Anixter Could Offer Electrifying Returns

We think this underfollowed small-cap electrical distributor is poised to outperform.

Following its recent transformation, we believe

Over the past three years, Anixter has completed three transactions that have bolstered its market presence, growth potential, and operating flexibility. After acquiring Tri-Ed in 2014, selling its capital-intensive supply fasteners segment in 2015, and purchasing HD Supply’s utility distribution business in 2015, Anixter is now the global leader in network and security distribution, a top player in electrical distribution, and the leading utility power solutions distributor in North America.

Anixter’s product specialization and focus on value-added technical and supply-chain services across a global platform differentiate the company from competitors that rely solely on product pricing and availability to drive business. Anixter’s capital-allocation strategy has favored returning cash to shareholders through special dividends and share repurchases. We expect the company to resume returning cash to shareholders in 2018 upon achieving its targeted capital structure.

Growing Presence in Key End Markets Anixter International is a leading industrial distributor that specializes in network and security, electrical, and utility power products and services. The Glenview, Illinois-based distributor carries nearly 600,000 products and has a global footprint of 320 warehouse/branch locations across 50 countries. Anixter operates three distinct businesses: network and security solutions; electrical and electronic solutions; and utility power solutions.

Anixter serves as a key middleman between a network of over 150,000 customers and thousands of suppliers. Customers value the company’s extensive product portfolio, global scale, technological expertise, and supply-chain services. On the supplier side of the equation, Anixter is a trusted partner to thousands of suppliers, including large industry players such as Eaton, Schneider Electric, and Corning. For many of its suppliers, Anixter is a top customer and represents a leading market channel. Suppliers are attracted to Anixter’s market position and history of growth.

Technical expertise remains a key facet of the company’s value proposition. Customers utilize Anixter’s dedicated technical staff and its UL-certified Infrastructure Solutions Lab to evaluate and test products and product applications. The company also independently tests its product inventory through the Infrastructure Solutions Lab; this helps ensure quality and can provide customers with important product information beyond what manufacturers offer. The Infrastructure Solutions Lab is the only facility of its kind that is certified by UL, the largest third-party testing organization in the world. In addition to product research, testing, and evaluation, Anixter uses its technical expertise and vast product knowledge to deliver customized, turnkey solutions for its customers.

Anixter’s supply-chain services are another key component of the company’s value proposition. Services include product sourcing, inventory management, product enhancement and packaging, global logistics, and e-commerce. Many customers have neither the time nor expertise to evaluate and select from the nearly 600,000 stock-keeping units that Anixter sources from thousands of suppliers, nor do they possess the scale to cost-effectively manage their supply chains. Anixter adds value for customers by simplifying the product procurement process, lowering working-capital needs, and driving cost and risk out of customer supply chains.

Anixter Serves Fragmented End Markets Industrial distribution is a very fragmented market. Each of the industrial distributors we cover reports a different addressable market size based on its product portfolio, distribution footprint, and customer base; however, none of them report market share above 10%.

Despite relatively low market share, Anixter is the global leader in network and security, the North American leader in utility power, and a top global player in electrical distribution. Although Anixter counts large distributors such as Sonepar, Wesco International WCC, Graybar, and Rexel as competitors, most of its competitors are smaller, privately held local and regional distributors. In fact, in the United States alone, there are over 5,000 electrical distributors.

