5 Medalists With 5-Globe Ratings and 'Intent'

For intentional ESG funds, the Sustainability Rating is a reality check.

Investors can use the Morningstar Sustainability Rating in a couple of ways. One is to identify a characteristic of a fund's portfolio: namely, how well its holdings score on a series of material environmental, social, and corporate governance, or ESG, metrics.

A company with good ESG scores is typically one that is managing the various ESG risks it faces, as well as opportunities that may arise from ESG issues, better than its peers. A fund with a Sustainability Rating of 5 globes is one whose overall holdings fare better on ESG metrics than those of 90% of its peers. It is an indicator to investors that a fund's underlying investments have strong sustainability characteristics. The Sustainability Rating allows investors to include sustainability alongside other criteria to evaluate funds.

The Sustainability Rating is not, however, intended to identify a fund that is an intentional sustainable or ESG fund. These are funds that, by prospectus, state that they incorporate environmental, social, and governance criteria into their investment process or indicate that they pursue a sustainability-related theme or seek measurable sustainability impact alongside financial return. The universe of such funds is growing rapidly, as I've noted in previous columns.

For intentional ESG funds, the Sustainability Rating is more of a reality check. These are funds that claim to emphasize ESG factors in their processes but have not been heretofore subjected to independent analysis on whether their portfolios differ meaningfully from those of their nonintentional peers within the same Morningstar Category. For intentional funds, it is not unreasonable to expect a 5-globe rating. In most cases, a 4-globe rating is also perfectly acceptable. A 4-globe rating means the fund's score ranks in the top third of the category. If an intentional fund has a Sustainability Rating of 3 globes or less, however, it's an indication that the fund may not be living up to its intentions or that its approach to sustainable investing is not reflected in the rating. Armed with this information, an investor can and should press management for more information on the fund's approach.

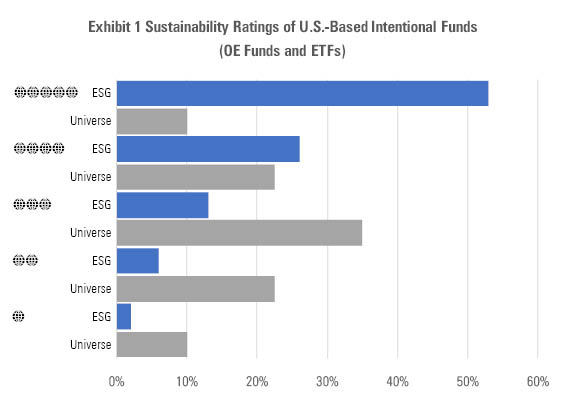

Most intentional ESG funds in the United States do indeed live up to their billing. More than half of those with Sustainability Ratings make it into 5-globe territory. Keep in mind that only the top 10% of funds in a category get the highest rating. Intentional ESG funds, therefore, are 5 times more likely to get a Sustainability Rating of 5 globes. Fully 80% of intentional ESG funds receive Sustainability Ratings of 4 or 5 globes.

Source: Morningstar Direct

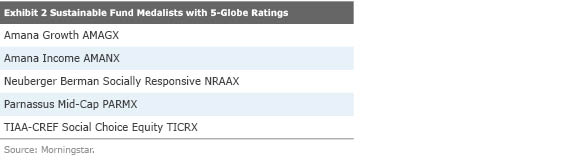

Here are five intentional ESG funds that have Morningstar Sustainability Ratings of 5 globes and also earn analyst medals:

Amana Growth AMAGX

and

Amana Income AMANX.

These Bronze-rated funds, managed by Saturna Capital, are run in accordance with Islamic investing principles. They don't invest in firms that charge or receive interest, and they employ a number of product exclusions that are common in socially responsible investing portfolios. But for the past several years, the funds have also been emphasizing companies with "robust policies in the areas of the environment, social responsibility, and corporate governance" according to their prospectus. Their Morningstar Sustainability Ratings are not only 5 globes, the scores on which the ratings are based rank in the top percentile of the funds' respective categories (large growth and large value). Moreover, both funds have maintained their 5-globe ratings consistently in the past year. Both funds are run by veteran manager Nick Kaiser and his comanager Scott Klimo. Kaiser is a longtime member of Morningstar's Ultimate Stock-Pickers, a list of top managers that our analysts monitor for their stock picks. For Amana Growth, the focus is on stocks with good earnings-growth potential, powered by strong products, while Amana Income features dividend-paying stocks with yields higher than that of the S&P 500. Common to both funds is extremely low turnover and, because of Islamic restrictions, sector concentrations that can sometimes lead to returns substantially different from their large-growth and large-value peers.

Neuberger Berman Socially Responsive NRAAX.

This Bronze-rated fund is among the oldest of the intentional ESG offerings, with comanagers Ingrid Dyott and Sajjad Ladiwala emphasizing ESG issues like workplace diversity, promotion of public health, and good overall corporate citizenship. In contrast with the Amana funds, this one stays diversified across sectors. Its focus is on finding best-in-class ESG companies within industry groups, even those, like oil and gas, that some ESG investors avoid altogether. Theirs is a quality growth strategy, with an emphasis on good growth potential, reasonable valuations, strong balance sheets, and quality management teams.

Parnassus Mid-Cap PARMX.

This Silver-rated fund, from the San Francisco-based boutique firm that has amassed the most assets of any ESG asset-manager, has generated high returns with low risk in the past decade relative to its mid-blend peers. Comanagers Lori Keith and Matthew Gershuny emphasize companies with competitive advantages, product relevancy that's likely to propel continued growth, quality management, and strong ESG performance. The fund has consistently maintained its 5-globe rating for the past year.

TIAA-CREF Social Choice Equity TICRX.

This all-cap indexlike offering emphasizes companies with top ESG ratings, particularly in the areas of labor relations, human rights, and environmental stewardship. A quant team constructs the portfolio to mimic the risk characteristics of the Russell 3000 Index. During the past decade, the Bronze-rated fund's returns have trailed that index by a small margin--15 basis points annualized--and place in the top quartile of the large-growth category. The fund has also maintained its 5-globe rating for the past year.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)