How Does Fidelity Charitable's Investment Menu Stack Up?

We take a close look at the ongoing fees and underlying investment offerings of the largest donor-advised fund in the U.S.

Donating money to charities through donor-advised funds has become increasingly popular over the past decade. According to data from the National Philanthropic Trust's Donor Advised Fund Report, overall assets as of the end of 2017 surpassed $100 billion for the first time.

One of the biggest advantages of a donor-advised fund from a strategic tax-planning perspective is their flexibility: You make donations to the account and receive immediate tax benefits for doing so. But then you're allowed to disburse the money from the accounts according to your own timetable. As of now, there is no set time frame during which you have to pay out the funds; the donation you make can sit in the donor-advised fund account indefinitely. In fact, you can pass the account along to your heirs. In other words, you can choose to pay out a donation to an approved charity right away, or invest the money in the donor-advised fund account and let it grow tax-free until you want to pay it out. Either way, you get an immediate tax deduction. And though you cede control of the assets, you retain advisory privileges over how the account is invested, and how the fund distributes money to charities.

Because the funds in donor-advised accounts aren't used simply as way stations for getting money immediately into a charity, my next question was, how do the underlying investment menus rate? And how much will investors end up paying in fees and expenses? (Investors in donor-advised funds pay annual administrative fees on account balances, and investors also pay fees on the underlying investments. Though not typically onerous, all of these fees eat away at the overall charitable donation, and direct investments to charity would not face the same fee burden.)

How Does Fidelity Charitable Stack Up? Minimum donation level required to set up an account: $5,000 Annual administrative fees: the greater of $100 or 0.6%; expense breaks on balances greater than $500,000

Fidelity Charitable offers four investment pools: the asset allocation pools, single asset class pools (index and actively managed), the impact investing pool, and the charitable legacy pool.

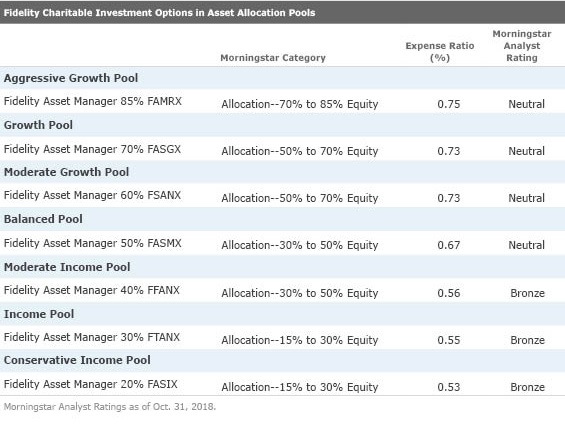

Asset Allocation Pools The asset allocation pools are designed to offer diversified exposure to multiple asset classes in a single investment, with a static, managed target allocation. The seven asset allocation pools correspond to the seven funds in the Fidelity Asset Manager series.

The funds in this series vary in aggressiveness by their allocation to equities. For instance, the Aggressive Growth asset allocation pool invests in Fidelity Asset Manager 85%. As you might imagine, this fund has close to 85% of its assets in equities (domestic and foreign, in a 70%/30% ratio in all funds in the series) and the balance in bonds (12%) and cash equivalents (3.5%).

As you work your way from most aggressive to least aggressive, the pools decrease their allocation to equities. The most conservative option, Fidelity Asset Manager 20%, has around 20% in equities, 46% in bonds, and 34% in cash equivalents. The funds with the higher allocations to equities are more appropriate for investors with longer time frames.

Jeff Holt, associate director of multiasset strategies, says the funds in the Asset Manager series rely mostly on active underlying strategies, and the bond strategies inspire more confidence than the equity ones. The same team that manages Silver-rated

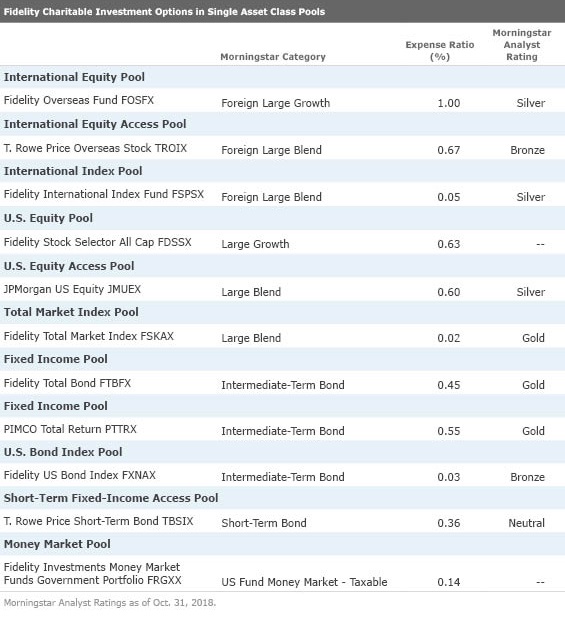

Single Asset Class Pools Fidelity Charitable also offers single asset class pools that feature actively managed options (both in-house and from other asset managers) and Fidelity index funds. These pools can be used in combination by investors who prefer to be more hands-on with their investment selection and allocation recommendations.

Impact Investing Pool

The third pool is what Fidelity calls the impact investing pool; it comprises

Though it excludes some of Russell 3000's heavyweights, such as

Charitable Legacy Pool Lastly, donors who have an account balance of more than $50,000 can choose the charitable legacy option, which Fidelity describes as being "similar to an endowment" in that donors with high account balances can recommend grants equal to the appreciation of the investment pool while preserving the principal.

The charitable legacy portfolio is made up of more than 40 funds, with allocations to equity (45%)--split among U.S. (17%), international (20%), and emerging markets (8%)--and fixed income (26%), with 11% in investment grade, 5% in high-yield, 3% in non-U.S. investment grade, 3% in emerging-markets debt, and 4.5% in inflation-protected bonds. The portfolio also has a 14% allocation to "real assets"--commodities, REITs, and natural resources equity funds--and 14% in absolute return funds. (See the portfolio here.)

The net expense ratio for the charitable legacy portfolio is 0.94%, which doesn't include the annual administrative fee, which is 0.6% of your account balance with fee breakpoints starting at balances over $500,000.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)