When to Use Charitable Remainder Trusts

Under the right circumstances, you’ll be doing right for the client and a good cause.

The purpose of a charitable remainder trust, or CRT, is to provide a benefit to the donor (income for life) and charity (distribution at death) while receiving an immediate charitable tax benefit.

Before we get into CRT strategy, let’s begin with a basic definition. A CRT is a trust that:

- Is funded with cash, securities, or other property.

- Will provide ongoing income to the donor for life (or a period of years).

- At death, distributes to charity any amount remaining in the trust.

Funding CRTs can be funded with cash, securities, or other property. In general, an operating business cannot be owned by a CRT (due to the "unrelated business" tax rules). For tax purposes, the initial funding is valued at fair market value. Obviously, cash value is dollar for dollar. Traded securities are valued at stock market value at contribution date. Other property, such as shares in a closely held business or rental property, require an appraisal.

It should be noted that initial appraised value could differ from the selling price of the property. For example, let’s say that 20% of a closely held company is contributed to a CRT on June 15, 2017. The company is sold on Aug. 1, 2017, for $5 million. Thus, the CRT receives $1 million. Although the shares are sold almost immediately for $1 million, the appraised value on June 15 would likely be lower because of valuation discounts, including:

- Discount for lack of marketability.

- Discount for minority interest.

- Discount for small-company risk.

Therefore, it is possible that the appraised value at funding could be much lower than $1 million. Beware: When contributing securities or property that will be sold, it is imperative that the CRT be set up and receive ownership before a transaction deal has been agreed upon. If the deal has been agreed upon before contribution to the CRT, the owner will recognize the income.

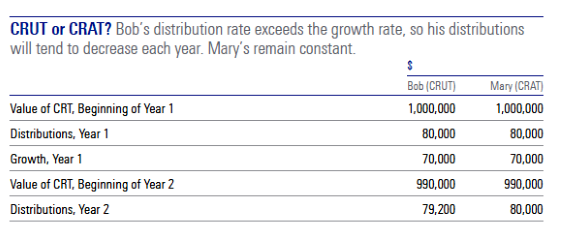

Ongoing Income Most CRTs are set up to provide income to the donor for life, although it is also possible to specify a number of years. The income distributions can be based on a fixed percentage of beginning of year values (charitable remainder unitrust, or CRUT), or a fixed dollar amount (charitable remainder annuity trust, or CRAT). For example, let's assume that two CRTs have a value of $1 million each on Jan. 1, 2018. The CRTs grow at a rate of 7% per year. Bob's CRT is a CRUT, and he has chosen to receive distributions of 8% per year. Mary's CRT is a CRAT, and she has chosen to receive $80,000 per year. Based on these assumptions, distributions for Bob and Mary are shown in the exhibit below.

Because the distribution rate exceeds the growth rate, Bob’s distributions will tend to decrease each year, while Mary’s remain constant.

Thus, choosing distribution rates and type of trust is key to accomplishing the goals of the donor.

Remainder to Charity When the income beneficiary passes away, whatever is left in the trust is distributed to charity (remainder beneficiary). The remainder beneficiary can be one or more charitable organizations. Note that:

- The CRT is irrevocable so that the remaining principal must always go to charity.

- Depending on how the trust is written, it is possible to change charitable beneficiaries during the donor's lifetime.

When CRT income distributions exceed the trust’s earnings, the charitable beneficiaries will receive less than the original CRT value. Conversely, when CRT income distributions are less than trust earnings, the charitable beneficiaries will receive more than the original CRT value.

Investments From a fiduciary standpoint, CRT investments must consider the fact that there are two beneficiaries: the income beneficiary and the remainder beneficiary. Thus, investments can't be managed solely to produce income, nor can they be managed solely for appreciation. A typical investment allocation for a CRT is 60% equities/40% fixed income.

Tax Consequences The initial funding of a CRT, because it is irrevocable, is considered a gift of two separate interests: the income interest and the remainder interest. If the donor retains the income interest, then that portion is not a gift. However, if the income interest is transferred to anyone other than the donor, the value of that portion is a reportable gift. The value of the remainder interest is a charitable gift.

The IRS has a prescribed methodology for valuing the income interest versus the remainder interest. Essentially, the net present value of the income stream is subtracted from the initial valuation to determine the net present value of the remainder interest.

To qualify under IRS rules, the charitable remainder interest must be at least 10%.

For example, if under the above scenario, Bob is age 60 at the formation of the CRT, the value of the income interest would be about $764,000 and the remainder interest would be valued at about $236,000. Because the remainder interest is greater than 10%, the CRT would qualify for tax purposes and $236,000 would be immediately deductible as a charitable contribution.

When donating securities or other property to a CRT, the full fair market value is taken into account for calculating the charitable remainder interest—even if the cost basis is lower. Additionally, the built-in appreciation is not taxed. This creates a double benefit when contributing appreciated property:

- The donor receives a tax deduction based on full fair market value.

- The donor does not pay tax on the built-in appreciation.

Each year, the income beneficiary will report taxable income from CRT distributions. This income will be reported in priority order as follows:

- Income generated in the trust, including ordinary income and realized gains.

- Unrealized capital gains from initial contributions.

- Return of capital (basis).

Strategy A CRT should be considered when two or more of the following situations exist:

- Need for annual tax-advantaged income.

- High tax bracket.

- Highly appreciated securities or other property.

- Charitable intent.

Let’s consider Matt’s circumstances. Matt is 60 years old and owns a 10% interest in a biotech company that is in the process of negotiating a sale to a large publicly held company. He believes the company will sell for $15 million. His cost basis in the stock is negligible. We will assume that Matt’s combined federal and state ordinary tax rate is 45% and his combined capital gain rate is 25%.

If Matt sells all of his stock for $1.5 million, his tax bill will be $375,000. He will have $1,125,000 remaining, which will be available for investment. If Matt wants to take a “safe” withdrawal rate of 5% per year, his annual pretax cash flow from the investment will be about $56,250.

Alternatively, let’s say that Matt puts 50% of his stock into a CRT, paying out at 5% per year, and that the appraised value at time of contribution is $700,000. Matt will get a charitable deduction of approximately $267,000, which will reduce his tax bill by about $120,000. He will also pay capital gain tax of $187,500 on the remaining $750,000 sold. Thus, his personal investment pool will be $682,500 ($750,000 sales proceeds less $187,500 capital gain tax plus $120,000 tax savings). Assuming stable 5% returns, Matt’s annual cash flow at 5% will be $34,125 from his investments plus $37,500 from his CRT, or a total of $71,625. This is $15,375 (27%) more per year than if he simply sold all of his stock.

Note that although his income stream increases, Matt has irrevocably given up principle of $630,000 ($750,000 put into CRT less tax savings of $120,000). However, Matt is happy with greater cash flow and knowing that his favorite charity will receive money after his lifetime.

Doing Right Advisors should consider suggesting a CRT whenever a client desires annual cash flow, has highly appreciated assets, is interested in charitable giving, or is in a high tax bracket. Advisors will not only be doing right by their client, but they also will be facilitating an eventual gift to a good cause. Of course, advisors and their clients should always work with a qualified attorney to ensure that all legal and tax requirements are met.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)