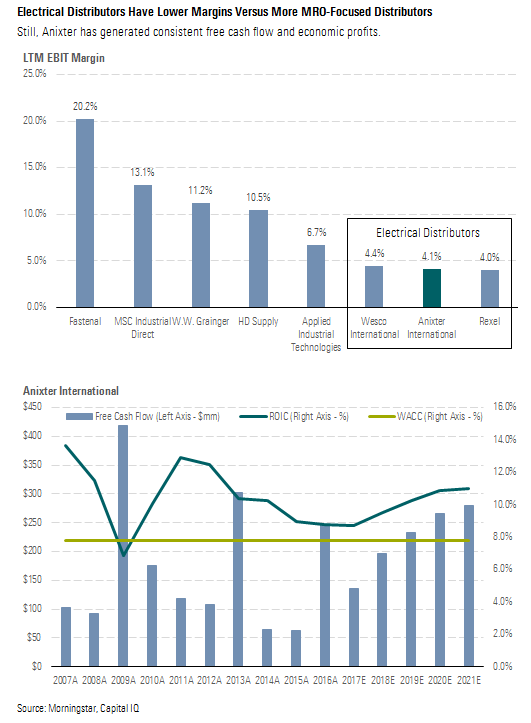

One of the most obvious differences between Anixter and some other industrial distributors is its relatively low operating margins. In 2016, Anixter generated approximately 28% of its sales from electrical distribution. The electrical distribution industry is highly fragmented, which creates some margin pressure. However, despite relatively thin margins, Anixter has proved its ability to generate free cash flow and economic profits throughout the business cycle.

Another key point of differentiation between Anixter and some of the higher-margin distributors is its product application mix. We estimate at least half of Anixter’s revenue is tied to capital projects, which typically have lower margins than maintenance, repair, and operations sales. Capital projects are planned purchases with long sales cycles that typically go through a rigorous bidding process, whereas MRO sales are more about convenience--having the right products available at the right time. Unplanned MRO sales (for example, components to fix a broken HVAC unit) can carry even higher margins. In the past, the mission-critical nature of some unplanned MRO sales has allowed distributors like W.W. Grainger GWW to charge egregious prices, but the emergence of Internet-based distributors has resulted in more sensible pricing.

We believe Anixter’s end-market exposure, though generating relatively thin margins, renders the company less exposed to competition from Amazon Business AMZN and other Internet-based competitors versus other distributors.

Transformation Better Positions the Company for Growth Over 2014-15, Anixter completed a series of deals that have better positioned it, in our view. The $420 million acquisition of Tri-Ed, a privately held security and low-voltage products distributor, expanded Anixter's security product portfolio, channel partner relationships, and distribution footprint. Also, Anixter sold its original-equipment manufacturer supply fasteners business for $380 million; this business was Anixter's least flexible and most capital-intensive. Finally, Anixter acquired HD Supply's power solutions business for $825 million; with this purchase, Anixter became the leading distributor in the North American utility space with a well-rounded suite of utility products and a larger book of customers. Both the Tri-Ed and the power solutions acquisitions increased Anixter's participation in higher-growth markets. Management has said the utility power market is growing at about a 4% compound annual growth rate and the network and security market is growing at a 3%-4% CAGR; meanwhile, the electrical components market is growing at a 2%-3% CAGR. Anixter expects cross-selling opportunities to support above-market growth rates; it targets $200 million in sales synergies from power solutions and an $80 million in sales synergies from Tri-Ed.

Although it initially had lower margins than the company average, power solutions is Anixter’s least capital-intensive business, which should bolster returns on invested capital. Furthermore, management expects 12.5% incremental margins on power solutions’ $200 million revenue synergy target, which seems achievable, given the segment’s cross-selling opportunities and lower operating costs. We are already seeing a steady improvement in profitability; in the segment’s first full year (2016) under Anixter’s ownership, power solutions posted a 5.5% adjusted EBITDA margin, and through the first six months of 2017, the segment has posted a 5.9% adjusted EBITDA margin.

Anixter Has a Narrow Economic Moat Product distribution is a tough business; low entry barriers combined with customer and supplier bargaining power can erode returns for industry players. Despite these pressures, Anixter's scale and ability to monetize its strong network of customers and suppliers have allowed the company to earn excess returns over business cycles, and we expect it to maintain its competitive advantages and continue to earn economic profits over at least the next 10 years. As such, we assign Anixter a narrow economic moat rating.

Anixter serves as an important conduit between 150,000 customers and thousands of suppliers. The importance of distributors is especially evident in the electrical products market, where approximately 75% of products pass through a distribution channel. As a large and trusted distributor, Anixter capitalizes on the network effect to extract meaningful value from its customer and supplier relationships, which helps drive excess returns.

