Proposed Tax Changes Could Make 529s More Flexible

The Boost Saving for College Act could entice more people to contribute to 529 plans.

Some proposed changes to tax legislation were recently introduced that could make 529 accounts more flexible. These changes could also help make college saving easier and more affordable for low- and middle-income households.

The Boost Saving for College Act, which was introduced by Sens. Richard Burr, R-N.C.; Bob Casey, D-Pa.; and Lisa Murkowski, R-Alaksa, would amend the Internal Revenue Code to modify the tax treatment of 529 plans. Here's a look at how some of the proposed changes would work, and their implications for 529 account holders.

The Saver's Credit One proposed change is that 529 contributions would be eligible for the Saver's Credit.

This proposed credit would go a long way toward helping lower- and middle-income households contribute to a 529 college savings plan, said the chair of the College Savings Plans Network, Alabama state Treasurer Young Boozer.

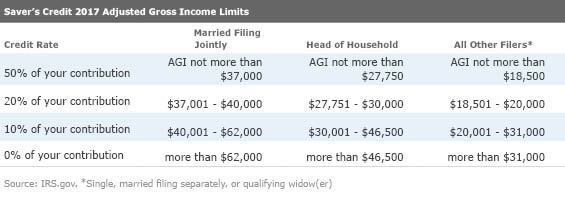

Currently, the Saver's Credit works like this: You might be eligible for at least a partial credit if you earn less than $31,000 (less than $62,000 if you're married filing jointly) and contribute to a tax-sheltered retirement account, such as an IRA, 401(k), 403(b), or 457(b). Aftertax contributions such as a Roth IRA or aftertax 401(k) also count, but rollover contributions are not eligible for the credit.

The amount of the credit is 50%, 20%, or 10% of your retirement plan or IRA contributions up to $2,000 ($4,000 if married filing jointly), depending on your adjusted gross income (reported on your Form 1040 or 1040A).

I find this tax credit a little difficult to understand, so here is an example: Say you and your spouse each contribute $1,000 ($2,000 in total) to an employer-sponsored retirement plan. Your combined income is $35,000. You would be eligible for a $1,000 tax credit (50% of $2,000).

Here's how it would change under the proposed legislation: Using the example above, let's say you also contribute $2,000 to a 529 plan you set up for your daughter. You are now entitled to take the maximum $2,000 credit: 50% of the $2,000 401(k) contribution plus 50% of the $2,000 529 contribution, for $2,000.

Remember that credits reduce your tax liability dollar for dollar, down to zero. (You can't take any excess credit as a refund.) Deductions, on the other hand, reduce your taxable income.

Employer Contributions Another aspect of the proposed amendment relates to employer contributions. Currently, any contributions employers make to their employees' 529 plans are subject to income tax, because unlike 401(k)s, 529s are funded with aftertax money.

A proposed change would allow the first $1,000 of employer matches per year to be excluded from your gross income, which means you wouldn't be taxed on it.

Roth IRA Rollover A third proposed change would allow you to roll over any unused 529 savings into a Roth IRA account, which would provide additional flexibility for the saver.

If the account beneficiary decides not to go to college, or if (by some miracle) college doesn't cost as much as you anticipated, what do you do with excess 529 savings? Under the current law, if you withdraw 529 funds for any purpose besides qualified educational expenses, the earnings are subject not only to ordinary income tax, but also to a 10% penalty.

If your child wins a scholarship, you can deduct the funds up to the amount of the tax-free scholarship from your 529 account penalty-free, though you would still owe income tax on the earnings portion.

Currently, your best course is to hold excess funds in the 529 account in case the beneficiary decides to use it for graduate school, or roll the unused 529 funds over to the 529 account of a family member of the beneficiary. (The rules on what constitutes a family member are extremely flexible, including siblings, parents, spouses, in-laws, stepparents and stepsiblings, and even first cousins.)

For some, though, this isn't flexible enough and is a deterrent to saving large amounts (or in some cases, any amount) in a 529 plan. As previously mentioned, the Boost Act would allow unused funds in a 529 plan to be rolled over into a Roth IRA. The rules regarding Roth IRAs are more flexible: You can withdraw as much as you want and use the funds however you would like provided you are 59 1/2, though special withdrawals are allowed for first-time home purchase or in the event that you become disabled before age 59 1/2. Tax-free, penalty-free withdrawals of contribution amounts are also allowed with Roth IRAs prior to age 59 1/2; with 529s, not only will you likely pay the 10% penalty, you will probably also be on the hook for taxes as well because nonqualified withdrawals are prorated between your principal contribution and your gain.

Under the proposed legislation, in order to do a Roth IRA rollover the funds must have been in the 529 plan for at least 10 years. Similar to the somewhat-complicated rules surrounding a "backdoor" Roth IRA conversion, the 10-year minimum holding period is likely there to prevent higher-income investors from using 529s simply as a pass-through vehicle into a Roth IRA, which have both income thresholds and contribution limits.

The chances of the proposed Roth IRA rollover being used as a way station rather than a college-savings vehicle are slim in Boozer's opinion, as the average account balance in 529 accounts is simply not that high. In most cases, all of the funds in the 529 account will be exhausted simply paying for college expenses, he said.

ABLE Account Rollover The final aspect of the bill is extremely straightforward, in my opinion: It would let families with a disabled child to roll a traditional 529 account over into an ABLE account, which is a tax-favored way to save for the needs of a person with a disability. It is built on same the legal framework as 529 college savings plans, and it works in a similar way. Contributions are made with aftertax dollars to a plan with a preset menu of investment choices. Earnings compound on a tax-free basis, and withdrawals to pay for qualified expenses are tax-free, too.

ABLE account eligibility is limited to individuals with significant disabilities, the onset of which occurred before the individual turned 26 years old. ABLE accounts also have a broader set of qualified expenses including education, housing, healthcare, employment training and support, and legal fees.

Individuals' needs and circumstances change throughout their lifetimes, often in ways we can't anticipate. The proposed ABLE account rollover would provide families with additional flexibility in the event that a 529 account beneficiary is diagnosed with a disability or becomes disabled as a result of accident or injury.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)