China and the Middle-Income Trap

The odds of escape aren't great...and may be getting worse.

China is far from the first country to endure slowing economic growth following its ascent from agrarian poverty to middle-income status. In fact, middle-income countries are disproportionately likely to experience large slowdowns. As a result, few ultimately ascend to high-income status. Economists coined this phenomenon the middle-income trap. This article continues our series on China’s next 10 years with a look at the country’s odds of escaping the trap.

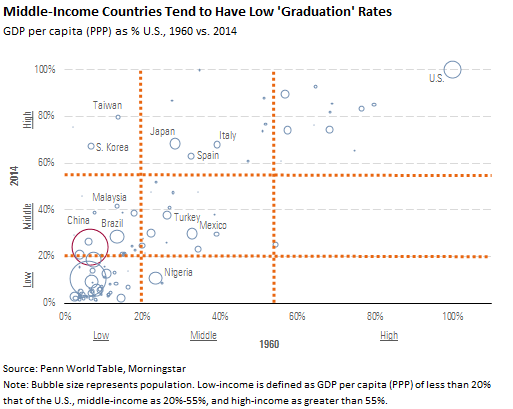

It's Getting Easier to Escape the Poverty Trap, but Harder to Escape the Middle-Income Trap The climb from middle-income to high-income has never been easy. Among the 96 countries categorized as low- or middle-income in 1960, only 12 non-OPEC countries eventually graduated to high-income status. This is the leap China aims to make, which would involve more than doubling GDP per capita from today's level.

Worryingly for China, history suggests that this climb may be getting harder. Of the 12 non-oil graduations since 1960, only four have occurred since 1990: Taiwan, Ireland, Spain, and South Korea.

Meanwhile, low-income countries are finding it easier to ascend to middle-income. Of the 21 low-to-middle transitions since 1960, 12 have occurred since 1990. China itself became a middle-income country in 2011.

Globalization and the Middle-Income Trap Why has there been an uptick in low-to-middle transitions just as middle-to-high graduation rates have fallen? Globalization might explain both phenomena.

Since 1990, there have been enormous improvements in information technology alongside dramatic reductions in trade and investment barriers. That’s enabled companies to pair rich-country technology with poor-country wages to an unprecedented extent. Thanks to capital and technology inflows from high-income countries, low-income countries have found it easier to vault to middle-income status.

But modern communications technology, freely flowing trade, and highly mobile capital seem to have pressured growth among middle-income countries by subjecting them to increased competition from countries with cheaper labor. In effect, globalization can trap middle-income countries between low-income countries with a competitive advantage in labor-intensive industries and high-income countries with a competitive advantage in knowledge-intensive industries.

For China, the risk is that growth falters amid stiffer competition from poorer countries like Bangladesh, India, and Vietnam that now seek to follow in its footsteps.

When High-Flying Economies Slow, They Fall All the Way Back to Earth The historical experience of countries that have fallen into the middle-income trap may offer clues about the road ahead of China, including a sense of how sharply growth slows once a country achieves middle-income status, the causes of slowing growth, and any attributes that influence the size of the slowdown.

Fortunately, the past several years have yielded a bumper crop of academic research on the middle-income trap. Perhaps the most widely cited work comes from economists Barry Eichengreen, Donghyun Park, and Kwanho Shin, who surveyed the period from 1957 to 2010 to identify the key characteristics and causes of slowing growth among middle-income countries.

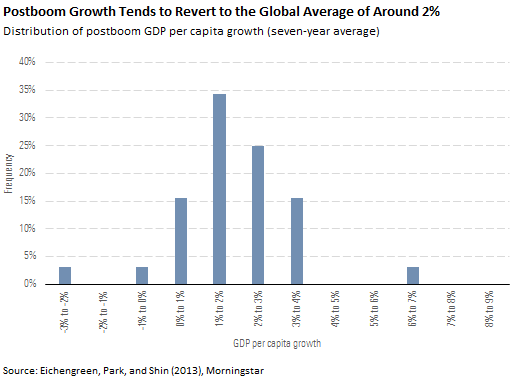

Nearly all the episodes studied by Eichengreen and colleagues were defined by a significant deceleration in growth. The typical country saw average GDP per capita growth fall by more than half over successive seven-year periods, or by about 3.6 percentage points. Median GDP per capita growth in the seven-year slowdown period was 2.1%, essentially in line with the long-term global average (1.9% since 1960).

Very few countries fared meaningfully better or worse than the median. Only 9% posted GDP per capita growth outside the 0%-4% range. Only 3% enjoyed the 5%-plus growth that consensus anticipates for China. Even our supposedly bearish forecast of 4% GDP per capita growth, on average, over the next seven years would be on the high side of history.

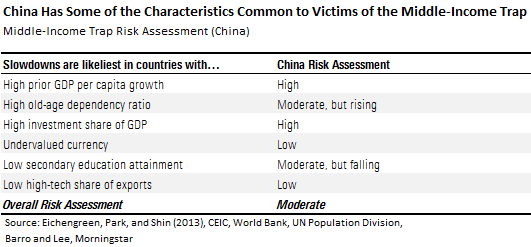

China's Odds of Escaping the Trap Aren't Great To gauge the risk that China falls into the middle-income trap and sees its once-explosive growth slip all the way to the global norm of roughly 2%, we begin by screening for a handful of key risk factors identified by Eichengreen, Park, and Shin from a long list of economic, demographic, and political variables. As we discuss below, China's risk scorecard is mixed.