Anixter’s customers find value in the company’s large assortment of products, technical expertise, and ability to streamline the procurement process. We believe Anixter’s product selection and availability, combined with its value-added services, offer customers convenience, support, and cost savings that help strengthen existing customer relationships and win new business. Anixter has a proven ability to increase customer wallet share. We attribute this directly to the company’s success in cross-selling its growing portfolio of products and services to a customer base that is increasingly looking to consolidate spending with value-added distributors that have global scale.

Suppliers, on the other hand, see Anixter as a source of growth, and they find value in Anixter’s large customer base and proficient sales, marketing, logistics, and service capabilities. Furthermore, we believe it is more efficient and less costly for suppliers to push volume through a large distributor with national scale, like Anixter, than to rely on a greater number of regional distributors or internal salesforce and logistics. Anixter is an important channel partner for thousands of suppliers, and we think its large and expanding customer base and ability to outgrow its end markets strengthens its standing with its suppliers.

Anixter uses its reputation with suppliers and its scale to expand its vendor base and product selection. It also uses these advantages to benefit from sales incentives and volume rebates and to gain preferential access to supplier training programs and support, which in turn allow Anixter to offer its customers better product selection, pricing, and services. As a key middleman that provides a valuable service to both customers and suppliers, Anixter has leveraged its market-leading position to create a virtuous cycle, which supports sustainable, profitable growth. The more customers and suppliers that Anixter serves, the more valuable its business becomes.

We believe Anixter benefits from scale-driven cost advantages over smaller competitors. Given the amount of product volume it sells, the company can take advantage of volume-based rebates and other sales incentives to lower its cost of goods sold. Anixter also negotiates favorable terms with suppliers, such as return rights and price protection agreements, which helps to mitigate risk.

Also, Anixter has 320 warehouses or branches across 300 cities in 50 countries operating on one global service platform, which allows it to cost-effectively serve multinational customers. The company’s ability to deliver installation-ready products around the globe is a key value-added service, and we think Anixter can complete these services more cost-effectively and efficiently than independent contractors and installers can. This helps Anixter deliver products and services at the lowest cost of ownership.

Why Anixter Is Least Exposed to Amazon Anixter's value proposition has always been more about its technical expertise and services rather than product price. Most competitors run a business model built around price and availability--serving customers that need a product at a good price, but do not need or value any additional services. We think Anixter's technical expertise and service offerings differentiate the company from pure product distributors that can offer lower per unit pricing but cannot bundle products with value-added services that offer the lowest cost of ownership to customers. We believe Amazon falls into that price and availability model. For example, if a contractor needs five replacement surveillance cameras and nothing else, Anixter many not offer the best value, and Amazon or other competitors may win that business. However, if a contractor is embarking on a complex, larger-scale security installation project, Anixter's value proposition shines through. We do not think Amazon will ever evolve into an entity that effectively competes with Anixter on complex projects that require technical expertise and a consultative approach.

Anixter servers many large, multinational companies, such as IBM, Siemens, and HP. Managing these relationships can be challenging because large customers often have complex procurement processes and requirements, negotiate custom pricing, and demand personalized service. These customers also require their suppliers to have a record managing large accounts. But Amazon has a limited history serving large customers that require consistent service across their global footprints. Its inexperience with large customers was one of the key tenets of the Federal Trade Commission’s opposition to the proposed Office Depot-Staples merger. Office Depot and Staples had argued that the tie-up was necessary to compete with Amazon. The FTC refuted the notion that Amazon could quickly gain market share with large customers, noting the following deficiencies: no experience in requests for proposals; no ability to provide customer-specific pricing or commitment to price guarantees; lack of dedicated customer service agents; unproven ability to provide utilization and invoice reports; inability to control third-party pricing and delivery; and lack of product variety and breadth. The FTC also argued that although Amazon entered the office supply business over a decade ago, large business-to-business customers still did not view it as a viable alternative to Office Depot and Staples. With time and investment, Amazon could overcome many of these hurdles; however, we believe its ability to take share from large customers will prove challenging in the near term.

