Northern Trust's ETF Business Is Off to a Good Start

The bank is on the right path.

Most of its business comes from institutional clients, which represent about three fourths of the firm's assets under management. The firm was a latecomer to the exchange-traded fund industry, launching its first ETFs in 2011 under its FlexShares brand. Its ETF business has grown to $15 billion in assets, representing a small part of the entire firm.

As an ETF sponsor, Northern Trust employs a thoughtful product development process and has yet to liquidate or merge any of its ETFs. Northern Trust's wealth clients are a captive audience that provide a relatively stable runway for new ETF products, allowing the firm to be patient and selective in terms of new product launches. Competitors without captive audiences must gather assets quickly otherwise they must close unprofitable products.

Compared with other fund providers, Northern Trust falls short in a few areas. First, the firm hasn't yet established a track record of consistently executing its stated strategy, especially in the ETF arena. Second, the investment team's portfolio manager retention rate is relatively low. Third, the team's compensation scheme is not clearly linked to index-tracking performance. Morningstar assigns Northern Trust a Parent rating of Neutral.

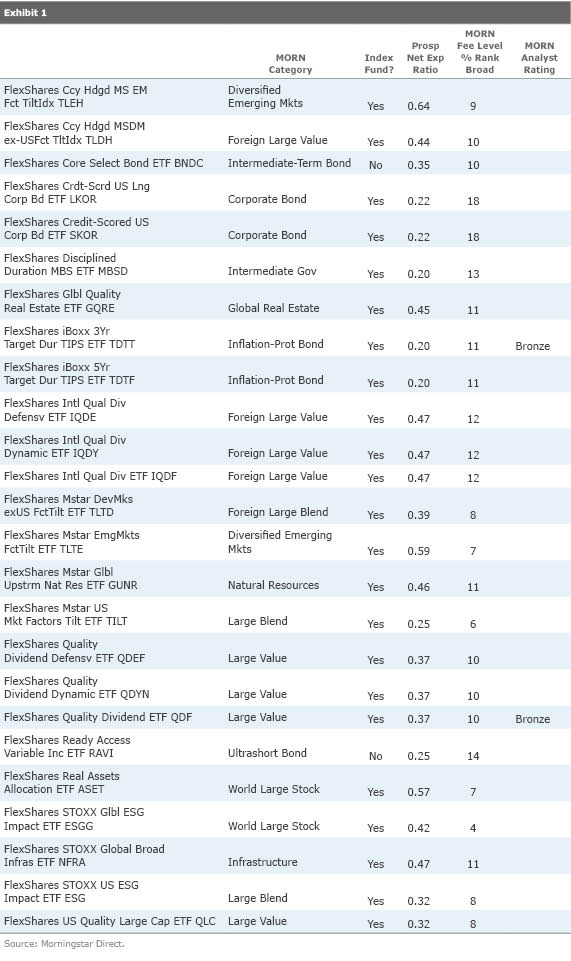

Product Strategy Northern Trust's FlexShares product line, shown in Exhibit 1, clearly embodies the firm's core strategy, which is covering niche, non-market-cap-weighted strategies that do not overlap with large incumbents such as BlackRock iShares, Vanguard, and State Street. 23 of FlexShares 25 ETFs track newly created indexes. About a half of the indexes were created in-house, and the other half come from third parties such as Morningstar.

Exhibit 1 shows the fee schedule of FlexShares products. It is apparent that the company does not attempt to be the lowest-cost provider; rather it focuses on differentiated, non-market-cap-weighted products that allow it to charge higher fees. The firm will not venture into areas where there are dominant players that have amassed sizable assets under management, and it eschews plain-vanilla building-block products.

Product development ideas typically come from surveying internal and external clients in an attempt to identify the shortcomings of competitor's products. Ideas must be supported by empirical evidence backed by sound economic theory. The firm's five-year capital markets forecast also helps it identify opportunities and influences product development. For example, the firm concluded that low interest rates and demand from income-oriented investors seeking alternatives to low-yielding fixed-income securities would likely persist. This view led to the launch of

Some of the ideas have been rejected in the past. Examples include short-term and seven-year Treasury Inflation-Protected Securities. Seven-year TIPS issuance are too scarce to make the product duration work. Also, short-end TIPS are too volatile to make the product economical owing to high transaction costs. As of this writing, Northern Trust offers two inflation-protected ETFs:

In addition to ETFs, the firm also offers mutual funds and separately managed accounts. As of this writing, the firm's open-end fund suite includes 39 strategies with $54 billion in net assets. The FlexShares unit is integrated into the firm's large asset management business, and the same investment team manages both open-end and ETF mandates. The portfolio management team scores low in their performance, fee level, compensation scheme, and manager retention rate.

Northern Trust's open-end funds generally charge more than their peers yet produce middle-of-the-road returns. On average, fund fees rank in the 20th percentile of their respective Morningstar Categories. Also, there are only five funds that have achieved first quartile five-year trailing absolute returns through September 2017. During the same period, about 40% of all Northern Trust open-end funds generated below category average performance.

Manager retention is also an area for improvement. As of September 2017, the five-year retention rate was 75%. This figure is low compared with other leading fund companies that boast a 90% or higher rate. It appears as if the stable asset base from the wealth channel is serving as a disincentive for the firm to invest heavily in the portfolio management team. Also, the compensation structure for ETF mandates can be improved by explicitly incorporating risk measures such as tracking error to better align the interests of investment personnel and ETF investors, which is a common practice at other leading index providers.

Conclusion Thanks to its captive audience of wealth clients, Northern Trust is not pressured to quickly gather assets, allowing it to be patient with new strategies. And it has been responsible with the types of products it brings to market. It is encouraging that since its 2011 entrance to the ETF space, it has not closed a single product. That said, the firm is still in the process of executing its selective ETF launch strategy and enormous fee pressure from all directions largely remains. Also, the fund's open-end fund business is facing headwinds both from its high prices and lackluster returns. The company must address the low portfolio manager retention rate to serve investors better. Overall, the firm is on a right path, but it has more to do to become an exemplary steward of investor capital.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)