10 Cheap Stocks With Enviable Yields

These high-quality dividend payers are trading at discounts to our estimates of their fair value.

In September, we made some changes to the Morningstar Dividend Yield Focus Index.

Our Dividend Yield Focus strategy examines both backward-looking and qualitative forward-looking measures to find high-yielding stocks that are financially healthy enough to sustain their dividend.

We first screen the Morningstar US Market Index for dividend-payers. (The dividend must come from qualified income, so real estate investment trusts are not included.) We then apply the quality screens: We search the high-yielders for companies that have Morningstar Economic Moat Ratings of wide or narrow, meaning that we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's Morningstar distance to default ratio, a metric that uses market information and accounting data to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). See the current holdings here.

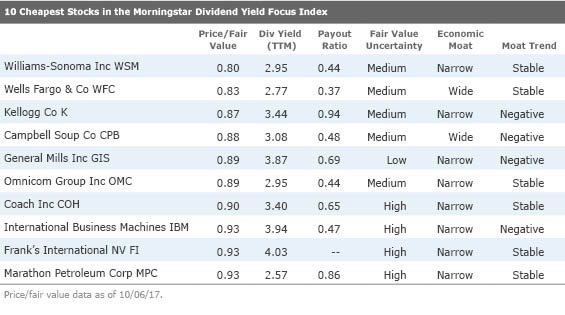

10 Cheapest Stocks in the Index The following 10 stocks are currently the cheapest in the index terms of price/fair value. (We assign a fair value only to those stocks under our coverage; 82% of the index comprises stocks that are under coverage.)

My interest was piqued in particular by three consumer defensive stocks:

The last time General Mills traded at this big a discount to our fair value estimate was 2008; the stock spent most of 2016 trading in an overvalued range relative to our fair value. Lash believes General Mills possesses a narrow economic moat.

"Operating as a leading packaged food manufacturer with around 30% share of the domestic ready-to-eat cereal aisle, 70% share of refrigerated baked goods, and more than 40% share of grain snacks, General Mills is a valued partner for retailers," said Lash.

Similarly, Kellogg also boasts a strong competitive position, but recent results have been tepid. Lash believes that demand will continue for trusted manufacturers like Kellogg that supply products across multiple categories, including cereal, snacks, and frozen items, as retailers are reluctant to risk costly out-of-stocks with unproven suppliers.

Campbell Soup boasts a wide moat with its iconic brand and nearly 60% share of the soup aisle. Campbell gains a particularly strong cost edge from its global distribution network. The soup manufacturer has generated returns on invested capital (including goodwill) of 18% on average, in excess of our 7% cost of capital estimate in the last 10 years, Lash said, and she expects the firm will continue generating excess returns.

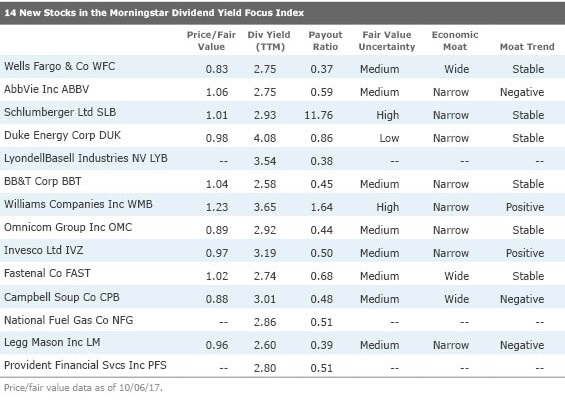

New Dividend-Payers in the Index In the table below, we show the newest entrants to the Dividend Yield Focus Index that pass our strict requirements for high yields, sustainable competitive advantages, and financial health. Note that the dividend yields listed below are backward-looking and could change.

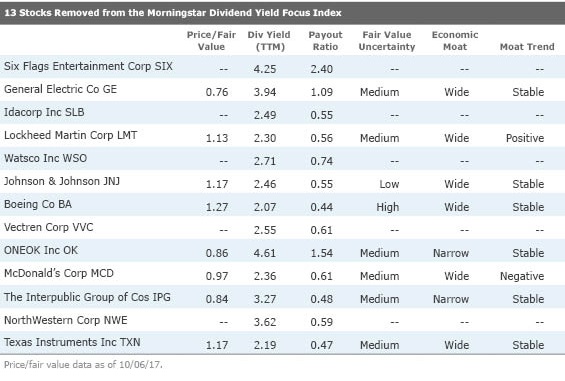

Stocks Removed from the Index

On the flip side, 13 companies were removed from the index. We removed only 13 stocks during the latest reconstitution because index holding Reynolds American stopped trading in late July when it was acquired by

No companies were removed owing to changes in the moat rating or fair value uncertainty rating during the most recent reconstitution.

Six companies--Idacorp IDA,

The other seven companies were removed because the company's distance to default ratio crept into a range that we weren't comfortable with.

Distance to default is another other safety-oriented metric that we use to build the index. True to its name, it's focused on financial health. Distance to default uses option-pricing theory to measure whether a firm is falling into financial distress. It's gauging whether the value of a company's assets will fall below the sum of its liabilities. If a company is in distress, the dividend is at risk and there's trouble ahead. So, like moat, distance to default is another important screen for this index. (Read more about distance to default here.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Correction: An earlier version of this article stated "82% of the index comprises stocks that are not under coverage." This has been corrected to say "82% of the index comprises stocks that are under coverage."

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)