We think Amazon’s business model is well suited to serve midsize customers and customers making one-off, unplanned purchases (known as spot buys) because these customers care more about price and speed of delivery and less about supply-chain services. We also think Amazon is a much more formidable threat in the less-specialized MRO product category because selling these types of products (for example, safety and janitorial supplies) requires little if any product knowledge. The good news for Amazon is that midsize accounts, spot buys, and MRO products typically carry higher margins. We think it makes much more sense for Amazon to use its existing capabilities to attack higher-margin markets and product categories rather than invest the time and money to replicate Anixter’s model, only to earn operating margins that are in line with Amazon’s current margins. Indeed, Amazon Business has publicly called out Grainger and Staples as its main competitors.

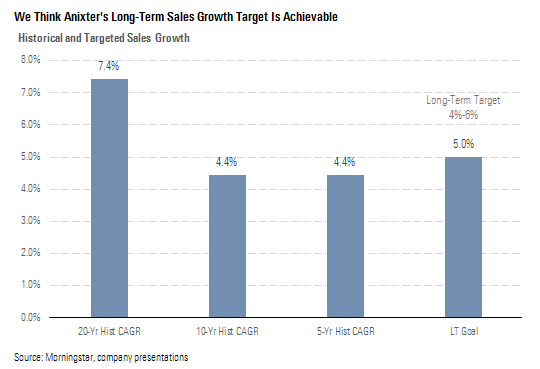

Myriad Positive Drivers Support Growth Expectations Management targets long-term sales growth of 4%-6%, which we view as reasonable based on historical performance and our outlook for Anixter's end markets. The company estimates long-term annual growth of 3%-4% in the network and security market, 2%-3% in the electrical products market, and 4% in the utility power solutions market. We assess some of the more important growth drivers below.

The outlook for data center growth is bright. Capital expenditure requirements for the main hyperscale players are expected to grow at a 13% CAGR through 2021. Hyperscale computing describes the scalable infrastructure needed to support voluminous data and demanding computing workloads.

Morningstar forecasts that both residential and commercial new construction activity will continue to grow over the next five years, which should benefit all three of Anixter’s businesses. We expect housing starts to peak at 1.9 million by 2021, before falling back to a demographically sustainable 1.5 million. Stronger household formation among the massive millennial generation is the key to our bullish forecast. We expect nonresidential construction spending to grow at about a 4% CAGR on a nominal basis over the next decade.

We expect Anixter’s security business to benefit from growing commercial retrofit and upgrade spending that is fueled by the convergence of electronics and mechanical security solutions. A March 2017 report from MarketsandMarkets projects the physical security market to grow at about a 10% CAGR through 2021.

Anixter’s utility power solutions segment benefits from utility capital expenditures and supply-chain outsourcing. Consensus contributing analysts expect half of the S&P 500 utility companies to increase capital expenditures over the next three years at combined 5.5% CAGR. However, consensus projections for total capital expenditures for all 28 S&P 500 utility companies are expected to modestly decline due to a handful of outliers that are projected to significantly cut capital expenditures. Anixter has disclosed that DTE Energy and PPL are customers. Consensus expectations are for capital expenditure growth at a 7.5% pace for DTE Energy and a 3.4% CAGR for PPL through 2019. Irrespective of capital projects, more utility companies are outsourcing their supply chains to partners like Anixter.

Copper is a significant component of wire and cable products, and changes in copper prices can have an impact on Anixter’s profitability. Because Anixter maintains a relatively constant percentage markup on such products, higher copper prices have a favorable impact on Anixter’s operating margin because the higher sales prices are realized with no incremental increase in fixed costs. If Morningstar’s bull-case copper forecast comes to fruition (due to slower-than-expected supply growth and/or stronger-than-expected growth rates in Chinese demand), Anixter would realize stronger sales growth and better profitability. However, even if our base-case copper forecast plays out, there is little downside to 2016 performance.

Weak industrial end markets have hampered industrial distributors, but over the past couple of quarters, many of the distributors we cover have reported growing optimism from customers in challenged end markets. As industrial end markets recover, we expect Anixter to benefit from increased customer demand and better pricing power that comes with an inflationary environment.

