The Odds for Active Management -- European Funds Version

The U.S. experience is the rule, not the exception.

Europe's Tale Morningstar's Ali Masarwah and Julien Roueche did some research on the performance of actively managed European funds. How likely were they to outgain their costless benchmarks? What was the effective of survivorship? Finally, how important were their costs? One man's work being another man's column material, let's see what Ali came up with. (And thank you, sir.)

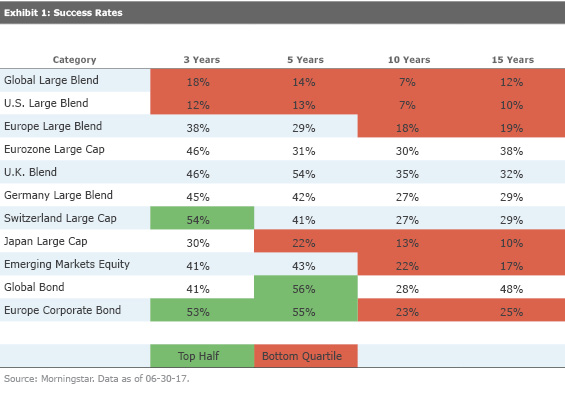

The simplest way to judge the success of a group of actively managed funds is to see how many beat the competing index funds—a calculation that Morningstar calls the Success Rate. The Success Rate ignores volatility, but as most actively run funds are roughly as risky as their relevant index funds, the shortcut doesn’t much affect the result. And it makes for easy interpretation. If the score is above 50%, that group of funds justified their existence. If not, they did not.

Such an approach, it is true, plays fast and loose. It may be that 49% of a group's funds thrashed their benchmarks, while the 51% that trailed barely did so.

However, for the purposes of this column, Ali and Julien's numbers suffice. We seek not the precise appearance of European-based active funds, but rather the general outline. The relevant question: At first glance, to a reasonable level of accuracy, do the results for the European funds seem to match what we have seen in the United States?

Success Rates The answer is yes, they do.

Across the sprawling European market, covering thousands of funds, the picture was consistent. Most actively managed funds lagged (or expired) the index funds over the trailing three years, more yet for five years, and more yet for the 10- and 15-year periods. This occurred with stock funds and with bond funds. It affected highly diversified funds, and it affected country funds.

I tried my best with the color scheme. Categories were shaded green for landing anywhere in the top half; all those that managed the feat did so only modestly, and were not near the top quartile. Meanwhile, categories were coded as red only if they finished in the bottom quartile. What could be more generous than that? Even so, there is distressingly more red than green on that table.

Faring worst were those funds that invest in U.S. stocks, which had a 12% Success Rate for the trailing three years, dropping to a pitiful 7% over a decade. That supports the popular idea that the U.S. stock market has become abnormally efficient, thereby reducing the opportunity for active investment management. It also indirectly praises the quality of American fund managers, at least when it comes to selecting their own country's stocks, because while disappointing, the scores for U.S.-based active stock funds aren't that bad.

That said, the conclusion seems inescapable: The argument for indexing is broad indeed. For quite some time, the argument by active-management proponents has been to concede that indexing works well for some investment types, in some markets, but to deny the tactic’s universality. The active versus passive analysis varies by place and time, they respond.

Not much, it doesn’t. As we have seen, evidence that the Success Rate pattern is consistent extends across asset classes and geographies, and among those portfolio managers who practice their craft in the U.S. and those who work in Europe. So much for variance by place. As for time, it is true that this study only has a single endpoint. However, its results hold across various starting points, and they also resemble those seen across the U.S. markets on many occasions.

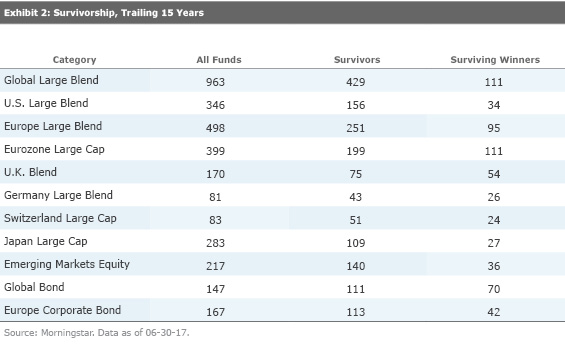

Surviving the Day The Success Rate measure gives funds but one way to win, and two ways to lose. They can miss by completing the time period, but having insufficient returns; or they can forfeit because they close up shop before the time period ends. Perhaps it is too harsh to count both paths as failures. After all, while we assume that funds are liquidated because they are performing badly, we don't know that to be the case. Perhaps some actively managed funds were performing respectably when they were axed.

Perhaps. The point remains, the odds were daunting for the active-fund investor who wished to buy a fund and forget about it. Here are the raw survivorship totals for each category.

To cite one particularly grim example, of the 283 Japan funds that began the 15-year period, only 109 ended that period still intact. Of those 109 survivors, three quarters trailed the index fund, with only 27 funds completing the time period and returning above the index fund. Could you have identified those relatively few winners ahead of time? If not, and you held one of the 174 funds that liquidated along the way, would you have known to reinvest those proceeds into one of those 27 funds?

I suspect probably not.

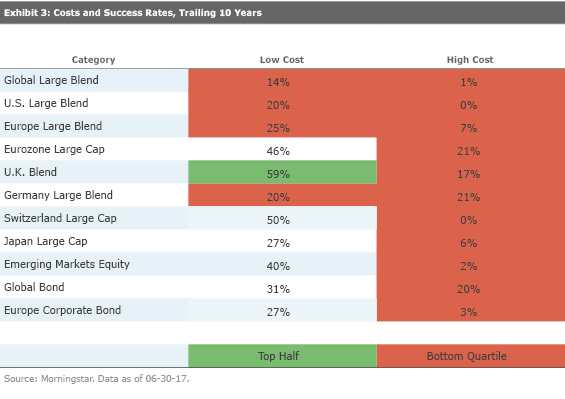

More Costs, Less Value By now, most investors have learned that with mutual funds, unlike many other purchases, we don't get what we pay for. Rather, we get what we don't pay for. That holds true for European-based funds as well the domestic varieties. Buying funds that are among the cheapest quintiles of their investment categories doesn't alter the active-management math—but it does improve it, sometimes substantially.

Meanwhile, the penalty for taking the opposite approach was dire indeed. With two categories, U.S. stocks and Swiss stocks, not a single fund from the most-expensive quintile succeeded over the past decade. That is, not one high-cost fund finished the decade intact, and with total returns that outshone that of its benchmark index fund. With most of the other categories, the Success Rate for high-cost funds didn’t reach double digits.

Which brings us to the closest the mutual fund industry comes to offering a sure thing. Here or there, now or later, buying an expensive actively managed fund will almost certainly prove a mistake. Doing so is akin to taking a blackjack card while holding a 10 and a seven (and the dealer holding the same). The decision will on occasion work out—but it will always have been the wrong call.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)