Seasons Change, but Many Ratings Stay the Same

Amid a handful of revisions, Morningstar affirmed 135 Analyst Ratings in October.

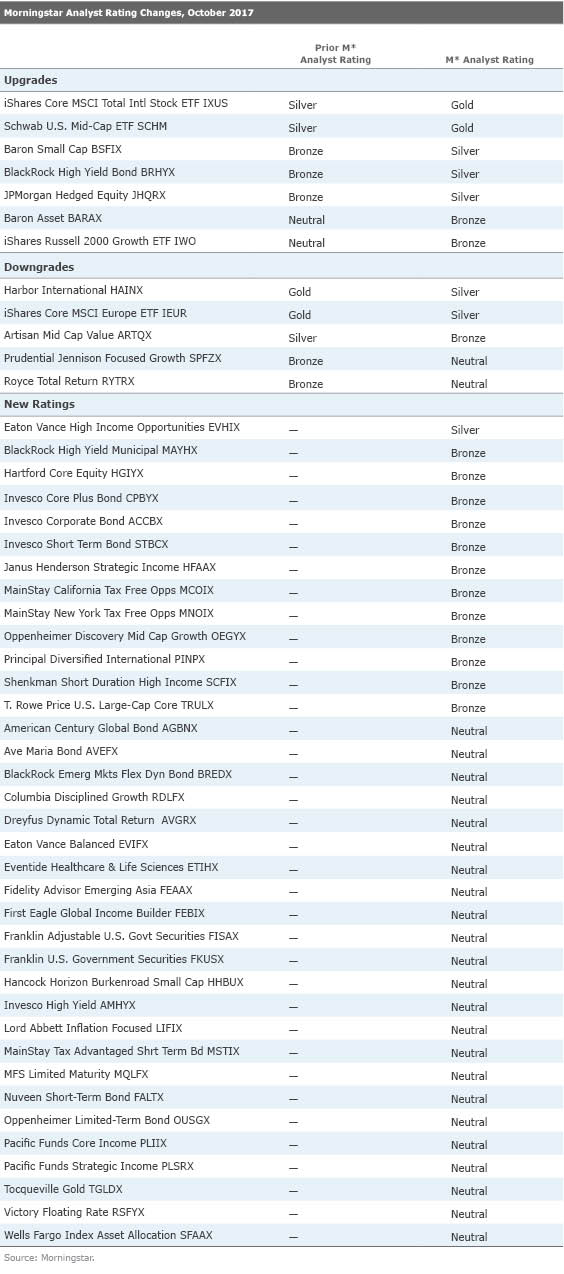

In October, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 135 funds, upgraded the ratings of seven funds, downgraded the ratings of five funds, and assigned new ratings to 36 funds. Below are some of October's highlights, followed by the full list of ratings changes.

Upgrades

Downgrade

New Ratings

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)