Anixter expects to achieve $280 million in sales synergies and at least $40 million in EBITDA synergies from Tri-Ed and power solutions cross-selling initiatives. The company sees incremental sales opportunities from selling security solutions to utility companies as well as selling additional product lines to existing Anixter customers.

Customers continue to consolidate their spending with large distributors to leverage their purchasing power and increase operational efficiency. With its national scale, broad product portfolio, and supply-chain services, Anixter should be able to capitalize on this consolidation trend and take market share from smaller and less capable distributors.

Anixter can also augment its growth with product and geographic expansion. The company is expanding its security, low-voltage, and utility products into Canada, Mexico, and other foreign markets. Although currently a relatively small part of Anixter’s product portfolio, wireless products such as distributed antenna systems are growing nicely.

Anixter Is Attractively Valued and on the Cusp of Returning Cash to Shareholders Historically, Anixter's capital-allocation strategy has favored returning cash to shareholders through episodic special dividends and share repurchases. Since 1996, we calculate the company has used approximately 75% of its free cash flow (cash flow from operations less capital expenditures) to fund special dividends and share repurchases. Over those 20 years, Anixter paid five special dividends ($1.50 per share in 2004, $4.00 in 2005, $3.25 in 2010, $4.50 in 2012, and $5.00 in 2013) and repurchased about 33 million shares at an average cost of about $29. Recent acquisitions have prevented the company from returning cash to shareholders since 2014, but we expect Anixter to resume this shareholder-friendly practice after it reaches its targeted EBITDA leverage ratio of 2.5-3 times and a 45%-50% debt/capital ratio. After it reaches its targeted capital structure, which we expect to happen by 2018, we believe the company will toggle between special dividends and share buybacks depending on management's perception of the company's value relative to the share price. We would not rule out the initiation of a modest regular dividend.

The industrial distribution sector looks attractive with an average free cash flow yield of about 6% versus the sector’s 10-year historical average of 4.4%. We think this discount can be attributed to weak industrial end markets and unease about the potential impact Amazon could have on industry margins. At about 10%, Anixter’s free cash flow yield stands out relative to other industrial distributors. We believe Anixter is least exposed to the Amazon threat and such a discount relative to peers and Anixter’s historical free cash flow yield is unwarranted.

Over our five-year explicit forecast, we model consolidated sales growing at about a 4.0% CAGR to about $9.3 billion and consolidated adjusted operating margin improving from 4.1% in 2016 to 5.0% in 2021 (adjusted EBITDA margins improve from 5.2% in 2016 to 6.1% in 2021). At the segment level, we see network and security solutions growing at a 4% CAGR through 2021, and we expect it to post average operating margins of 7%, on average. Recent electrical and electronic solutions segment performance has been burdened by weak end markets, but we think sales troughed in 2016, and we expect segment sales to return to growth in 2017, followed by 3% average organic revenue growth through 2021 as end markets normalize. As this segment returns to growth, we think operating margins can reach almost 7% (from 4.9% in 2016) as it benefits from operating leverage. We model the utility power solutions segment to increase sales at nearly a 6% CAGR through 2021 with average operating margins just above 5%. Our projected sales growth and EBITDA margins are in line with Anixter’s historical performance, but look conservative relative to management’s long-term goals.

We See Value to Unlock In our view, Anixter is an underfollowed, small-cap company that is at risk of going unnoticed. However, we believe its return to special dividends and buybacks, paired with improving growth and profitability, can help the company gain recognition. With increased competition from Internet-based distributors, broad-line distributors such as Grainger may never return to historical profitability levels; however, we think that Anixter remains insulated from this competitive threat, and we expect it to return to historical profitability as its end markets improve. Although we prefer not to emphasize speculative M&A activity as a catalyst, we think it is important to note that previous takeout rumors and an aging chairman with a 12% ownership stake suggest that Anixter could eventually become a takeout target.

Risks to our thesis include challenged end-market demand that results in weak organic sales growth and profitability. In addition, declining copper prices and product commoditization could drive lower operating margins. And Amazon’s impact on the market could be more disruptive than we currently expect.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)