5 Small-Cap Funds With Room to Run

I sought out funds that are below the median point at which small-cap funds close.

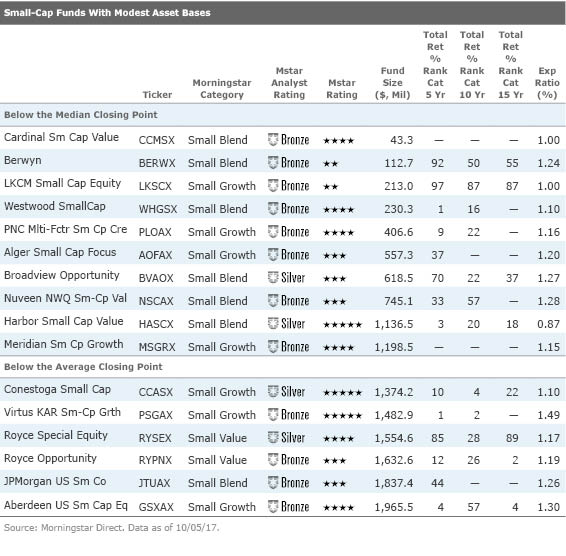

In my last column, I wrote about the levels at which funds typically close to new investors. This time out, I thought I'd share some funds that pass those size hurdles. You may recall that the median small-cap fund closed at $1.3 billion and the average was $2.2 billion.

In the table below, I list funds with total asset bases below the median closing point and below the average closing point. All of them are Morningstar Medalists.

I'll share a few thoughts on the subset of funds that are below the median and available through No Transaction Fee networks.

The fund returned 8.6% annualized from its 2005 inception through September 2017. That topped the peer group's 7.6% annualized return but was a hair behind the 9.1% return for Russell 2000 Growth Index. However, the fund looks even better on a risk-adjusted basis, as it has had above-average returns with below-average risk. The fund charges 1.16% for its A shares.

Best of the Rest

There are two very appealing Silver medalists in the second group of NTF-available funds that are above the median closing asset level but below the average closing point.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)