Risk Factor: High GDP Growth China Risk Assessment: High Eichengreen, Park, and Shin find faster-growing countries are more susceptible to large slowdowns. They hypothesize this may be a long-term side effect of government efforts to prop up growth in the short term, writing that "the more aggressive the measures undertaken to boost growth, the less likely exceptional growth can be maintained."

China, which despite slowing growth has clocked the highest average GDP per capita growth rate of any country over the past 10 years, appears high-risk by this measure. The repeated stimulus required to keep growth aloft would certainly qualify as aggressive measures. Similarly, the side effects of stimulus--excess capacity and bad debt--seem likely to reduce growth in the long term.

Risk Factor: High Old-Age Dependency Ratio China Risk Assessment: Moderate but Rising Precedent suggests China's aging population, a topic we tackled in an earlier article, will put the country at greater risk of a slowdown. Eichengreen and colleagues note that a rising old-age dependency ratio--the number of seniors for every working-age adult--tends to be "associated with lower savings rates and [falling] labor force participation rates."

Currently, China has 14 seniors for every 100 working-age adults, which is typical among middle-income countries. However, this ratio will increase about 50% over the next 10 years. By 2026, China’s old-age dependency ratio will be on par with countries like the United States, Canada, and Australia today.

Risk Factor: High Investment Share of GDP China Risk Assessment: High Beijing's efforts to generate high GDP growth have required the country to sustain an unusually high investment share of GDP: 44% in 2016 versus a middle-income norm of roughly 20%-30%. High investment rates, Eichengreen and coauthors argue, "increase the likelihood of slowdown as they may translate into low future returns on capital" once "brute-force capital formation eventually becomes unsustainable." As discussed in our prior article, China's rapidly rising capital output ratio certainly suggests the days of high returns have passed.

Risk Factor: Undervalued Currency China Risk Assessment: Low Countries with undervalued currencies appear to have a harder time escaping the middle-income trap. That might appear counterintuitive, as a cheap currency should make it easier to compete in foreign markets. Eichengreen, Park, and Shin argue, however, that "countries with undervalued currencies have less incentive to move up the technological ladder out of unskilled-labor-intensive, low-value-added sectors and thus find it more difficult to sustain rapid growth."

While it’s difficult to say for sure, we doubt the yuan is undervalued at present. The global relationship between market exchange rates and purchasing power parity exchange rates suggests the Chinese currency might be overvalued by 20% or more. If Eichengreen and colleagues are right, this should make China less likely to fall into the middle-income trap.

Risk Factor: Low Secondary Education Attainment China Risk Assessment: Moderate but Falling Countries with poorly educated populations are more likely to succumb to the middle-income trap. Eichengreen and colleagues find secondary education (junior high and high school to Americans) to be especially critical. The authors hypothesize that middle-income countries with fewer high school graduates find it "harder to move up market when challenged from below by other late-industrializing, low-labor-cost countries."

China would appear to rate as somewhat risky on this measure. The country’s population age 15 and older averages 2.65 years of secondary education, less than the middle-income country norm of about 3 years. But the risk posed by an undereducated workforce is receding. New entrants to China’s workforce are far more educated than the previous generation, a consequence of the country’s unusually rapid development and periods of unrest that kept children out of school. Accordingly, the education gap between China’s workforce and that of its peers is set to close in the years to come.

Risk Factor: Low High-Tech Share of Exports China Risk Assessment: Low Eichengreen, Park, and Shin find countries with limited high-tech exports are at increased risk of a significant slowdown. This may indicate, they argue, a failure to transition from labor-intensive products to knowledge-intensive products.

High-tech exports currently constitute about 26% of China’s manufactured exports. That’s among the highest shares globally. But given the China’s role as assembler of many high-tech devices, it probably overstates the country’s innovation prowess.

China Has a Fair Chance of Escaping the Middle-Income Trap China carries some of the markers historically associated with the middle-income trap, including rapid GDP growth, a high investment share of GDP, and an aging population. Yet on other factors that tend to predict slowdowns, including an undervalued currency and limited high-tech exports, China appears comparably low-risk.

On balance, while we would not regard China to be at especially high risk of falling into the middle-income trap, the odds of escape aren’t that great either. We’re inclined to agree with the assessment of former Finance Minister Lou Jiwei, who, in a 2015 speech at China’s prestigious Tsinghua University, pegged the country’s chances at 50-50.

For China to improve its odds of escape, it must tap new sources of productivity growth. Academic research consistently finds that the few countries that make the leap to high-income status tend to perform well on four key dimensions: institutional quality, innovation, human capital, and information and communication infrastructure. In forthcoming articles, we’ll evaluate China across those four criteria and gauge the country’s prospects for joining the ranks of high-income countries.

/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)