Your 2018 Medicare Open Enrollment Checklist

Contributor Mark Miller explains how to effectively and efficiently re-evaluate your prescription drug or Medicare Advantage coverage.

Don't love everything about your Medicare coverage? Here's your chance to fix it.

Medicare's fall open enrollment period began Oct. 15 and runs until Dec. 7. This is the time when enrollees can re-shop their prescription drug coverage (Part D) or Advantage plans--the managed care all-in-one alternative to traditional Medicare.

Few seniors re-shop their coverage every year. And, if you have traditional fee-for-service Medicare with a Medigap supplemental add-on, there's no need to change that. But if you also have a Part D drug plan, it's a good idea to re-evaluate that coverage. These plans often change their premiums from year to year (more on that below). The Kaiser Family Foundation calculates that for current enrollees who do not change their coverage next year, 73% will see premium increases; among those, about one third will see premiums rise $10 or more per month.

Plans also frequently change their rules for cost-sharing, coverage of specific medications--and even whether a specific drug will be covered.

Meanwhile, many Advantage plans include drug coverage that can change from year to year. And Advantage plans can make changes to their networks of healthcare providers at any time.

Start the decision process by reviewing the Annual Notice of Change that comes in the mail each September. Part D and Advantage plans are required to send these notices, which list any changes in coverage for the year ahead. The notice is not personalized--that is, it doesn't take into account your own list of medications. Instead, it lists changes to premiums, cost-sharing, or the rules under which a medication will be covered next year.

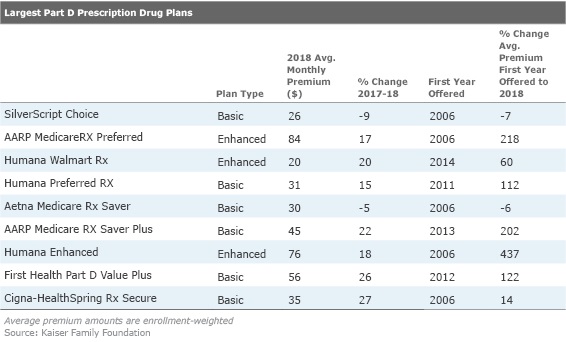

Keep in mind that premiums can change sharply from year to year. Among the top 10 standalone prescription drug plans (measured by enrollment), premiums will rise an average 9% (weighted by enrollment) next year, according to the Kaiser Family Foundation. But the average premium for the largest plan, SilverScript Choice, will be down an average of 9% next year. Meanwhile, the second- and third-largest plans will see average premiums jump sharply--17% for AARP Medicare RX Preferred, and 20% for Humana Walmart Rx.

And if you haven't evaluated your coverage in a while, consider how much premiums change over the years. The AARP Medicare RX Preferred premium has risen 218% since the plan's launch in 2006, for example. Humana Enhanced is up a whopping 437% since 2006.

When evaluating premiums, keep in mind that these will vary depending on whether you pick a basic or enhanced plan. Basic plans come with a gap in coverage, often called the "donut hole," where the beneficiary must pay out of pocket after reaching a cap. In 2018, the number is $3,750, and coverage resumes when total out-of-pocket spending reaches $5,000. Under the Affordable Care Act, costs borne by enrollees inside the donut hole are shrinking gradually. In 2018, enrollees who fall into the gap will receive a 65 percent discount on brand-name drugs (up from 60 percent this year). The discount on generics will rise from 49 percent to 56 percent.

Enhanced plans come with higher premiums; they usually come with lower deductibles and offer some coverage in the donut hole.

These coverage differences help account for the wide variations in premiums. Among the top plans next year, you can spend as little as $20 per month, or as much as $84 per month.

Seeing the Big Picture When you evaluate plans, keep in mind that premiums alone don't tell the whole story. Also consider their cost-sharing features.

In the early years of Part D (the program began covering enrollees in 2006), plan structure was fairly simple.

"You might see a $10 cost-sharing amount or co-pay for a generic drug, and $50 for a brand drug or a specialty tier," says Juliette Cubanski, associate director of the program on Medicare policy at the Kaiser Family Foundation. "Then they started dividing tiers into preferred and nonpreferred generic and brand drugs and specialty tiers," she adds. "And now we've seen them moving to a mix of both copays for some tiers and co-insurance for other tiers."

Copays are flat amounts, while co-insurance is a percentage of total cost. That means some high-cost, specialty drugs could generate sizable out-of-pocket expenses.

Don't focus on the wrong things when you shop. Many focus only on the premium, and not projected total costs, says Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center, a nonprofit consumer advocacy group. Further, don't pick a plan simply because you're familiar with the plan provider--or because a neighbor, friend, or relative has bought it.

"What's right for you is not necessarily what's right for your neighbor, or for your spouse," she says.

Higher Income? You'll Pay More The premiums shown on the plan finder will not reflect your costs if your modified adjusted gross income is above $85,000 (single filer) or $170,000 (joint filers). Medicare enrollees with income exceeding those levels for their 2016 tax returns will pay income-related premium surcharges in 2018. These will range from $13.00 to $74.80 in 2018 (depending on their income level). High income surcharges will impact 7% of Medicare enrollees next year. (Surcharges also are tacked onto Part B premiums.)

If you enrolled in Medicare late, you'll also pay more for Part D (and Part B).

The high-income surcharges are pegged to five brackets. Starting in 2018, beneficiaries in the higher brackets will shoulder a higher percentage of their total Part D (and Part B) costs. The new formula will impact enrollees with a modified adjusted gross income above $133,500 ($267,000 for married couples). For more details, see this analysis from the Kaiser Family Foundation.

Do-overs If you enroll in a Medicare Advantage plan and are not satisfied with the coverage, you can use the Advantage Disenrollment Period, which runs from Jan. 1 to Feb. 14 to change your coverage. During this time, you can switch to traditional Medicare and add a Part D drug plan, even if your Advantage plan did not include drug coverage, according to the Medicare Rights Center. Find more details on special enrollment and disenrollment periods here.

How to Shop Your starting point is the Plan Finder on the Medicare website. Plug in your Medicare number and drugs (you will need each drug's name and dosage). The plan finder then displays a list of plans that match your needs, including their estimated total cost (premiums and out-of-pocket expenses); which drugs are covered; and customer-satisfaction ratings. The finder also advises on drug utilization and restrictions.

If your drug needs are complicated, a range of expert help is available.

State Health Insurance Assistance Programs provide free counseling on coverage options. All 50 states have these programs; click here to find yours. The Trump administration and congressional budget writers have proposed to eliminate them, but any cuts, if they do come at all, will not affect this fall's enrollment season.

The Medicare Rights Center also offers free counseling by phone (1-800-333-4114).

If you are willing to pay to obtain expert help with plan selection, hire an independent, fee-based counseling service such as Allsup Medicare Advisor or Goodcare. For a few hundred dollars, these firms will provide a written, personalized plan analysis and offer phone consultations.

Finally, enroll in plans by calling Medicare (1-800-Medicare) rather than calling the plan provider. This creates an independent record of what you have purchased in case problems surface with your coverage later on.

Morningstar columnist Mark Miller is a nationally-recognized expert on trends in retirement and aging. He also contributes to Reuters, WealthManagement.com and The New York Times. His forthcoming book, Jolt: Stories of Trauma and Transformation, will be published in February 2018 by Post Hill Press.The views expressed in this article do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)