Morningstar's Take on the 3rd Quarter

Geopolitical rumbles and natural disasters couldn't keep stocks down in the third quarter.

Stocks continued to climb during the third quarter as escalating tensions with North Korea, a series of devastating storms, and the Fed's announcement that it would begin to normalize its balance sheet didn't dent the market as investors focused on the prospects of lower corporate tax rates. The broad-based Morningstar US Market Index rose 4.5% in the quarter and has risen over 14% year to date.

Morningstar's analysts have provided an in-depth review and outlooks across equity sector, fund categories, and the broader economy. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Stock Market Outlook China Rebalancing Presents Winners and Losers China's economic rebalancing means an overvalued basic materials sector, but consumption growth creates opportunities in areas such as telecom.

Stock Sector Outlooks Basic Materials: Valuations Propped Up by Shaky China Fundamentals With China's credit growth slowing, we continue to expect mined commodity prices in general, and particularly iron ore, to fall materially and for share prices to follow.

Communication Services: Smaller Rivals Call the Shots in U.S. Wireless The AT&T-Verizon duopoly is being undermined at the margin by T-Mobile and Sprint. Plus, the French telecom market has stabilized.

Consumer Defensive: Valuations More Reasonable After Third-Quarter Retreat Risks to traditional business models remain from e-commerce and retail bifurcation.

Healthcare: Stock Selection Key as Valuations Rise Valuations in the healthcare sector in aggregate look fair, increasing the importance on stock selection where innovation and redeployment of capital weigh heavily.

Financial Services: Banks Can't Rest Easy The macro economy remains generally benign, but banks continue to strive for increased operational and capital efficiency.

Energy: All Roads Point to Oversupply in 2018 Nothing is certain in the world of oil, but a crude awakening for energy investors could be near.

Consumer Cyclical: Tepid Mall Traffic Could Constrain the All-Important Holiday Season Retailers realize foot traffic is declining, but reactions have largely failed to return performance to historical growth levels.

Real Estate: Enter With Caution REITs appear fairly valued on average, and some rockiness could be on the horizon, but opportunity exists within certain asset classes.

Industrials: Worldwide Growth Is Resilient, but Valuations Look Full Despite a general premium to our fair value estimates in the sector, we still see several opportunities for investors.

Utilities: Valuations Still Running Out of Control Even the outlook for tightening monetary policies worldwide can't stop utilities from reaching near-record valuations.

Mutual Funds Third Quarter in U.S. Stock Funds: Steady as She Goes It was a relatively calm quarter for domestic-stock funds.

Credit Market Insights A Solid Quarter for the Bond Markets A brief bout of volatility kept interest rates low this quarter, while ongoing healthy corporate fundamentals supported corporate credit spreads.

Private Market Insights Private Equity Outlook: Larger Funds, Larger Deals As investors deploy large reserves of capital into a market with elevated prices, deal sizes have climbed to decade-highs.

Venture Capital Outlook: Exits Come Into Focus as Valuations Continue to Climb Availability of funds for VC-backed companies pushes out exit timelines and encourages alternative liquidity.

Data Report

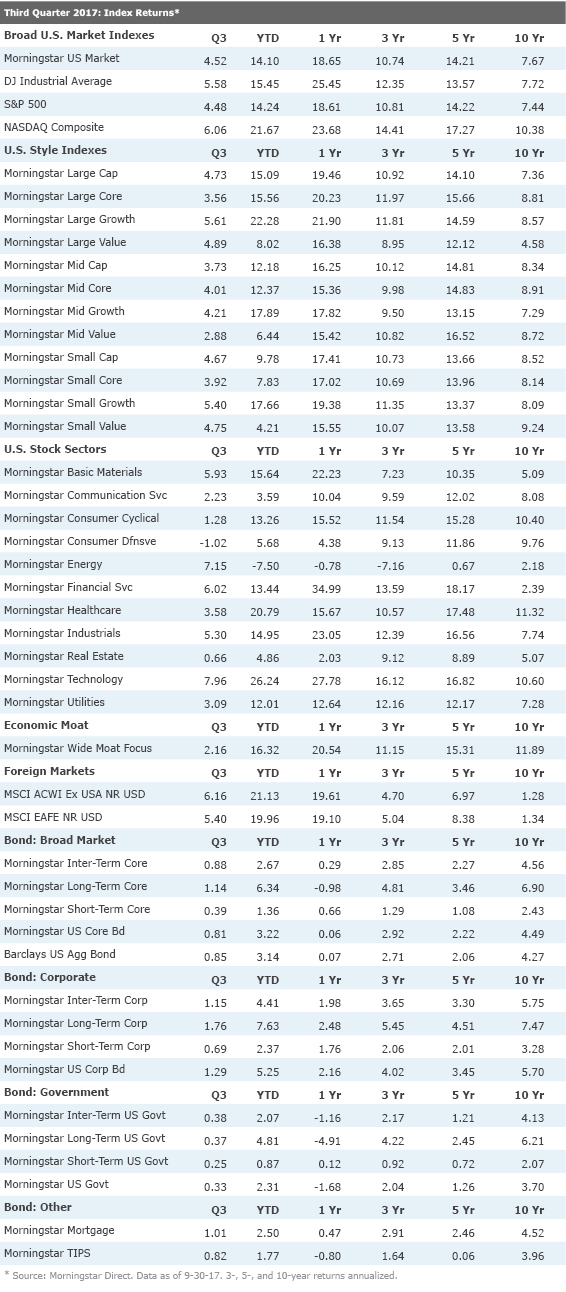

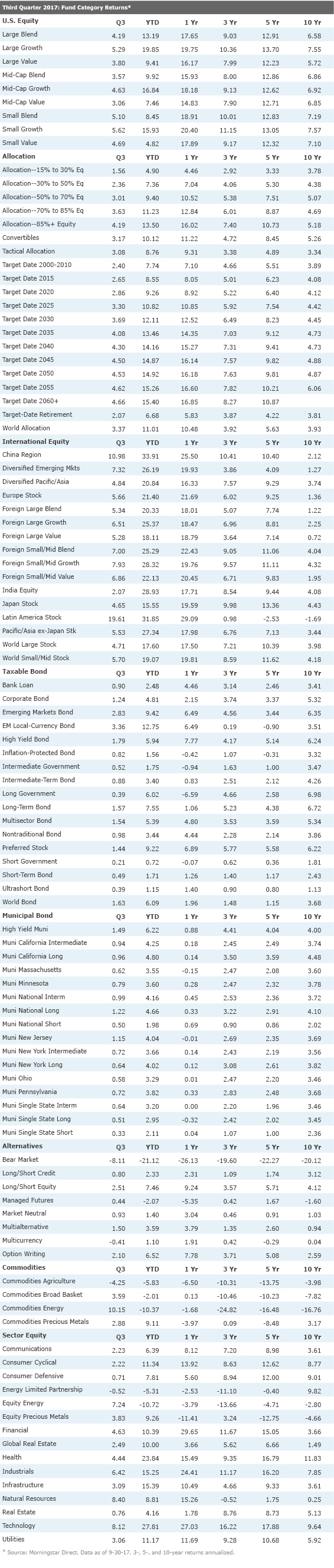

Open-End Fund Category Returns Index Returns Download Data (Excel)

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)