they believe it will help their business but, in so doing, they have a broader environmental or societal impact.

A company that adopts clean-energy targets, for example, is not only saving money for itself and its shareholders, it is reducing overall carbon emissions. A consumer-facing firm that monitors its supply chain for fair and safe labor practices, is not only safeguarding its reputation, it is raising standards for workers in the regions where they work. A company that promotes diversity in the C-suite and boardroom not only improves its ability to make quality business decisions, it breaks down long-standing barriers faced by women and racial or ethnic minorities to achieve these positions.

A second way to have impact with your fund investments is through stewardship. This takes the form of direct engagement with companies, sponsorship of shareholder proposals, proxy voting, and sometimes, engagement in broader public policy efforts. Funds that take impact seriously actively engage with companies about ESG issues. Engagement typically involves private discussions with management, often with other like-minded investors, and it often produces results, as companies come to a better understanding of the issue and how to address it. In the past year, many engagements were about climate-risk disclosure. Others focused on issues like responsible water use, encouraging banks to increase funding for renewable energy, human rights standards for workers in Asia, and better transparency on corporate lobbying and political contributions.

When engagement doesn't work, shareholders can sponsor proposals that are voted on at the company's annual shareholder meeting. Shareholder proposals asking for annual climate-risk disclosure statements garnered a majority of shareholder votes this year at

All funds have to disclose their proxy votes each year by the end of August. Some funds make their proxy disclosure information readily available, but others either don't post it at all or bury it on their websites. The SEC's website has this information (Form N-PX), but the site is not very user-friendly. Best practice is for a fund company to issue a report summarizing its proxy votes and make the report easily available on its website.

A third way to have an impact with your fund investments is through bond funds that direct some or all of their portfolios toward so-called green or other social-purpose bonds. Green bonds fund projects that have positive environmental or climate benefits. They are issued by governments to finance public projects, by banks to finance client projects, and by companies to fund their own internal projects. Other types of impact bonds focus on affordable housing, community and economic development, and natural resource conservation. Finally, there are funds that focus on specific sustainability themes, like renewable energy sector funds, or diversified funds that focus on companies with women in leadership.

Investing for impact is rapidly becoming both more transparent and more connected to a specific set of goals for sustainable development passed in 2015 by the United Nations General Assembly. The 17 Sustainable Development Goals seek to "end poverty, protect the planet, and ensure prosperity for all," with specific targets to be reached by 2030. While the SDGs are not specific to investing, they call on investors to play their part alongside other global influencers to achieve them. The SDGs are quickly becoming the measuring stick for evaluating sustainable impact. Investors have started to demand more impact reporting from their funds, and the SDGs provide a useful framework for funds to evaluate the impact of their investments and stewardship activities.

5 Impactful Funds

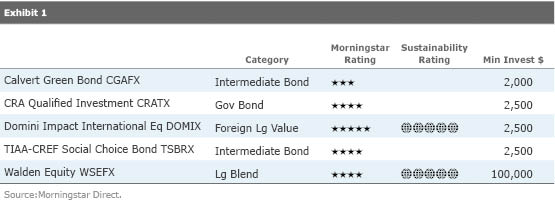

Exhibit 1 lists several funds that achieve impact alongside financial return.

CRA Qualified Investment

CRATX is an intermediate government-bond fund that focuses on affordable housing and local economic development projects in the U.S. and reports to investors on the impact of the fund's investments.

Calvert Green Bond

CGAFX is an intermediate-term bond fund that is the only one of the three green-bond funds with more than a three-year track record.

TIAA-CREF Social Choice Bond

TSBRX is a highly rated fund that devotes a substantial portion of its portfolio to bonds that finance social and environmental projects.

Domini Impact International Equity

DOMIX also issues a quarterly impact report.

Walden Equity

WSEFX is managed by Walden Asset Management, which has long been a stewardship leader. Walden's efforts this year

to issue its first stewardship report. The firm was also the first U.S. signatory to the

committing it to using the SDGs "as a central framework to work with when investing toward 2030."

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q27ZB7KFPZBMHFKY6IURRWJQHM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)