Venture Capital Outlook: Exits Come Into Focus as Valuations Continue to Climb

Availability of funds for VC-backed companies pushes out exit timelines and encourages alternative liquidity.

- Venture capital deal counts have stabilized in 2017 after experiencing a steady downturn throughout 2016. While fewer deals are being executed, deal sizes have continued trending larger, and 2017 is on pace to experience the second-highest year of capital invested we've recorded. With fundraising remaining strong and average funds sizes at decade highs, we expect the shift toward larger deals to persist.

- The Softbank Vision Fund—a mammoth $93 billion vehicle whose limited partners (LPs) include Middle East sovereign wealth funds—represents a nontraditional investor in VC-backed companies that has a much longer-term approach than the previous generation of "tourist" investors, such as mutual funds and hedge funds. We believe that funds like this, which have patient capital and the ability to write outsized checks, will only continue to fuel higher valuations and push out exit timelines for large late-stage companies.

- In part due to readily available reserves of VC dollars, we've seen sustained increases in the median time to exit for VC-backed companies, which has raised liquidity concerns for employees and long-term investors. In response, new alternative forms of liquidity, such as special purpose acquisition companies (SPACs) and secondary markets, have emerged. Although we don't anticipate a fundamental change in the exit process for VC-backed companies, we do think that direct secondary markets for venture capital shares will expand and evolve in the coming year.

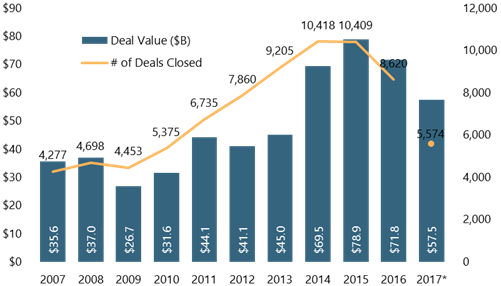

After decelerating throughout 2016, VC investment activity has stabilized in 2017, with $57.5 billion being deployed over a total of 5,574 completed deals at the midway point in September. Although deal count is pacing to match the level of activity experienced in 2016, capital invested is poised to come in much higher.

At the current pace, total 2017 VC invested will come in near $78 billion, which represents the high-water mark, recorded in 2015, since the dotcom bubble. This also serves as a perfect illustration of the significant increase in average round sizes, especially in later stages, which has occurred as VCs raise ever-larger funds and more-mature VC-backed companies opt to stay private or raise more capital instead of pursuing traditional exit routes.

U.S. VC Activity by Year

Source: PitchBook | * Data as of 9/12/2017

Although we don’t see deal counts returning to 2014 and 2015 levels, we do believe there is room for venture capital activity to rise, underpinned by the large reserves of dry powder VC funds are sitting on after years of above-average fundraising.

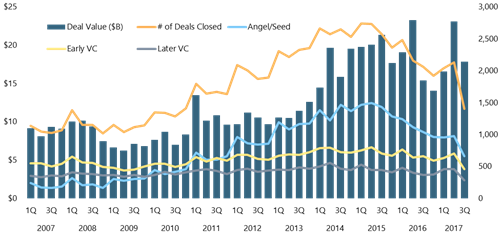

U.S. VC Activity by Quarter

Source: PitchBook | Data as of 9/12/2017

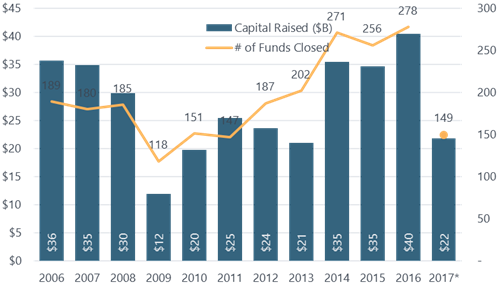

In fundraising, although 2017 may not match some of the levels recorded in the previous three years, several indicators point to continued strength in the market. A decade-high 86% of funds hit their targeted size so far in 2017, and the median time to close a fund has dropped from 18 months in 2016 to 14 months in 2017.

We see investors continuing to reach for yield in the current low-rate, low-growth environment, and the strong distributions from venture in recent years should entice them to continue making commitments to the strategy.

U.S. VC Fundraising by Year

Source: PitchBook | * Data as of 9/12/2017

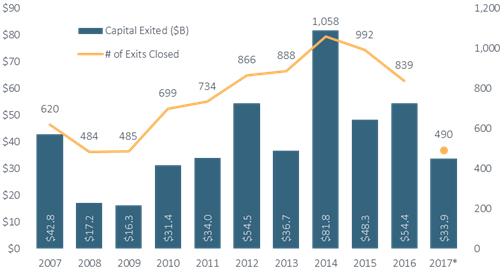

Even though 2017 is on track to record the lowest exit value and count since 2014, VC-backed IPOs in 2017 have raised over 200% more capital than in all of 2016, and a record six unicorns have debuted on the public markets (Snap, MuleSoft, Cloudera, Okta, Blue Apron, and Redfin).

Currently, much of the potential pressure to exit has been mitigated by the fact that VC-backed companies are raising massive follow-on rounds as deep-pocketed nontraditional investors, such as Softbank’s Vision Fund, show more interest in venture. Compared to other “tourists” that have dabbled in VC in recent years, this new pack of nontraditional investors has a much longer-term investment horizon. This increase in supply of capital has driven valuations higher and afforded VC-backed companies more liberty to dictate funding terms, especially for well-performing late-stage companies.

U.S. VC Exits by Year

Source: PitchBook | * Data as of 9/12/2017

Although VC-backed IPO activity has improved, it’s important to note that IPOs account for an average of only 15.7% of total venture capital exits, so the broader slowdown in exit activity should not be overlooked. To relieve some of the pressure, VC firms and VC-backed companies are beginning to explore alternative liquidity solutions. While some of these alternatives have been in existence for many years, they have been gaining popularity in 2017, and we predict the topic will only gain more traction through the remainder of 2017 and into 2018.

The direct secondary market—an area we believe will continue to grow, as mentioned in previous research—is one option to provide employees and other insiders with liquidity without going forward with a traditional exit. New routes to the public markets have also arisen, including Social Capital Hedosophia’s SPAC and Spotify’s consideration of a direct listing of its shares.

Although we see these exit alternatives as outliers rather than a categorical shift in the way VC-backed companies return capital to investors, they show that innovation and disruption can be applied to the venture capital process itself and not just the companies VCs choose to invest in.

More Market Outlooks

Stock Market Outlook: China Rebalancing Presents Winners and Losers

Credit Market Insights: A Solid Quarter for the Bond Markets

Basic Materials: Valuations Propped Up by Shaky China Fundamentals

Communication Services: Smaller Rivals Call the Shots in U.S. Wireless

Consumer Cyclical: Tepid Mall Traffic Could Constrain the All-Important Holiday Season

Consumer Defensive: Valuations More Reasonable After Third-Quarter Retreat

Energy: All Roads Point to Oversupply in 2018

Financial Services: Banks Can't Rest Easy

Healthcare: Stock Selection Key as Valuations Rise

Industrials: Worldwide Growth Is Resilient, But Valuations Look Full

Real Estate: Enter With Caution

Technology: Valuations Painting Overly Rosy Scenarios

Utilities: Valuations Still Running Out of Control

M&A Outlook: High Prices Impede Dealmaking in the U.S.

Private Equity Outlook: Larger Funds, Larger Deals

U.S. Stock Funds: Steady as She Goes

International-Stock Funds: The Beat Goes on

Bond Funds: A Period of Relative Calm

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)