T. Rowe Price Is Managing Change Well

Solid succession planning and a strong analyst bench work in its favor.

This article was originally published in the August 2017 issue of Morningstar FundInvestor.

Earlier this year, Morningstar visited

On the whole, we came away encouraged with how T. Rowe Price has handled personnel changes while retaining the research-focused culture that has long defined it.

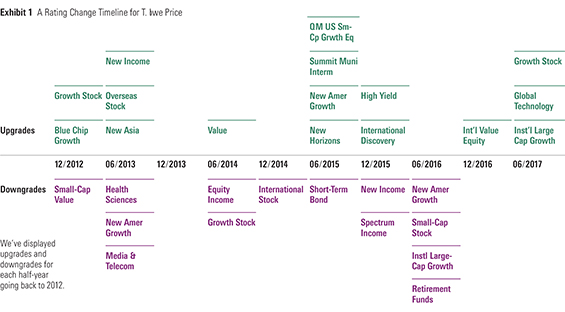

We've illustrated our shifting views on T. Rowe's funds with this graphic depicting upgrades and downgrades in recent years. It was published this summer in Morningstar FundInvestor before International Stock was upgraded.

Strong Analyst Bench Analyst-driven research is key to most T. Rowe Price funds, so a stable, effective team is important. The firm has raised its game in this respect, moving out underperformers and transferring a few analysts internally to bolster its ranks. Following disappointing stock-picking in the consumer discretionary sector, the firm created a new consumer sector lead role (a position that already existed for other sectors) to improve global collaboration, add accountability, and boost team morale. It also transferred an analyst from the high-functioning energy team and hired back someone who'd previously worked at T. Rowe Price to add depth. The business-services team also saw a couple of internal moves. These changes should help T. Rowe's equity team function better, which is critical to fund performance.

The changes haven't been as disruptive as the departures the equity team experienced in 2014, when three members of its healthcare team left to start a hedge fund and T. Rowe Price had to rebuild more abruptly. It's also encouraging that the firm has continued to recruit at top business schools, even as active managers on the whole have faced business pressure with money moving to passive funds. (2016 was the first calendar year that T. Rowe Price saw firmwide net outflows across its mutual funds since 2000, so it has held up better than most active managers.)

With a fair amount of hiring the past few years, the directors of research have worked to effectively bring new hires up the learning curve--especially as some have seen only one type of market (up) in their careers; here, T. Rowe Price's most experienced managers provide meaningful context and mentoring. The firm has also built an admirable associate analyst program that has helped boost stock coverage of small- and mid-cap companies. Some promising associates work exclusively with a portfolio manager, including at

Changing of the Guard, Part One While the equity analyst ranks have stabilized, some managers have retired in recent years. Retirements are inevitable, and at T. Rowe many managers retire in their early 60s. Seeing four retirements announced between 2012 and 2016, then, was simply a matter of timing and didn't signal anything especially alarming about broader firmwide dynamics given the ages of the outgoing managers. Plus, T. Rowe Price handles those transitions smoothly, with significant time for the new manager to work with the departing one.

However, a noticeable changing of the guard has occurred in two areas: small cap and large growth. Preston Athey of T. Rowe Price Small-Cap Value and Greg McCrickard of

Both funds' Morningstar Analyst Ratings were downgraded from Silver: T. Rowe Price Small-Cap Value's Bronze rating is attributable in part to successor David Wagner's tenure on the small-cap team (he'd been associate manager since 2005). T. Rowe Price Small-Cap Stock is rated Neutral as the change is still relatively fresh, and Frank Alonso's history on the small-cap team dates back only to 2013 (he joined T. Rowe as a consumer analyst in 2000).

Still, there are reasons for optimism. T. Rowe Price has expanded its small/mid-cap coverage as the analyst team has stabilized, not only relying on the associate analysts but also adding a few dedicated analyst positions. The newer managers have only recently left the analyst ranks themselves and are engaged with T. Rowe's research team. The incoming managers have worked more closely with the broad analyst team to source new ideas versus using sell-side research. Plus, Wagner and Alonso posted good results at a small/mid-cap strategy available to non-U.S. investors before taking on their new roles. That experience wasn't perfectly analogous to their current roles, given the strategy's much smaller asset base and the small/mid-cap focus, but it at least provided some management experience.

Changing of the Guard, Part Two

Two of T. Rowe Price's three large-growth managers are also new to their roles within the past four years. (Larry Puglia has remained a steady presence at Silver-rated

Along the same lines,

Bigger Picture

In other areas, T. Rowe Price has upped its game. Foreign equity is stronger than it's ever been, with five Analyst Rating upgrades since 2011; as of September, all of T. Rowe's actively managed international-equity funds rated by Morningstar were Medalists.

Overall, T. Rowe Price has shown an ability to sustain itself through changes to its analyst and manager ranks. Since Morningstar first started issuing Analyst Ratings in November 2011 through September 2017, T. Rowe funds experienced 14 downgrades and 17 upgrades, highlighting the firm's ability to handle change and get the right people in the right places despite some key departures.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)